Trust Wallet Becomes First Major Web3 Wallet With Native Predictions Markets

Trust Wallet has launched a new in-app “Predictions” tab that lets users trade tokenized outcomes on real-world events directly from their self-custodial wallets, positioning the product as the first mainstream wallet-native prediction market integration.

The company launched this feature with Myriad, as its first partner on prediction markets.

Trust Wallet Integrates Predictions Tab on Swaps Page

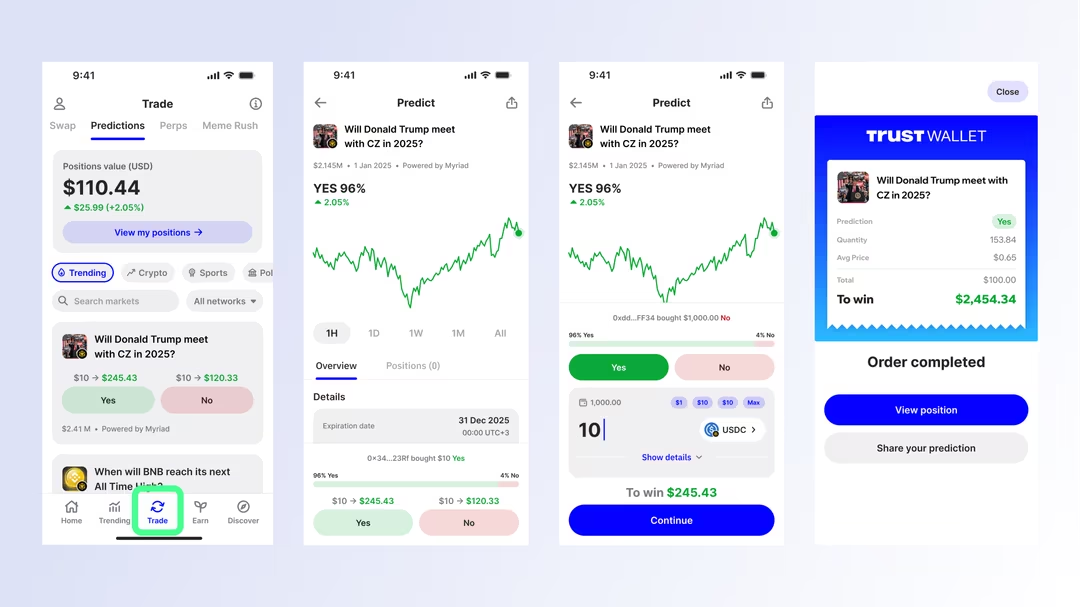

Trust Wallet has introduced “Predictions” as a new tab on its Swaps page, allowing eligible users to browse markets, select YES/NO or other outcomes, and track event resolution without leaving the app, according to its announcement.

How is the integration of Myriad in Trust Wallet. Source: Trust Wallet

Access to prediction markets in Trust Wallet is not universal; the regulatory and geographic rules of each underlying prediction market determine availability.

Myriad Launches First, Polymarket and Kalshi to Follow

At launch, Predictions is powered by Myriad, with integrations for Polymarket and Kalshi planned to follow, each one on a different chain.

Through these partners, users will gain access to markets covering crypto milestones, politics, sports, culture, and macro events in a single aggregated interface, rather than hopping between multiple platforms. It would even make arbitrage between the platforms easier.

Prediction Markets Attract Growing Industry Interest

The move comes as on-chain prediction markets attract renewed attention from both crypto-native and traditional players, with platforms such as Polymarket securing institutional backing from ICE and integrating with financial services like Google Finance and Yahoo! Finance.

Analysts frame these markets as a way to trade on information and sentiment around elections, token launches and macro events, turning crowd forecasts into a liquid, tradable data source, with a lot of future.

nextThe post Trust Wallet Becomes First Major Web3 Wallet With Native Predictions Markets appeared first on Coinspeaker.

You May Also Like

LMAX Group Deepens Ripple Partnership With RLUSD Collateral Rollout

Pastor Involved in High-Stakes Crypto Fraud