Ethereum News: Ethereum Whale Wakes: $120M Staked After 10 Years

After a decade of inactivity, the Ethereum ICO wallet stakes 120M. Whales are adding up as ETH tests important support zones at $2,200-$2,400 zone.

One Ethereum ICO wallet, which contained 40,000 ETH, was unlocked after 10 years of dormancy and was valued at 120 million dollars. The wallet did not sell but staked its entire holdings. In the meantime, technical analysts point out crucial support rates of 2,200-2,400.

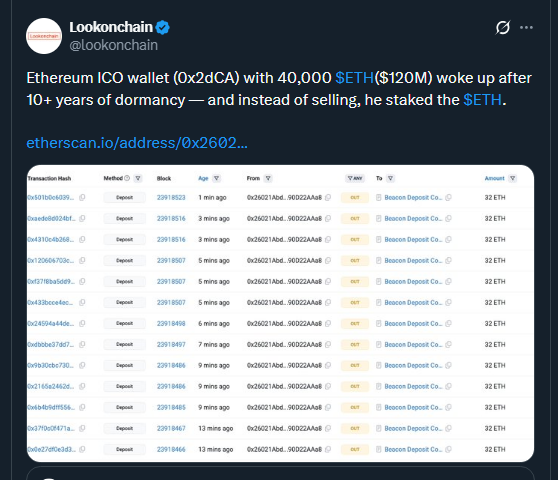

A major event in the cryptocurrency community occurred when a dormant Ethereum wallet sprang to life. As per the Lookonchain on X, the wallet address 0x2dCA contained 40,000 ETH worth 120 million dollars. The wallet remained inactive for over a decade before making its move.

Source: Lookonchain on X

The holder initially bought them at the launch of the genesis block of Ethereum in July 2015, and they cost him around 12 thousand dollars. The whale, instead of selling off the position, staked the supply. This move is an indicator of a high degree of confidence in the long-term of Ethereum.

You might also like: Ethereum News: Ethereum ETF Sees $312M Inflow Before Critical Fusaka Upgrade

Smart Money Accumulates During Market Tests

The market analysts are pointing to important price points of Ethereum. Dollar-cost averaging strategies should be considered by the investors according to the Ali Charts on X. The suggested accumulation ranges are 2200, 1500, and 1100 prices.

Source: Ali Charts on X.

Eljaboom posted on X regarding wider market forces. Retail traders do not consider the importance of prevailing price action. Ether is currently testing a generational support trendline. Smart money adds up and does not sell at these levels.

Source: Eljaboom posted on X

The range between $2,200 and $2,400 is not just a mere support zone. This is the primary reversal point of the price action. The existing design resembles the rising base of Ethereum in 2020. That compaction led to a colossal escape in later months.

You might also like: Ethereum News: Ethereum Leverage Surges as Bulls Eye Critical Breakout

Historical Patterns Point to Potential Upside

The technical arrangement shows customary features of past bull runs. According to market players, a new rise above specific levels by the ETH/BTC pair historically resulted in prolonged increasing trends. The chart formation indicates future expectations of highs.

As most await price implosion, technicals show various signals. The arrangement points to a textbook leg to new heights. Macro-level pressure is accumulating on support levels.

Top addresses show increasing holdings over time. The Top 1% Supply Rise stood at 97.6 percent, compared to 96.1 percent last year. The Eth2 Beacon Deposit Contract has 72.4 million ETH valued at about 203 billion.

The post Ethereum News: Ethereum Whale Wakes: $120M Staked After 10 Years appeared first on Live Bitcoin News.

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

LMAX Group Deepens Ripple Partnership With RLUSD Collateral Rollout