Ripple Launches Holiday Anti-Scam Campaign to Fight Holiday Scams and Protect XRP Holders

- Ripple’s Scamberry Pie campaign focuses on scam education and online protection for XRP holders during the holiday season.

- 21Shares’ TOXR spot XRP ETF has started trading in the U.S., adding to growing regulated exposure to the token.

Ripple has launched a holiday anti-scam campaign that urges people to stay alert to online fraud targeting XRP holders and other users.

Ripple CEO Brad Garlinghouse announced the effort on X on Dec. 3, directing people to the website scamberrypie.com for tips on how to protect themselves and their families from digital scams. The campaign centers on “Scamberry Pie,” an education push that uses holiday-themed material to make conversations about online fraud easier at home.

Ripple Scamberry Pie Campaign. Source: X

Ripple Scamberry Pie Campaign. Source: X

Garlinghouse said the firm is partnering with Match Group, Cash App, the National Cryptocurrency Association and Coinbase to spread the message. The collaboration aims to warn users about phishing sites, fake investment offers and other schemes that often increase during the holiday season.

He also praised the company’s internal security team for working throughout the year to remove malicious websites and fake “live” videos that target token holders. Garlinghouse wrote that the effort to protect users “takes a village,” as the company, partners and community members continue reporting and taking down fraudulent content.

Meanwhile: 21Shares XRP ETF Launched on Monday

Meanwhile, 21Shares’ U.S. spot XRP ETF launched on Monday under the ticker TOXR, as highlighted in our previous article.. The product became effective after the SEC approved its 8-A filing, which 21Shares had submitted on Nov. 7. The fund set a management fee of 0.50 percent and opened with a target of raising $500,000 in initial capital.

The ETF was structured to track the CME CF XRP–Dollar Reference Rate, giving investors exposure to spot price through a regulated benchmark. As a result, buyers gained access to price movements without handling wallets, custody, or direct token purchases. Both retail and institutional clients could trade TOXR through standard brokerage accounts.

With Monday’s launch, 21Shares joined other major issuers in the expanding U.S. XRP ETF market. The debut followed a wave of new XRP-focused funds from providers including Grayscale and Franklin Templeton. In only a few days, five XRP ETFs began trading in the United States, signaling rising demand for regulated products tied to the token.

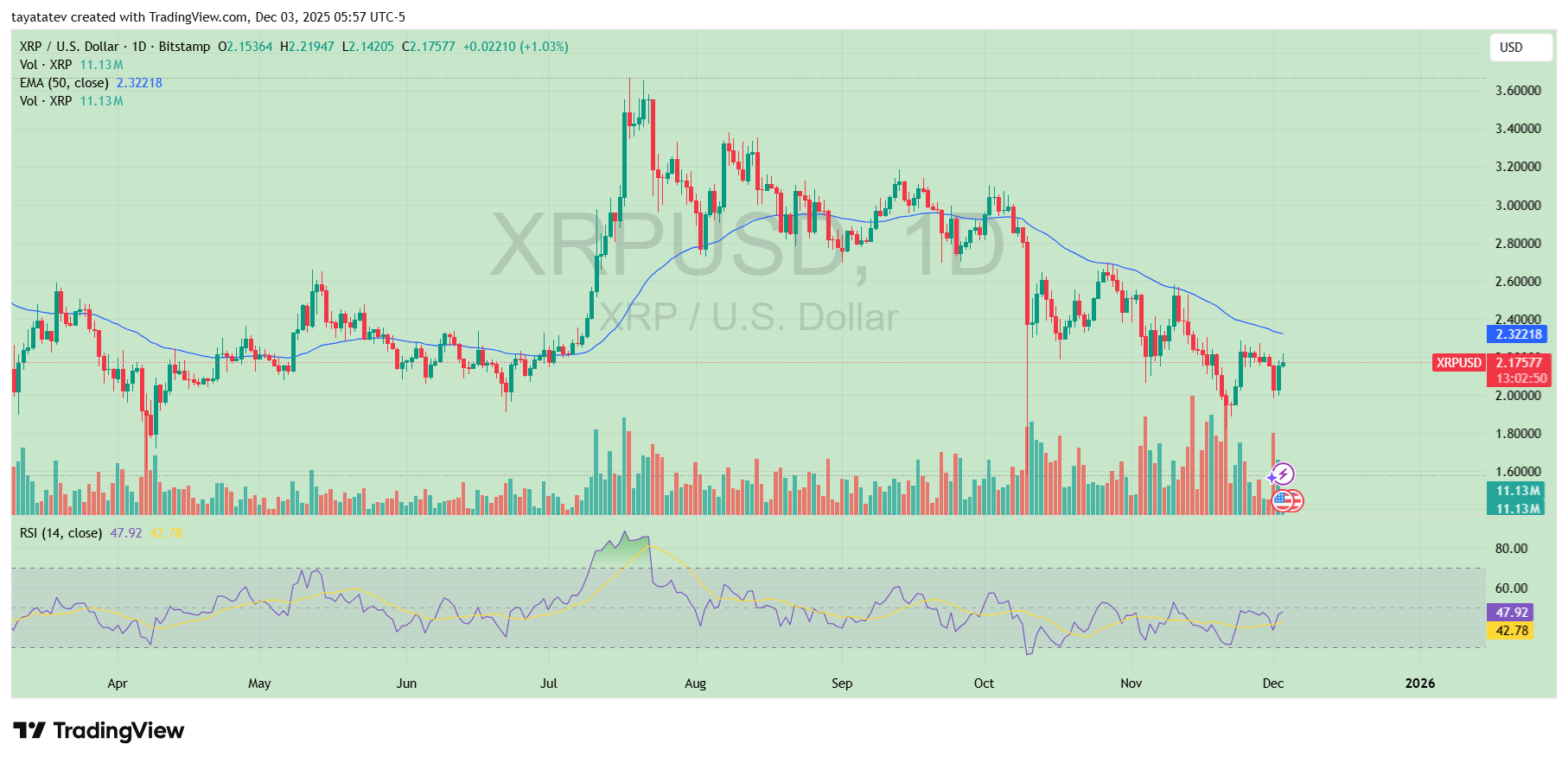

XRP Price and Indicators on the Day

XRP spent the day moving quietly, trading mostly around 2.17 dollars. It tried to lift a little, but it still sat under the 50-day moving average near 2.32 dollars, and that level kept blocking any stronger move. Trading volume stayed close to what you’d expect for a calm session.

XRP Price Daily Chart. Source: TradingView

XRP Price Daily Chart. Source: TradingView

The RSI sat around 48, so momentum leaned soft. It wasn’t weak enough to show heavy selling and not strong enough to show real buying. The chart kept the same tone through the day: slow, cautious, and waiting for a clearer push either way.

]]>You May Also Like

Michigan’s Stalled Reserve Bill Advances After 7 Months

DeFi Leaders Raise Alarm Over Market Structure Bill’s Shaky Future