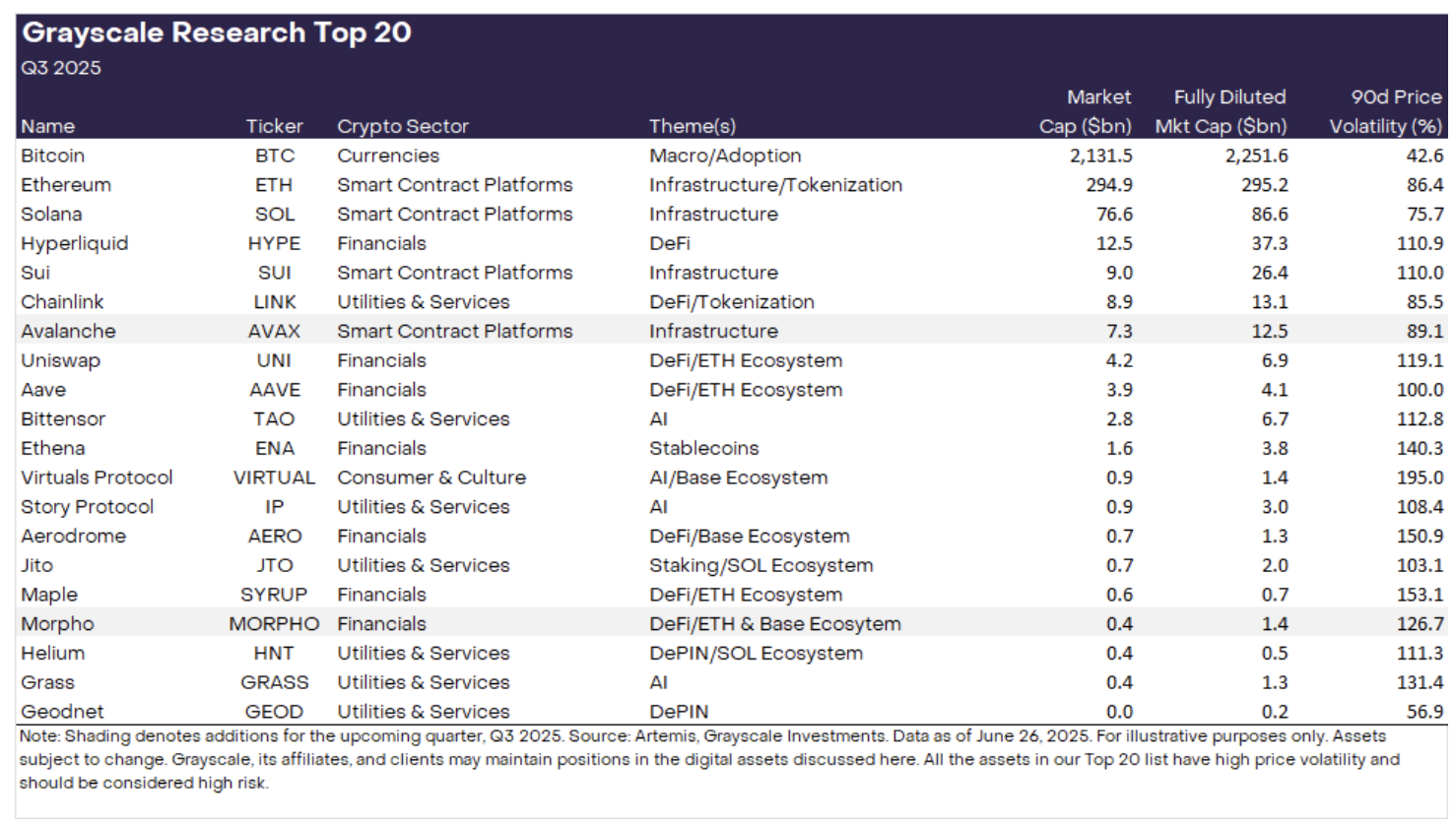

Grayscale updated its Top 20 list for Q3, adding AVAX and MORPHO

Crypto asset manager Grayscale has updated its Top 20 list for the third quarter, adding Avalanche and Morpho — two assets it sees as having strong potential in the months ahead.

On June 26, Grayscale updated its Top 20 asset list as part of its Q3 2025 Crypto Sectors report, with the only changes being the addition of Avalanche (AVAX) and Morpho (MORPHO).

According to Grayscale research team, Avalanche was added due to a recent surge in transaction volume and user activity, possibly linked to new gaming integrations (specifically, the onboarding of video game MapleStory) and stablecoin usage, suggesting organic ecosystem growth.

: AVAX and MORPHO added to Top 20 for Q3 2025 | research.grayscale.com

: AVAX and MORPHO added to Top 20 for Q3 2025 | research.grayscale.com

Morpho was included for its rapid expansion as a decentralized lending protocol, now the second-largest by Total Value Locked, with over $4 billion and growing fee revenue. Grayscale also highlighted the launch of Morpho V2 last month, aimed at bridging DeFi with traditional financial institutions.

More generally, the company sees strong potential in on-chain lending and believes lending-focused assets like Morpho, Aave (AAVE) and Maple Finance (SYRUP) (also on its Top 20 list) are well positioned to capture a meaningful share of future growth in the sector.

