Crypto Industry Files Complaint Against Australia’s ABC Over Bitcoin Article

The Australian Bitcoin Industry Body has filed a formal complaint with the Australian Broadcasting Corporation over what it calls “factually inaccurate and misleading” coverage of Bitcoin, escalating tensions between the country’s growing crypto sector and traditional media.

The complaint targets an ABC article that portrayed Bitcoin primarily as a vehicle for money laundering while ignoring documented use cases in energy stabilization, humanitarian remittances, and sovereign reserves.

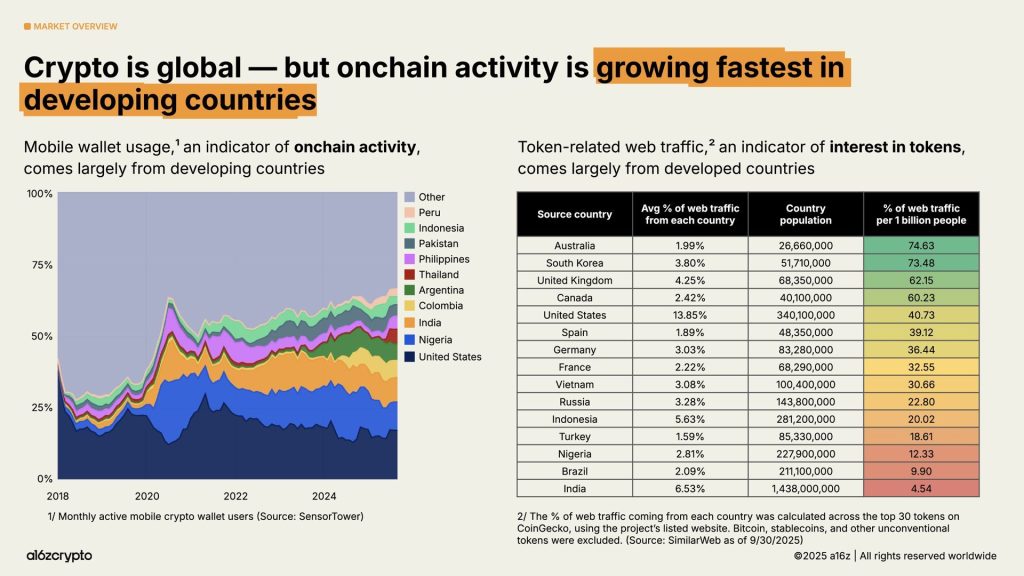

The move comes as Australia’s crypto adoption rate outpaced even the US, reaching 31% in 2025, up from 28% in 2024, placing the nation among the world’s most crypto-engaged populations according to a16z’s State of Crypto 2025 report.

Source: a16z

Source: a16z

ABIB said it receives frequent contact from frustrated members regarding recurring misrepresentation of Bitcoin in Australian media, particularly from publicly funded institutions required by statute to provide accurate journalism.

Industry Body Cites Multiple Policy Breaches

ABIB’s submission identifies specific sentences that it alleges breach the broadcaster’s editorial policies and code of conduct.

The complaint centers on one-sided framing that conflates Bitcoin with criminal activity while omitting publicly available information about legitimate applications.

The ABC article, written by chief business correspondent Ian Verrender, characterized Bitcoin as having “no useful purpose” and described money laundering as its “last useful business.”

The piece focused on Bitcoin’s price volatility, dropping from $126,000 to below $90,000, while emphasizing the cryptocurrency’s alleged failures.

ABIB countered that the coverage reduced Bitcoin to outdated tropes focused on price swings and U.S. politics, calling on ABC to issue corrections and engage subject-matter expertise in future reporting.

Complaint Arrives Amid Regulatory Transformation

The dispute arises amid significant regulatory evolution in Australia’s digital asset sector.

In November, Treasurer Jim Chalmers and Financial Services Minister Daniel Mulino introduced the Corporations Amendment (Digital Assets Framework) Bill 2025, establishing the country’s first comprehensive regulatory framework for companies holding crypto on behalf of customers.

The ministers said they “take Australia’s crypto industry seriously,” adding that blockchain and digital assets present “big opportunities for our economy, our financial sector, and our businesses.”

The government’s reforms could unlock $24 billion in annual productivity gains while strengthening safeguards for Australians entrusting their digital assets to private platforms.

Under the bill, crypto exchanges and custody providers must obtain an Australian Financial Services License, bringing them under ASIC supervision.

The framework introduces two new license categories. A digital asset platform and tokenized custody platform, with licensed firms required to comply with ASIC standards for transactions, settlement processes, and asset custody.

Regulators Balance Innovation With Protection

ASIC has also clarified digital asset regulation while supporting industry development.

In October, the regulator declared stablecoins, wrapped tokens, tokenized securities, and digital asset wallets to be financial products under existing law, requiring service providers to obtain licenses while granting an eight-month transition period through June 30, 2026.

ASIC Commissioner Alan Kirkland said, “Distributed ledger technology and tokenization are reshaping global finance,” and that the guidance provides regulatory clarity, enabling firms to innovate confidently.

In fact, ASIC Chair Joe Longo warned that Australia risks falling behind as blockchain-driven tokenization reshapes global markets, cautioning that unless Australia adapts, it could become a “land of missed opportunity.“

He noted that J.P. Morgan told him their money market funds will be entirely tokenized within two years.

Australia’s institutional crypto engagement has accelerated significantly, with self-managed superannuation funds accounting for a quarter of the pension system and crypto exposure jumping sevenfold since 2021 to A$1.7 billion.

The growing adoption has attracted major players, with Coinbase preparing to launch a dedicated SMSF service with over 500 investors on its waiting list, targeting the country’s pension pool, while OKX launched a similar product in June that exceeded expectations.

The regulatory framework includes an 18-month grace period before licensing rules take effect.

Small operators handling less than A$10 million in annual transaction volume will be exempt.

For those who might go against the rule, earlier legislation has proposed penalties of up to 10% of annual turnover for platforms breaching rules, with firms facing fines of A$16.5 million, three times the benefit gained, or 10% of annual turnover for misleading conduct.

You May Also Like

Holywater Raises Additional $22 Million To Expand AI Vertical Video Platform

OpenVPP accused of falsely advertising cooperation with the US government; SEC commissioner clarifies no involvement