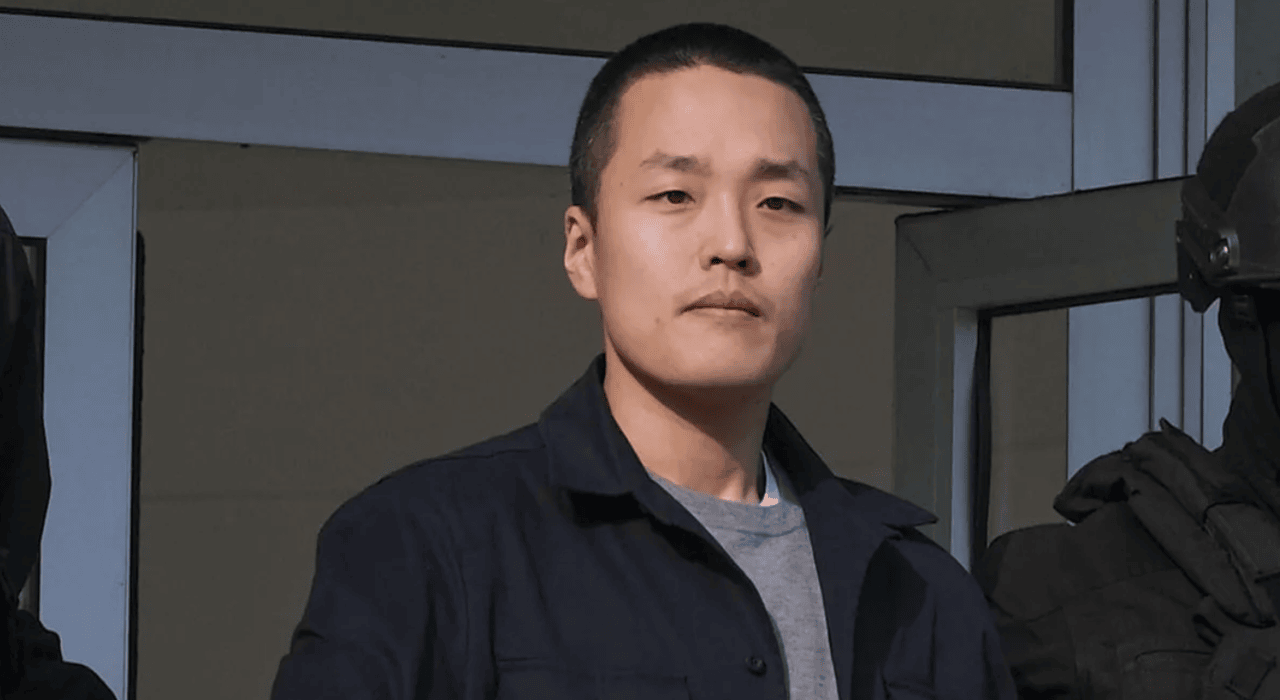

US Prosecutors Seek 12-Year Sentence for Terraform Labs’ Do Kwon

United States prosecutors in the Southern District of New York on December 5, 2025, recommended a 12-year prison sentence for Do Kwon, co-founder of Terraform Labs.

This follows a plea agreement that limits potential punishment to 12 years despite serious charges that could carry up to 25 years.

Kwon’s actions contributed to the collapse of the TerraUSD (UST) stablecoin and the Luna token, resulting in a $40 billion loss and chaos in the crypto market. He was arrested in Montenegro in 2023 for using fake travel documents and later extradited to the U.S.

The Fraud and Guilty Plea

Terraform Labs promoted TerraUSD as a new type of stablecoin that would automatically maintain its $1 value. However, prosecutors showed that Kwon secretly bought large amounts of tokens in 2021 to create the illusion of stability. He hid important risks from investors while claiming the system was safe and decentralized.

In May 2022, confidence dropped, and UST lost its $1 value, causing Luna to lose more than 99% of its worth. However, during a plea hearing on August 12, 2025, Kwon pleaded guilty to two felony counts: conspiracy to commit wire fraud and wire fraud. In a candid admission, he stated:

This guilty plea limited his maximum prison time to 12 years, even though the law allowed for up to 25 years.

Dispute in the Sentencing

Defense lawyers requested a sentence of no more than five years for Kwon, citing nearly three years spent in harsh conditions in Montenegro and arguing his actions were motivated by pride rather than greed. In contrast, prosecutors seek a full 12-year sentence to deter future crypto fraud and highlight the crime’s seriousness.

They highlighted that Kwon tried to escape justice by using fake passports after the crash. Kwon has agreed to pay $19.3 million, return some of the properties, and compensate the victims. According to the plea deal, he will be sent to South Korea after serving half of his sentence.

Meanwhile, South Korean prosecutors are seeking up to 40 years in prison for related charges, including breaking capital market laws. The SEC has already secured a $420 million civil fraud judgment against Kwon and Terraform. U.S. District Judge Paul Engelmayer will decide Kwon’s final sentence next week.

The post US Prosecutors Seek 12-Year Sentence for Terraform Labs’ Do Kwon appeared first on CoinTab News.

You May Also Like

Cardano News Today: Latest Cryptocurrency News Live

Team Launches AI Tools to Boost KYC and Mainnet Migration for Investors