Indian Investors on CoinDCX Shift to Wider Crypto Portfolios

Indian investors on CoinDCX broaden portfolios in 2025 as diversification, SIP growth, and Tier-2 participation reshape crypto adoption.

Indian investors using CoinDCX are steadily widening their portfolios as 2025 brings more deliberate allocation patterns. Moreover, increasing research-led participation is the sign of a shift away from single-asset thinking towards structured investment behavior.

Indian Investors Move Beyond Bitcoin

According to CoinDCX’s new annual report, the number of people diversifying their portfolios has increased dramatically across the platform. Furthermore, the average investor is holding roughly five tokens today, as opposed to two or three in 2022. The report titled 2025: The Story of Crypto in India is also based on exchange data, ecosystem blogs, and quarterly participation trends.

Related Reading: Crypto News: India and US Maintain Top Positions in Global Crypto Adoption | Live Bitcoin News

The trading volume of the exchange was reported at Rs 51,333 crores in FY 25. However, analysts point out that the bigger change is in the behavior of investors. CoinDCX’s leadership emphasised that worldwide regulation, institutional entry, and continued education hastened this shift. As a result, the mainstream comes to view crypto more like a long-term asset class.

According to the report, 43.3% of the holdings of investors are concentrated in Layer-1 tokens. In addition, Mumbai, Bengaluru, and Pune experienced strong Ethereum surges, with the volume of ETH in Bengaluru increasing 6.6x. Pune had a 10x increase, Lucknow, a 5x increase and became a notable SUI hub.

Average investor age increased from 25 to 32, meaning a more financially experienced base. Meanwhile, systematic investment plans were over 200,000 in early 2025, over tenfold the previous year. Therefore, disciplined investment patterns now take over from short-term trading.

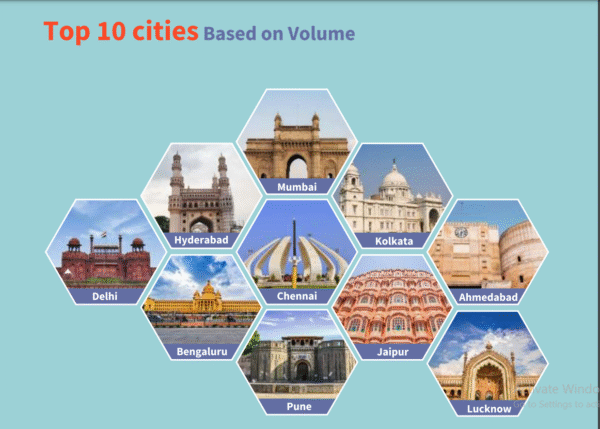

Tier-2 Cities Drive Strong Expansion

Tier-2 and Tier-3 cities came up with approximately 40% of India’s crypto user base in 2025. Along with this, the cities such as Patna, Jaipur and Bhopal also joined the list of top trading centers. Jaipur doubled its Ethereum volume, and Solana’s tripled, while Pune became a leading Solana market.

Furthermore, more than 80% of new users in the past six months were from the equity markets. This crossover implies higher tolerance for diversified digital assets. Institutional participants such as family offices accounted for almost half of exchange volumes in early 2025.

Experts Point Out Increasing Diversity in Portfolios

Source: CoinDCX

Source: CoinDCX

Industry observers call out growing gender and age diversity. The participation of women doubled every year, with Kolkata, Delhi and Mumbai taking the lead. Additionally, new emerging hubs like Bhubaneswar, Kochi and Vadodara also had robust involvement. Women investors were leaning towards diversified sets comprised of Bitcoin, Ethereum, Shiba Inu, Dogecoin, Polygon, XRP, Solana, and Cardano.

Investors are now breaking down tokens by sectors and utilities, like equity-style investments. Moreover, some of the more popular holdings include Bitcoin at 26.5% and Ethereum is particularly strong among women investors. Dogecoin and Solana also still maintain a lot of interest.

As the participation spreads, analysts expect the Indian digital asset market to mature further in 2026. Additionally, the report suggests traditional Bitcoin halving cycles will have less of an impact as institutional allocations stabilize. Hedge funds currently average 7% crypto exposure with most planning increases.

Consequently, experts believe that broader portfolios and increased usage of SIP may allow for more stable patterns of liquidation when markets fluctuate. As adoption grows across emerging cities, it seems that the next growth phase in India is one that will be driven by structure and longer term engagement as opposed to speculative cycles.

The post Indian Investors on CoinDCX Shift to Wider Crypto Portfolios appeared first on Live Bitcoin News.

You May Also Like

Tom Lee, 2026’yı “Ethereum Yılı” İlan Etti: Fiyat Tahminini Paylaştı!

How to earn from cloud mining: IeByte’s upgraded auto-cloud mining platform unlocks genuine passive earnings