To make room for AVAX and MORPHO, Lido (LDO) and Optimism (OP) were removed despite their core roles in staking and Layer 2 scaling, respectively. Grayscale flagged regulatory uncertainty around staking that could pressure Lido’s fee revenue, while Optimism’s token has struggled to capture economic value despite widespread tech adoption.

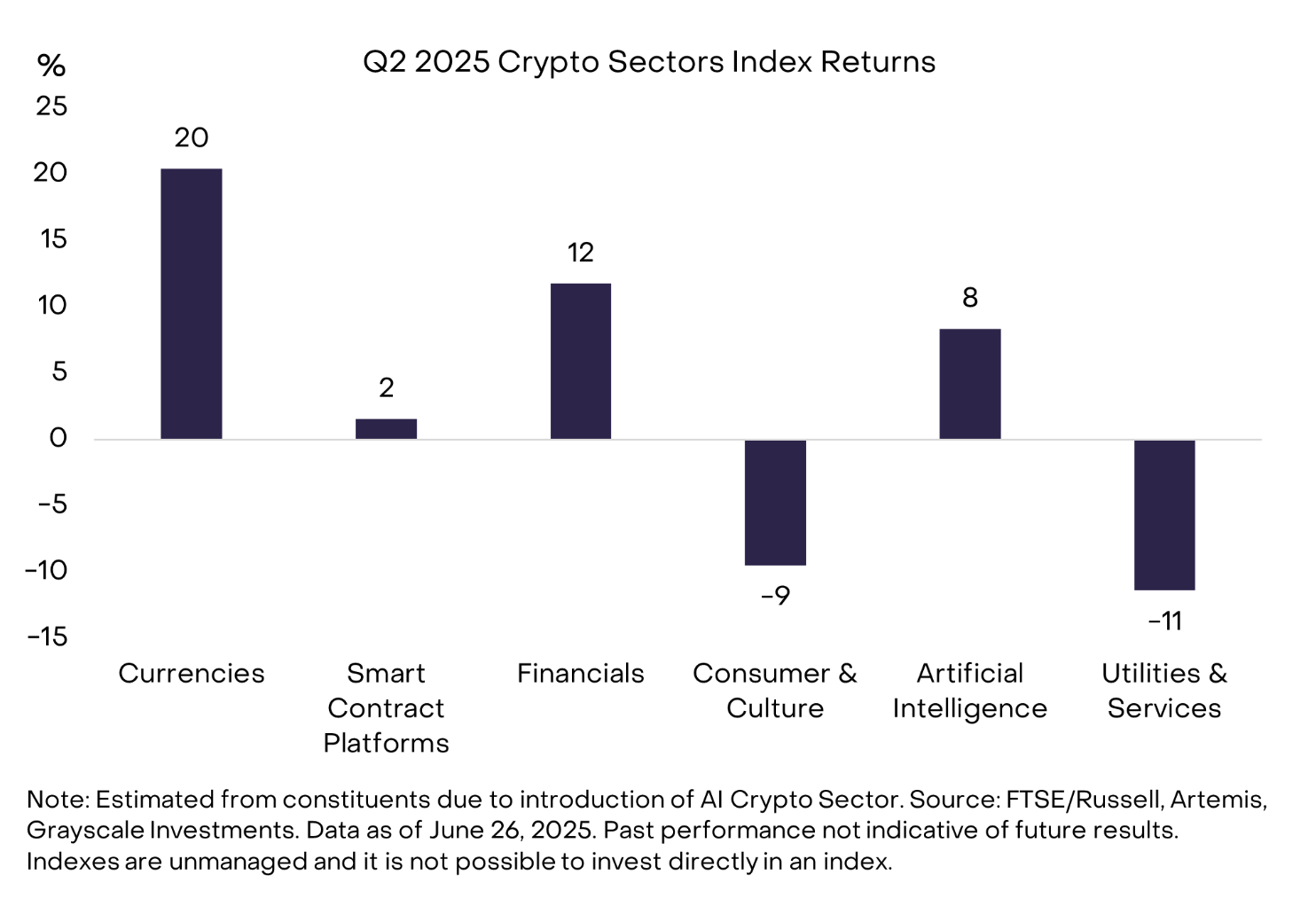

The report also covered broader crypto sector trends. Q2 2025 saw mixed returns across segments, with Bitcoin leading gains in the Currencies sector. Smart Contract Platforms recorded a rise in transaction volume, but fee revenues fell as memecoin activity cooled. Grayscale highlighted growing interest in decentralized AI, DeFi lending, and smart contract platforms despite broader macro and regulatory uncertainty.

Additionally, the company finalized the launch of its AI Crypto Sector, tracking 24 AI-related tokens now worth $15 billion, led by Bittensor (TAO).

: Q2 2025 Crypto Sectors Index | research.grayscale.com

: Q2 2025 Crypto Sectors Index | research.grayscale.com

You May Also Like

Modernizing Legacy E-Commerce Platforms: From Oracle ATG To Cloud-Native Architectures

Solana Price Prediction from Standard Chartered