Zcash Price Regains Footing Above $375 as Founder Responds to Michael Saylor’s Criticism

Zcash ZEC $365.7 24h volatility: 1.7% Market cap: $6.01 B Vol. 24h: $1.28 B regained footing above the $375 level on Dec. 5 after a heated public exchange between Zcash founder Eli Ben-Sasson and Bitcoin advocate Michael Saylor reignited market interest. The Bitcoin-maximalist stance led by the likes of Saylor, frames altcoins assets as securities vulnerable to market manipulation.

The dispute escalated on Nov. 16, just as Zcash briefly surged toward $700 in November, when Hunter Horsley, CEO of Bitwise, argued on X that Bitcoin maxis struggled to provide coherent criticisms of Zcash. His comments sparked heated debate that brought renewed attention to the privacy-coin.

On Dec. 5, Ben-Sasson shared details of his first discussion with Saylor, noting that newer project Starknet’s mission is ultimately to grow the Bitcoin economy through staking, yield generation and DeFi activity.

Ben-Sasson said, countering criticism of Zcash’s design, emphasizing that privacy and regulatory compliance can coexist alongside shielded transactions.

Reacting to Saylor warning about too-rapid innovation, Ben-Sasson argued that a decade of research is more than sufficient for activation. He concluded by noting he still intends to raise quantum-resilience in future discussions.

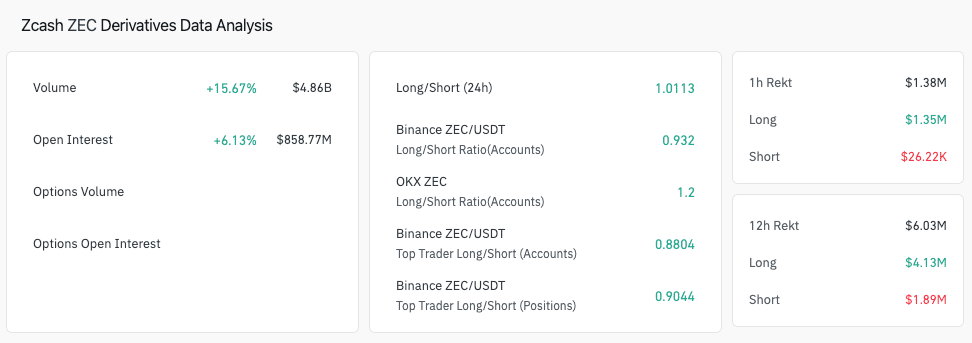

Coin Glass data shows Zcash open interest rose 6% mildly exceeding the 5% spot gains, showing that traders are backing spot purchases with healthy leverage, in anticipation of further upside. The long/short ratio flipped above 1.0 confirming that the fresh leverage positions were predominantly bullish on ZEC price.

Zcash (ZEC) Derivative Market Analysis | Source: TradingView

Zcash Price Analysis: Bullish Pennant Points Toward a Potential $700 Breakout

Zcash is trading near $369 at press time, recovering from a sharp late-November correction while forming a bullish pennant on the daily chart. The pattern follows a steep rally from the sub-$100 zone in September and now points to a potential retest of the $730 territory.

Zcash (ZEC) Price Analysis | TradingView

However, Zcash is yet to reclaim the middle Bollinger Band near $501. Holding this level prevents a return to the lower Bollinger band and keeps the ZEC bullish pennant in play. If momentum holds, ZEC could retest $500 first, followed by a breakout attempt toward $730, if leverage inflows persist.

On the downside, ZEC’s bullish pennant fails only if price closes below $272, the lower Bollinger Band and macro trendline. Before that level ZEC price is likely to find significant support at the weekly timeframe low of $305.

nextThe post Zcash Price Regains Footing Above $375 as Founder Responds to Michael Saylor’s Criticism appeared first on Coinspeaker.

You May Also Like

BlackRock boosts AI and US equity exposure in $185 billion models

Dogecoin Price Could See A Major Spike To $10 If This Trend Repeats