ETH Reclaims $3K as Ethereum Fusaka Expands Blob Parameters and Network Performance

- The Ethereum Fusaka upgrade went live, introducing PeerDAS and higher blob capacity to significantly boost rollup scalability.

- ETH bulls need to defend the $3,000 for the price rally to continue, and a failure to hold could lead to new lows.

The Ethereum (ETH) price is up 9% during the crypto market upside today, moving past the crucial support at $3,000. This comes as the Ethereum Fusaka upgrade goes live with greater blob capacity and the PeerDAS enhancements. Market experts are now weighing whether the bulls will be able to hold above $3,000 for a sustained upside ahead.

ETH Price Remains on Investors’ Radar

In the last two weeks, the ETH price has lost the $3,000 support twice, moving further lower to $2,750. It’s been a tough battle between the bulls and bears. Popular crypto analyst Ted Pillows noted that ETH gaining past $3,000 signals a bullish continuation ahead.

According to Pillows, maintaining this support could set the stage for Ethereum to advance toward the $3,200 zone in the near term. However, he cautioned that a failure to hold above $3,000 may lead to a full retracement of the recent move

Source: Ted Pillows

Source: Ted Pillows

ETH Whales and Big Players Give Mixed Reaction

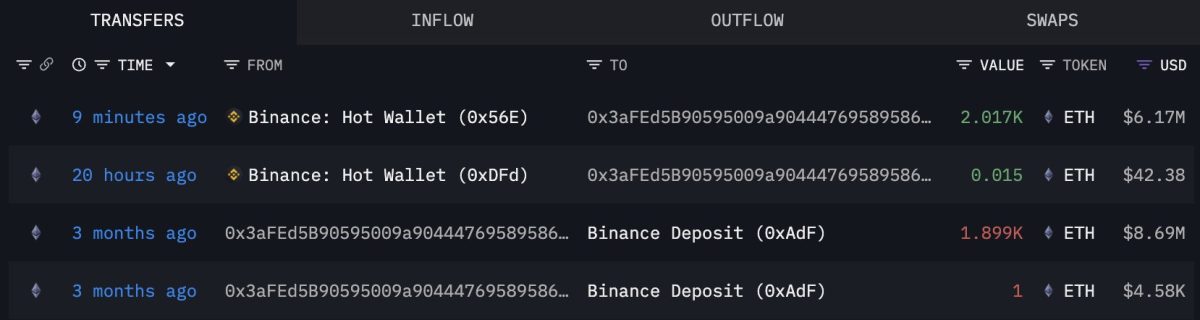

As per the data from blockchain analytics platform Arkham Intelligence, a large ETH holder has successfully executed the buy-low, sell-high strategy. For e.g. wallet 0x3aFE sold 1,900 ETH worth $8.69 million at the local peak on August 25, when Ethereum traded at $4,574.

The same wallet has now repurchased 2,017 ETH for $6.17 million at a price of $3,061, effectively increasing its holdings while spending less capital.

Source: Arkham Intelligence

Source: Arkham Intelligence

On the other hand, Tom Lee’s BitMine Technologies has continued to expand its ETH Treasury by buying every dip. However, on-chain data shows that the BlackRock iShares Ethereum Trust (ETHA) is making massive deposits on the Coinbase exchange. This has led to concerns of a major sell-off pressure coming ahead.

All Eyes On Ethereum Fusaka Upgrade

As reported by CNF, the Ethereum Fusaka lays the foundation for significantly lower rollup transaction fees heading into 2026. The fork introduces PeerDAS, increases block gas capacity, and establishes the framework for two upcoming blob-parameter expansions scheduled for later this month and in January.

The upgrade lets validators verify blob data using sampling instead of downloading entire payloads, thereby improving efficiency to a great extent. Technical specifications indicate that this mechanism will allow Ethereum to scale blob throughput by roughly an order of magnitude. It is a major step toward long-term data availability improvements for rollups.

On the other hand, Ethereum is reportedly testing a ‘Secret Santa’ protocol to allow private gaming on Ethereum. Researchers at Distributed Lab have introduced ZK Secret Santa (ZKSS) to boost the network capabilities in confidential transactions, private governance mechanisms, etc.

]]>You May Also Like

Trump erupts at his own Supreme Court picks for betraying Republicans

UniCredit: BTC recovery needs support from market sentiment and ETF inflows; a drop below $50,000 may face a structural shift.