Grayscale: Bitcoin slide is ‘typical,’ sees new highs in 2026

Bitcoin’s latest 30% slide hasn’t rattled Grayscale Research, which argues that the decline mirrors historical patterns and is unlikely to mark the beginning of a prolonged downturn.

- Grayscale Research says Bitcoin’s recent 30% pullback is normal for a bull market and does not signal the start of a deep, multi-year downturn.

- Privacy-focused tokens outperformed in November, while new XRP and Dogecoin exchange-traded products hit the market amid expanding U.S. crypto ETP offerings.

- Fed rate cuts and bipartisan crypto legislation could lift crypto markets into 2026, even as valuations lag improving fundamentals.

In a new report, published Dec. 1, the asset manager said it expects Bitcoin (BTC) to notch new highs next year despite mixed short-term indicators potentially.

The pullback — the ninth meaningful drop since the current bull market began — fits squarely within Bitcoin’s typical market behavior. Since 2010, the cryptocurrency has suffered roughly 50 drawdowns of 10% or more, with an average peak-to-trough decline of about 30%

“Bitcoin investors have been rewarded for HODL-ing, but they’ve had to endure tough drawdowns along the way,” the firm wrote. The latest decline, which began in early October and extended through November, bottomed out at 32%.

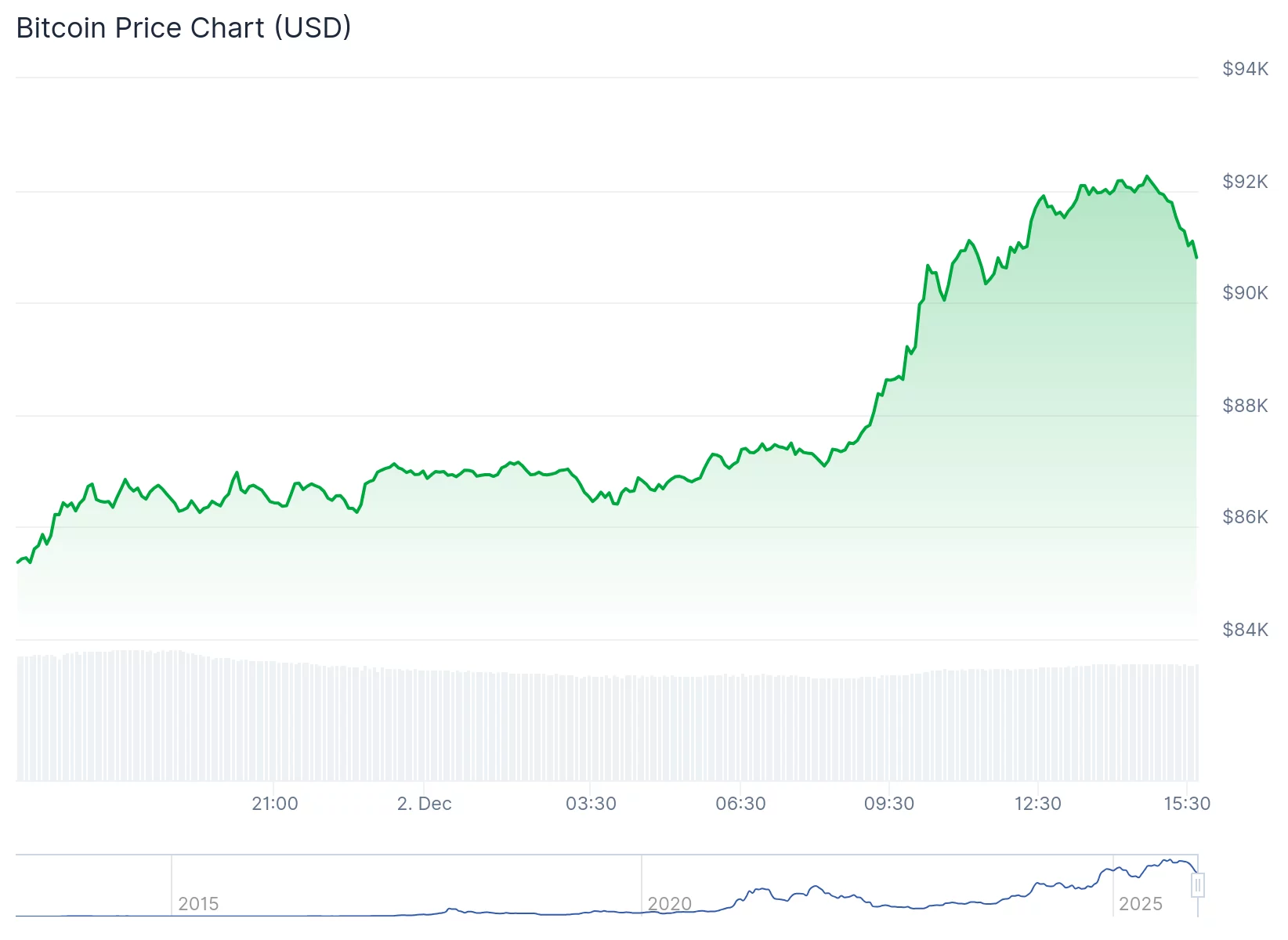

Today, Bitcoin is up over 6% and trading in the $90,000 range. See below:

Grayscale rejects ‘four-year cycle’ doom scenario

While Bitcoin’s halving cycle has historically aligned with multi-year price patterns, Grayscale pushed back against the widespread belief that the market is due for a 2026 downturn. The firm said this cycle looks markedly different: no parabolic blow-off top, more institutional participation via exchange-traded products and digital asset treasuries, and a supportive macro backdrop.

The company also sees signs that a short-term bottom may be forming, pointing to heavily skewed put options and digital asset treasuries trading at discounts to their net asset values — indicators of reduced speculative excess.

Privacy tokens shine as AI sector slumps

Outside Bitcoin, crypto markets split sharply by sector in November. Privacy coins, like Zcash and Monero, led the gains. Whether that will last remains to be seen.

