Mauritius to introduce electronic travel authorisation amid surge in tourists

Mauritius is set to introduce an Electronic Travel Authorisation (ETA) to streamline and modernise border clearance for travellers. The development is the government’s attempt to ramp up the tourism sector by adding more attractions.

In what was described as an overhaul initiative, Mauritius’ Prime Minister, Dr Navinchandra Ramgoolam, during the celebrations marking the 50th anniversary of Constance Hotels & Resorts, explained that the planned project is central to the country’s national development strategy. The proposed electronic travel authorisation system is expected to reshape entry and exit procedures for all travellers.

The initiative would function as an online pre-clearance that travellers complete before boarding a flight. Its introduction is set to reduce wait times and simplify procedures for both tourists and Mauritian nationals. This initiative has been adopted by advanced countries such as the USA, Canada, and some European countries.

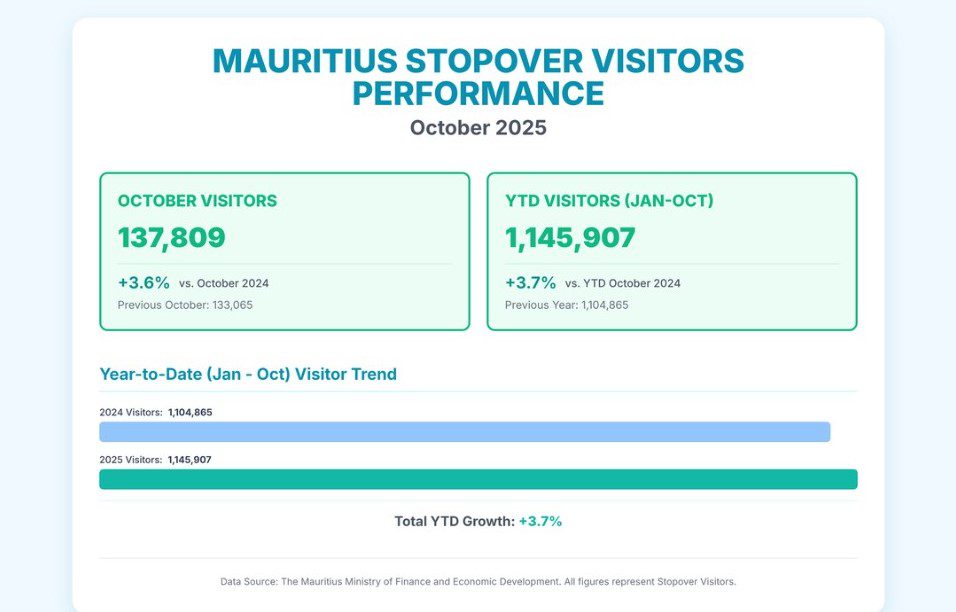

For Mauritius, the reason behind its ETA modernisation is tourism, as the sector plays a crucial role in the Mauritian economy. According to Tourism Analysis, Mauritius has welcomed over 1.14 million arrivals between January and October 2025, a 3.7% surge compared to the 1.1 million during the same period in 2024.

The report also showed that about 96% of arrivals were recorded by air, while nearly 17,000 visitors arrived by sea.

Addressing an audience of public- and private-sector representatives, the Prime Minister highlighted the need to fasten modernisation efforts to maintain the destination’s competitiveness and have an additional advantage. This will also see improvements in infrastructure, digital connectivity, and regulatory frameworks.

Tourism in Mauritius is a major economic pillar, drawing visitors with its beaches, natural beauty, and high-end resorts. The country is putting significant resources into developing a sustainable tourism destination.

Key attractions include beaches like Le Morne, natural sites like the Seven Coloured Earth and Black River Gorges National Park, and cultural experiences such as visiting markets and local festivals.

Also Read: Uber launches a 3-hour safari service in Nairobi, blending tech with tourism.

Other details on Mauritius’ ETA

While the full details of the plan remain unknown, reports suggest that the ETA could apply to all travellers, including those currently exempt from visa requirements. The initiative is also expected to feature a digital recognition system, under development, that will support the strategy of digitising border-control processes.

As the plan is still in process, Mauritius’ entry requirements remain the same. While most foreign visitors can enter visa-free for short stays, travellers from certain countries must apply for a visa in advance or obtain one on arrival. This is in line with the Southeast African country’s current regulations.

Port Louis, Capital of Mauritius

Port Louis, Capital of Mauritius

On its current process, travellers will complete the Mauritius All-in-One Digital Travel Form before departure. This form generates a PDF containing a QR code, which will be printed and presented to health authorities upon arrival.

If the form has not been completed beforehand, foreign nationals must then fill out a paper immigration landing card at the airport, extending the entry process.

However, the introduction of ETA seeks to streamline these processes.

You May Also Like

Cronos (CRO) Flatlines Despite Altcoin Season, Analyst Explains Why

Stripe-Backed Bridge Secures U.S. National Trust Banking License