BTC News: Bitcoin Has a 96% Chance Of Recovering Next Year

Bitcoin models and on-chain data signal undervaluation, stronger demand and improving ETF flows, pointing to a likely Bitcoin recovery in 2026.

Bitcoin has spent recent months under pressure, yet several valuation tools and fresh market data are pointing toward a strong recovery setup for 2026.

Analysts are pointing out falling prices, rising network activity and renewed spot demand as signs that the market may be forming a durable base.

Bitcoin Valuation Models Hint at Strong Rebound

Bitcoin currently trades more than 30% below its October all-time high of $126,000, according to sources like CoinMarketCap. This correction pushed the price under its Metcalfe Value for the first time in two years.

Economist Timothy Peterson tracked this model, which estimates a fair price for Bitcoin using active addresses and transaction counts.

Historically speaking, when price falls under that line, his research shows positive one-year returns almost every time.

Peterson noted that the current setup resembles early 2023. That period marked the start of a climb that carried Bitcoin to $74,000 by March of last year. He added that the latest drop cleared excess leverage and removed earlier speculative noise.

The model now points toward undervaluation because the network keeps expanding.

So far, wallet activity and transaction counts both show steady growth and these trends show rising real usage rather than short bursts of trading.

Past examples also support this view. Bitcoin sank below its fair value in 2019 and 2020, and each dip came right before a solid rebound over the following months.

The pattern repeated in early 2023 and Market watchers now study whether the coming year could follow the same rhythm.

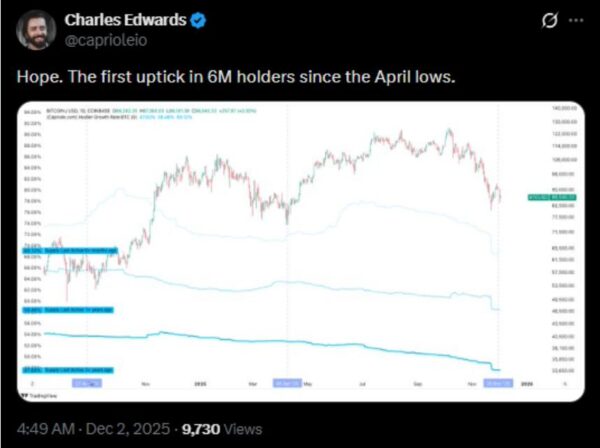

Fresh data from Nansen shows a 15% jump in weekly Bitcoin transactions, reaching more than 3 million. That rise indicates stronger interest from users who hold Bitcoin for longer periods.

Investors who lock coins for six months or more also reached a new high, and historically, strong holder growth often aligns with market recoveries.

Spot Trading Activity Moves Toward a Healthier Trend

Spot market figures support the recovery narrative. According to reports from Glassnode, spot cumulative volume delta flipped from negative to positive after weeks of selling.

The trend came from a rise in buying pressure that was equal to about $29 million.

Analysts at Glassnode state that positive CVD now shows improving sentiment.

Stronger buy-side trading may also help stabilise price levels if volume holds steady. Thin liquidity during the recent decline made the market more fragile and the latest readings now show that conditions are stabilising.

Market depth still matters.

Spot trading activity shows that Bitcoin is healthy

Spot trading activity shows that Bitcoin is healthy

Higher trading volume and more sustained demand are needed before a firm push toward six figures. Yet the tone has changed. Selling from short-term traders has slowed down, and a modest return of buyers helped support price levels near the low $90,000 area.

Related Reading: Bitcoin Premium Shifts Positive, Signaling U.S. Investor Strength

ETFs and Options Data Indicate a Local Bottom

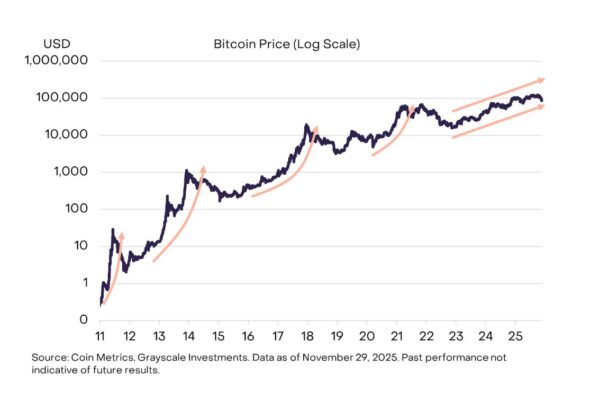

Grayscale released a new report arguing that this year’s drop looks more like a local bottom than the start of a long downturn.

A steep rise in option skew indicates that investors hedged against more downside earlier. That pattern tends to form near local floors.

Grayscale also challenged the long-standing four-year cycle theory. The firm states that Bitcoin may break the usual loop that ties price patterns to halving years.

Grayscale challenges the 4-year cycle theory | source: Glassnode

Grayscale challenges the 4-year cycle theory | source: Glassnode

Their analysts believe new highs are still possible next year, due to the changing market structure.

ETF flows also support this idea. November recorded heavy outflows of about $3.48 billion, which added selling pressure to the market.

That trend reversed this week and spot ETFs posted four straight days of inflows, including $8.5 million on Monday.

The post BTC News: Bitcoin Has a 96% Chance Of Recovering Next Year appeared first on Live Bitcoin News.

You May Also Like

Subaru Motors Finance Reviews 2026

Shiba Inu Price Prediction: Dubai Cracks Down on KuCoin as Pepeto Outpaces DOGE and SHIB With $7.4M Raised

![[Two Pronged] Teen daughter hates father for cheating and won’t respect him](https://www.rappler.com/tachyon/2026/03/two-pronged-daughter-mad-at-father.jpg)