Kevin Hassett has The Strongest Chance At Fed Chair, According To Prediction Market Bettors

Hassett emerges as Trump’s likely Fed chair pick as markets price in his lead and crypto watchers track his rate stance.

Trump’s latest remarks have placed Kevin Hassett at the center of the Federal Reserve chair race. The comment came during a White House event where Trump introduced Hassett to guests and described him as a respected person.

His tone left little doubt about where the decision may be heading.

Could Hassett Be The Next Fed Chair?

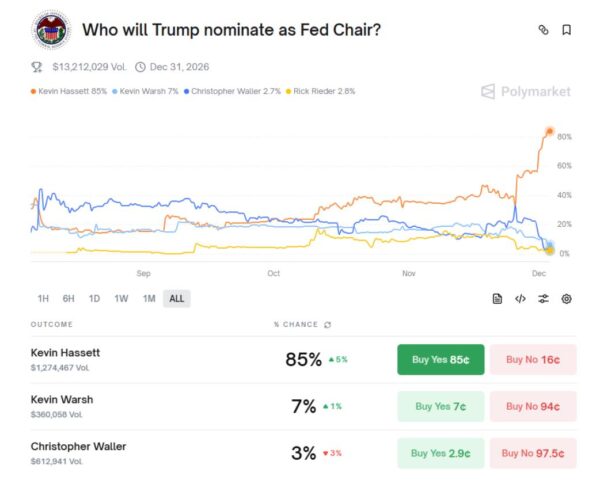

Trump said earlier that the field of candidates had narrowed from ten names to one. Markets reacted fast to the signal and traders pushed Hassett’s odds to 85% on Kalshi after the event.

Polymarket showed a similar spike as traders priced in Trump’s hint. These jumps showed how seriously observers took Trump’s comment.

Hassett serves as director of the National Economic Council. Trump placed him in the role at the start of this year.

Hassett also held a past post as chairman of the Council of Economic Advisers from 2017 to 2019. Thus, his experience in the White House gives him strong ties to Trump’s team.

Hassett owns a $1 million stake in Coinbase. He also leads the digital asset working group for the government. These details drew attention from crypto watchers who follow the Fed chair race.

Many believe Hassett supports a more flexible view toward digital assets.

How the Fed Chair Search Narrowed to a Small Group

Treasury Secretary Scott Bessent guided the search process since Labor Day. The early field started at eleven candidates, and later narrowed to five finalists. The list included Hassett, former Fed governor Kevin Warsh, current Fed governors Christopher Waller and Michelle Bowman and BlackRock executive Rick Rieder.

Finalists will meet with Vice President JD Vance and White House staff this week. Trump said he expects to announce his pick early next year.

Bessent had suggested the decision could come before Christmas, but recent comments from Trump show that the final choice may already be set.

Warsh once seemed to be the favourite candidate. However, that perception faded over the past several weeks and people close to Warsh said he no longer views himself as the front-runner.

The change came as Trump’s praise for Hassett increased.

Rekated Reading: New Crypto-Friendly Trump Official Emerges As Top Candidate For Fed Chair

Why Crypto Watchers Care About the Fed Chair Race

Notably, the Fed chair does not regulate crypto directly. However, the chair guides rates and banking rules, and these decisions in turn, influence market behaviour.

Lower rates tend to help crypto markets because borrowing costs drop and risk appetite rises. Hassett has argued that current rates are currently too high, and his stance caught the eye of crypto advocates who want a leader who is open to a lower-rate policy.

The Fed oversees banks, and changes to banking rules shape how crypto firms work with financial institutions.

Crypto Watchers have assigned 85% odds for Hassett | source: Polymarket

Crypto Watchers have assigned 85% odds for Hassett | source: Polymarket

This link makes the Fed chair choice important to crypto investors. A leader who supports smoother ties between banks and crypto firms could make or break the tone of the sector.

Bessent said the government wants a leader who stays calm and works more quietly for the public.

Hassett said Trump plans to pick someone who helps Americans secure cheaper car loans and easier mortgage access, and he pointed to rate expectations as a major factor.

The post Kevin Hassett has The Strongest Chance At Fed Chair, According To Prediction Market Bettors appeared first on Live Bitcoin News.

You May Also Like

The Channel Factories We’ve Been Waiting For

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip