Bank of America Recommends 1-4% Crypto Portfolio Allocation

Bank of America has advised its clients to allocate up to 4% of their portfolios in cryptocurrency, according to a Yahoo Finance report on Dec. 2. The guidance follows a turbulent November in which Bitcoin BTC $90 891 24h volatility: 6.4% Market cap: $1.81 T Vol. 24h: $83.46 B swung from a $126,000 all-time high in October to lows near $82,000 in November before stabilizing near $90,000 on Dec. 2.

The firm also confirmed that investment strategists will begin coverage of four Bitcoin ETFs in 2026. The bank emphasized its global footprint in the Q3 2025 report, citing roughly 70 million consumer and small-business clients, 3,600 retail centers, 15,000 ATMs, 59 million verified digital users and 4 million small-business households.

Notably, corporate demand for crypto strengthened in the final week of November after a turbulent month. CoinShares report on Nov. 25 shows crypto ETPs recorded $1.07 billion last week supported by expectations of a US rate cut after comments from FOMC member John Williams.

The US drove nearly $1 billion of the total, even as Thanksgiving-week volumes remained subdued. Bitcoin, Ethereum ETH $2 978 24h volatility: 8.2% Market cap: $359.48 B Vol. 24h: $28.11 B and XRP XRP $2.15 24h volatility: 7.0% Market cap: $130.00 B Vol. 24h: $4.57 B saw strong demand with $464 million, $309 million and a record $289 million in inflows, respectively.

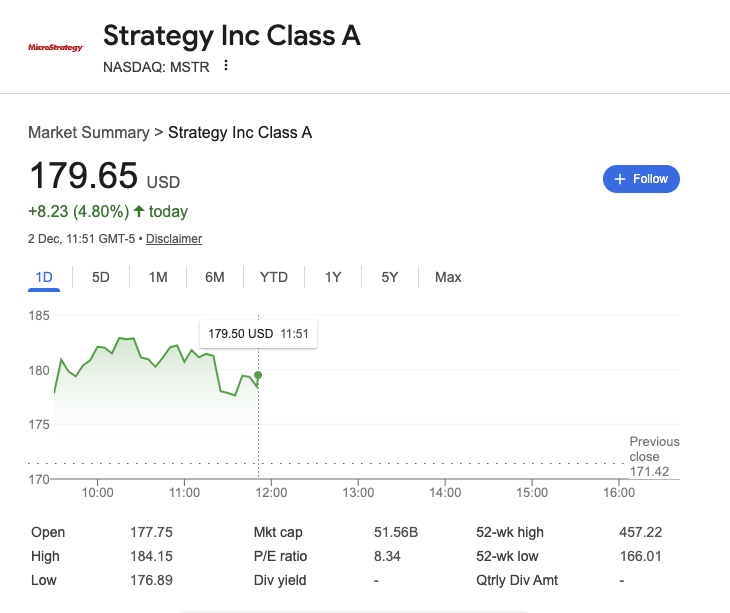

Strategy (MSRT) share price rebounded 4.7% on Dec. 2 as Bitcoin price retakes $90,000 | Source: Nasdaq

While macro flows improved, sentiment around Strategy (formerly MicroStrategy) remained volatile. Its shares rebounded 5% on Dec. 2 after a 12% slump that had sparked liquidation concerns. Despite the pressure, Michael Saylor confirmed the purchase of another 130 BTC, lifting holdings to 650,000 BTC.

Saylor also disclosed a $1.44 billion reserve, funded through recent ATM stock issuance, to support dividends and interest payments.

JPMorgan Flags Bitcoin–Gold Divergence as Risk Signal

JPMorgan portfolio manager Jack Caffrey said on Dec. 2 that Bitcoin remains one of the indicators he monitors to estimate market risk. He described the recent divergence between Bitcoin’s negative performance in November and Gold’s rally above $4,000 as an unusual signal, raising questions on Bitcoin’s status as a “risk-free” asset.

Caffrey told CNBC’s Squawk Box that the divergence could reflect investors positioning for a steeper yield curve, which historically supports gold. He highlighted upticks in big tech stocks such as Alphabet and resilience in pharmaceutical firms like Johnson & Johnson as signs of core economic strength.

He also argued that the recent divergence between Bitcoin and Gold price indicates cautious outlook as investors anticipate year-end macro swings.

nextThe post Bank of America Recommends 1-4% Crypto Portfolio Allocation appeared first on Coinspeaker.

You May Also Like

Japan-Based Bitcoin Treasury Company Metaplanet Completes $1.4 Billion IPO! Will It Buy Bitcoin? Here Are the Details

InvestCapitalWorld Updates Platform Features to Support Broader Multi-Asset Market Access