Zcash price plunged 24% on Tuesday, with analysts warning of further downside but noting that long-term charts and the privacy thesis remain intact.

Ethereum-related privacy initiatives also accelerated: Vitalik Buterin introduced a new privacy framework at Devcon, and Aztec launched its Ignition Chain.

By contrast, Grayscale’s Artificial Intelligence Crypto Sector plunged 25% despite growing adoption of some AI-linked technologies.

Near Protocol’s (NEAR) “Intents” product — which automates cross-chain transactions and has boosted the utility of Zcash — saw sharply rising traction. Coinbase’s new x402 open payments protocol also gained momentum, jumping from 50,000 to more than 2 million daily transactions in November.

The crypto exchange-traded product landscape expanded further in November as the first XRP and Dogecoin ETPs began trading after U.S. regulators approved new generic listing standards.

Lower rates, bipartisan legislation could fuel 2026 rally

Grayscale said macro conditions could provide meaningful tailwinds into year-end. A potential interest-rate cut at the Federal Reserve’s Dec. 10 meeting — and hints of additional easing next year — could weaken the U.S. dollar and boost demand for assets like Bitcoin and gold.

Reports that National Economic Council Director Kevin Hassett is the leading candidate to replace Fed Chair Jerome Powell also reinforce expectations for lower rates. Hassett previously called the Fed’s September rate cut “a good first step” toward “much lower rates.”

Another possible catalyst: continued bipartisan progress on crypto market-structure legislation in Congress. The Senate Agriculture Committee released a bipartisan draft bill in November. If crypto avoids becoming a wedge issue ahead of the 2026 midterms, the legislation could reshape institutional participation.

Despite short-term volatility, Grayscale maintains that the most significant returns will favor long-term holders. “Eventually fundamentals and valuations will converge,” the firm wrote, “and we are optimistic about the outlook into year-end and 2026.”

You May Also Like

LMAX Group Deepens Ripple Partnership With RLUSD Collateral Rollout

Pastor Involved in High-Stakes Crypto Fraud