Analysts: Bitcoin on-chain activity is rising, demand remains strong, and this cycle may not be over yet.

PANews reported on December 7th that analyst @TXMCtrades stated on the X platform that Bitcoin's activity metric is rising, potentially indicating that the current market cycle is not yet over. Activity is the sum of all on-chain lifecycle spending and holding activity. Activity increases when tokens are net traded; it decreases when tokens are held, and adjusts based on the token's issuance date.

In a bull market, activity typically increases as supply changes hands at higher prices, indicating new capital inflows. As demand weakens, momentum slows, and the indicator declines. It's a concise indicator, similar to a long-term moving average of on-chain activity.

Despite the price decline, activity in this cycle continues to rise, indicating a bottom in spot Bitcoin demand that is not yet reflected in price action. While activity typically lags far behind price movements and is therefore not a market signal, the momentum remains positive from this perspective. Some large entities are taking action in the market; it's just that their identities are unknown.

You May Also Like

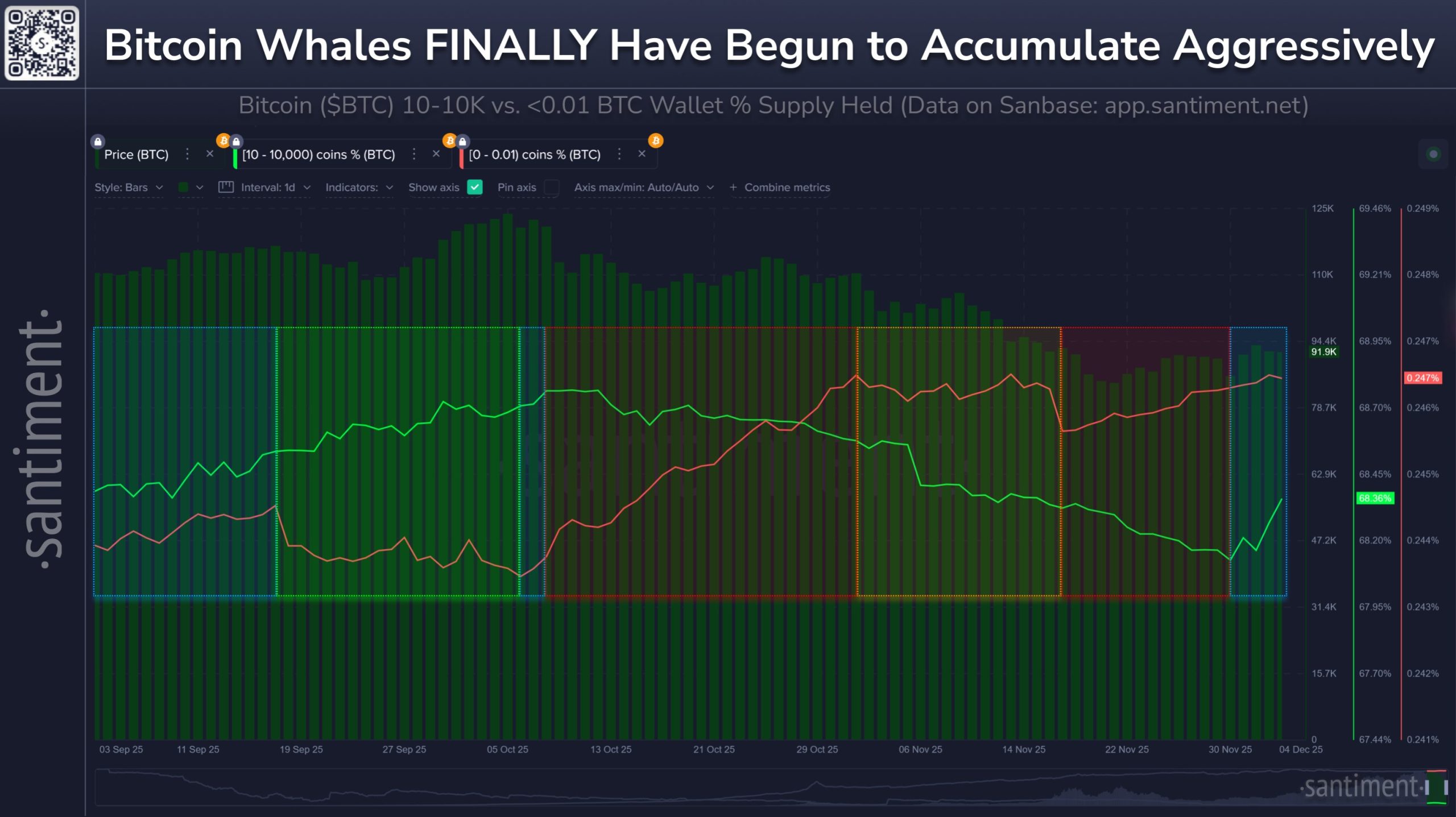

Bitcoin Whales Accumulate 47,584 BTC in December After Massive Two-Month Selloff

US crypto tsar David Sacks denies overstaying his job amid Warren scrutiny

A total of 167 workdays have passed since Trump’s inauguration — though David Sacks’ team reportedly insists he has been cautious not to exceed his limit. A spokesperson for US AI and crypto czar David Sacks has refuted the idea that he may have breached his 130-day limit as a special government employee, following scrutiny from several US lawmakers.The spokesperson for Sacks told CNBC on Wednesday that he carefully manages his SGE days to ensure that he stays under the limit and that those days don’t have to be in a row.It comes after Massachusetts Senator Elizabeth Warren and other US lawmakers questioned whether Sacks exceeded the number of days under his short-term federal appointment. Read more