Best Crypto to Buy Now? XRP Price Prediction December 2025-2026

For years, XRP has been at the center of intense debate in the crypto world. Once viewed as a top solution for global payments, it has become controversial due to regulatory pressure, volatile price swings, and shifting investor confidence.

$XRP previously surged to $3.65 during major bull runs but retraced sharply afterward. Now the token is moving sideways as traders wait for a new catalyst. It currently trades near $2.05 and remains the fourth-largest cryptocurrency by market cap.

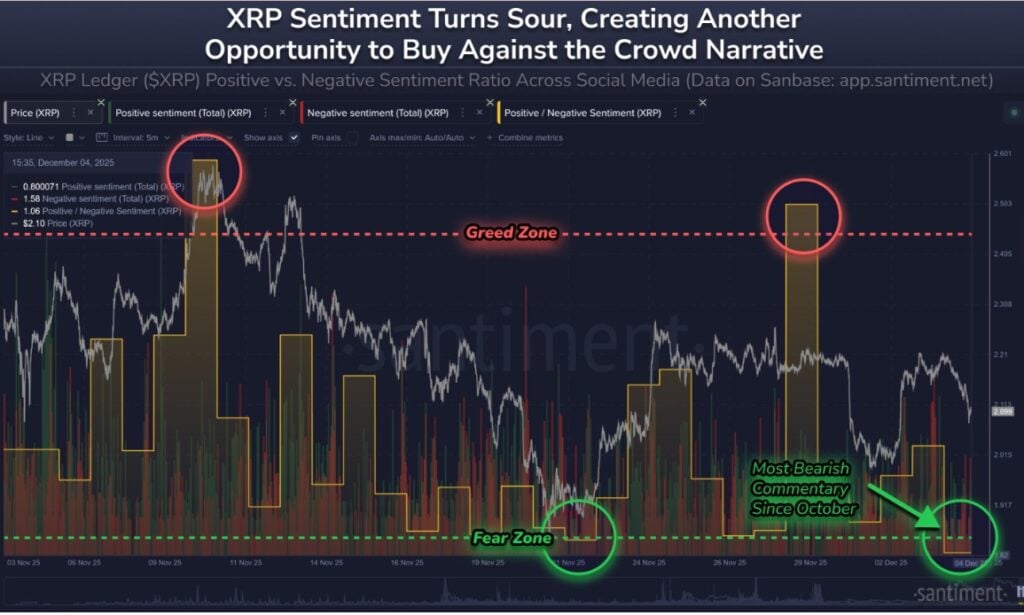

XRP’s social sentiment has fallen to its weakest level since October, placing the asset firmly back in what Santiment refers to as the “fear zone.” With market conditions turning shaky, investors are now focused on XRP price prediction and whether the token remains one of the best crypto to buy now.

Santiment notes that similar sentiment drops in past cycles often preceded strong XRP rallies. Despite the current uncertainty, this level of fear has historically marked the start of major recoveries.

How Institutional Adoption Could Shape XRP’s Role in Cross-Border Payments

Despite past volatility and long stretches of stagnation, the overall landscape is shifting rapidly as major financial institutions begin embracing digital assets at an unprecedented pace.

Starting January 5, 2026, Bank of America will begin CIO coverage of four Bitcoin ETFs, including BITB, FBTC, Grayscale Mini Trust, and IBIT, allowing over 15,000 advisers across Merrill, the Private Bank, and Merrill Edge to proactively recommend regulated crypto products for the first time.

For investors drawn to thematic innovation and willing to handle higher volatility, a small allocation of 1% to 4% in digital assets may be suitable, according to Chris Hyzy, CIO of Bank of America Private Bank.

He also emphasized that this approach should focus on regulated products, careful allocation, and a solid understanding of both potential gains and risks. This marks a sharp contrast to earlier years when banks actively distanced themselves from crypto.

As global adoption accelerates, blockchain technology and tokenization are becoming integral to future financial infrastructure, with XRP expected to play a meaningful role in cross-border payments and new financial rails.

Although current market conditions still involve sharp swings and periods of bearish volatility, these cycles often precede extended bull runs.

Source – Cilinix Crypto YouTube Channel

XRP Price Prediction

XRP’s short-term outlook has shifted slightly after recent price action failed to generate strong bullish continuation. The asset previously showed momentum, but its inability to react strongly at key lower-timeframe imbalance zones signaled a temporary slowdown.

Even so, the overall market structure for $XRP does not appear bearish, as indicators such as negative funding rates often align with bottom-forming conditions. XRP has also shown signs of absorption, where selling pressure increases but price remains stable, signaling potential strength.

For the past few weeks, XRP has been consolidating between its major support at $2 and resistance near $2.25, suggesting a controlled environment rather than a breakdown setup. $XRP is expected to find support again and make its way toward the unfilled imbalances around $2.18 to $2.20.

Once price revisits these levels, the reaction will help determine whether a full breakout can finally occur. For now, the long-term target of $2.40 to $2.41 remains intact.

Top Contender for the Best Crypto to Buy Now Before Year-End

With the weekend approaching, traders are closely watching potential price movements for XRP while searching for the next high-potential crypto. One standout is Bitcoin Hyper (HYPER), currently in presale and already exceeding $29 million in funding.

Bitcoin Hyper is emerging as one of the best crypto presales of 2025-2026, introducing a high-speed Bitcoin layer 2 chain designed for scalability and efficiency. By enabling near-instant transactions and lower fees, it expands the functionality of Bitcoin without creating a separate ecosystem.

The platform supports payments, decentralized applications, and financial services like lending and borrowing, all secured with zero-knowledge proofs and trustless mechanisms. Investors can participate using popular crypto through standard wallets and bank card.

Combining utility with meme-inspired branding, Bitcoin Hyper aims to attract developers and users while maintaining Bitcoin’s decentralized ethos. While XRP remains a popular choice for traders, Bitcoin Hyper stands out for its high growth potential in a volatile market.

Visit Bitcoin Hyper

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Trump Crypto Adviser Urges Bipartisan Support After Senate Committee Unveils Partisan Crypto Bill

CME Group to launch options on XRP and SOL futures