- Binance will remove several leveraged trading pairs including PENGU/FDUSD.

- Removal aims to manage risk and regulatory compliance.

- Forced liquidation of positions begins December 11, 2025.

Binance, the world’s largest cryptocurrency exchange, announced plans to remove several leveraged trading pairs on December 11, 2025, affecting PENGU, NOT, FLOKI, and INJ paired with FDUSD.

This announcement is part of Binance’s strategy to reduce speculative risk, potentially impacting market liquidity and token prices due to forced liquidations.

Significant Changes in Binance’s Trading Pair Offerings

Binance will remove several leveraged trading pairs, including PENGU/FDUSD on December 11, 2025. Isolated-margin lending suspends on December 8, 2025. Users must close positions to avoid losses.

Forced liquidation will occur for the affected pairs, impacting PENGU, NOT, FLOKI, and INJ against FDUSD. This move addresses risk by reducing leverage-related liquidity in these tokens.

Community sentiment is mixed, with Binance’s Telegram group emphasizing timely management to avoid losses. No formal responses from regulatory bodies or Binance’s leadership yet.

Analyzing Market Impact Amid Regulatory Focus

Did you know? Previous removal of high-volatility trading pairs by Binance resulted in short-term decreases in trading volumes and a temporary downturn in affected token markets.

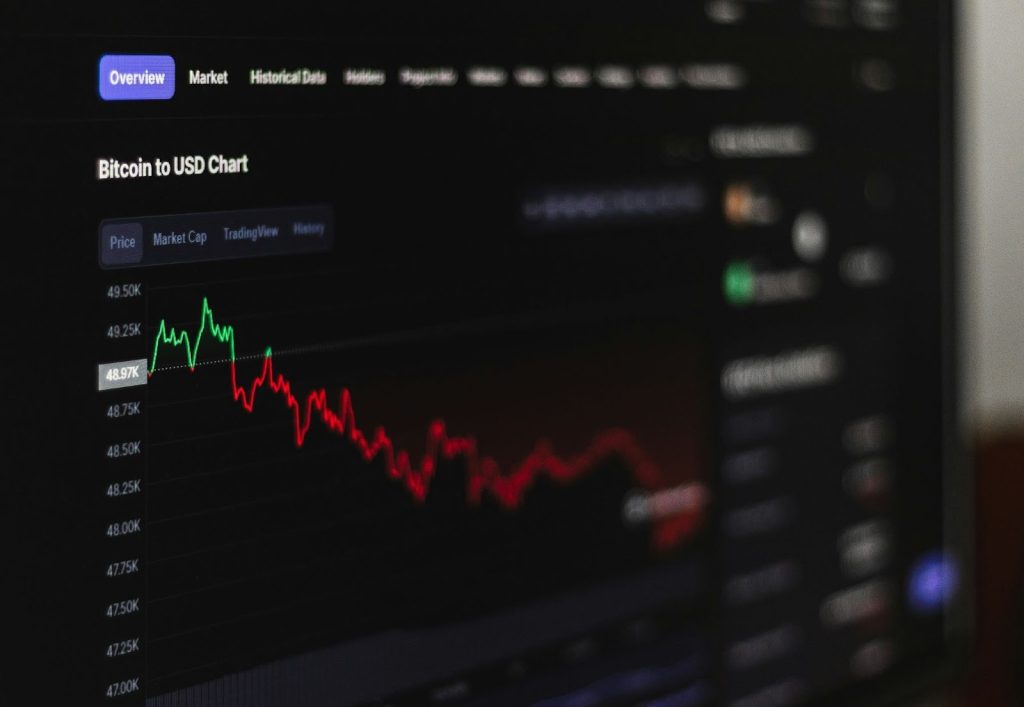

According to CoinMarketCap, PENGU has a current price of $0.01, with a market cap of $756.28 million. The last 24-hour trading volume was $206.29 million, noting a decrease of 37.63%. Price changes over 30 days show a decline of 20.54%.

Pudgy Penguins(PENGU), daily chart, screenshot on CoinMarketCap at 05:29 UTC on December 4, 2025. Source: CoinMarketCapThe Coincu research team suggests that removing these pairs will mitigate speculative risk, steadying market volatility. Historical trends indicate similar actions have helped Binance maintain compliance and control risk in volatile markets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/binance-removes-leveraged-trading-pairs/