Berachain ranks second among public chains with $360 million in capital inflow. Can the “liquidity narrative” last?

Author: Frank, PANews

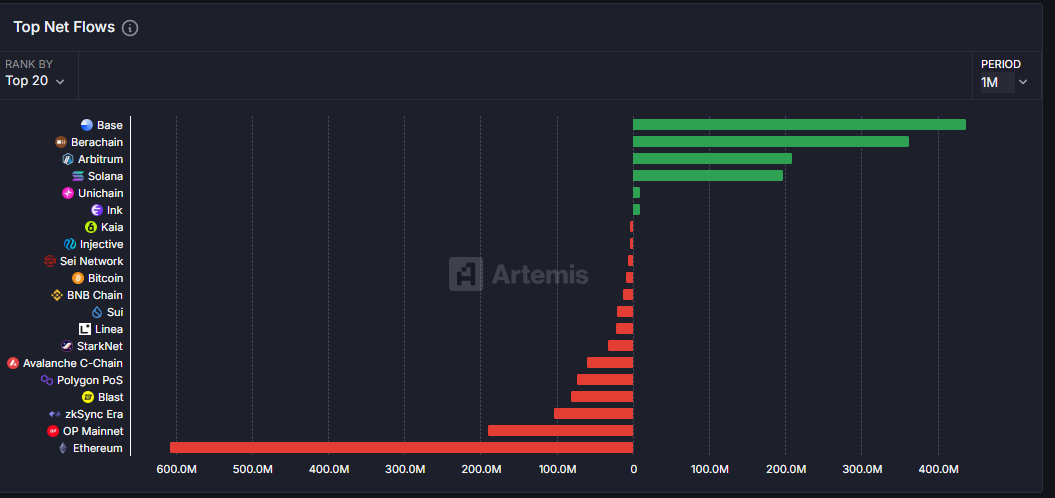

In the context of the recent overall downturn in the crypto market, Berachain ranked second in the public chain track with a net inflow of US$360 million in the past month, becoming one of the few Layer 1 projects that grew against the trend. After the mainnet was launched, its total locked value (TVL) stabilized at US$2.9 billion, ranking sixth in the entire network, verifying the attractiveness of its liquidity proof (PoL) mechanism to pledged funds.

However, the ecosystem is also facing some controversy. The price of the token BERA fluctuates drastically, the disparity in airdrop distribution raises questions about fairness, and Lianchuang publicly reflects on the token economic model. After the airdrop, can Berachain, relying on the liquidity narrative of the PoL mechanism, regain the trust of the community and turn from a new force into an evergreen?

The net capital inflow ranked second in the month, and TVL ranked among the top six

The most eye-catching data of Berachain is the capital inflow. As of March 18, Berachain's net capital inflow in the past month was about 360 million US dollars, second only to Base. In the stage when the market is falling and the ecology of various public chains is in a downturn, it is rare for Berachain's capital inflow to have such a performance.

However, after careful analysis, it can be seen that the concentrated inflow of funds into Berachain was mainly between February 16 and March 3. During this period, Berachain's main network was just launched, the test network was launched, and the airdrop was received. Therefore, it seems to be expected that there will be a batch of funds flowing in.

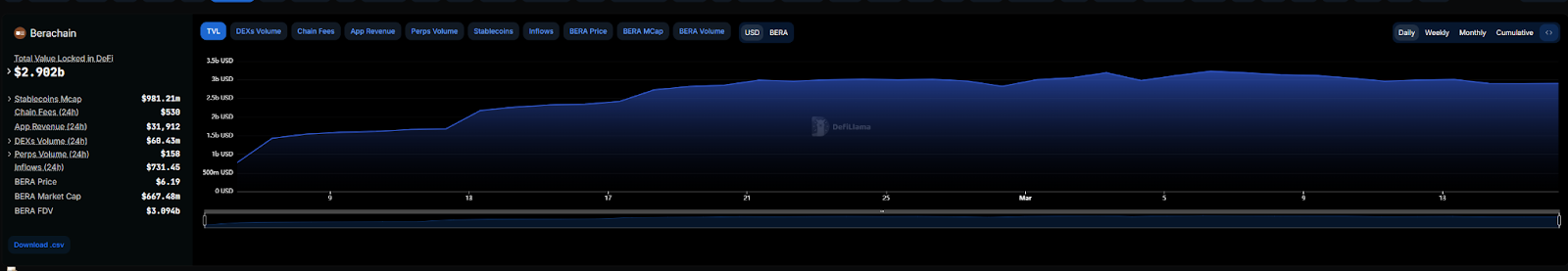

In addition to the net inflow of funds, Berachain's TVL has also been in a relatively stable state since the launch of the mainnet. It has not experienced a sharp explosive growth nor has it declined too much due to market changes. As of March 18, Berachain's TVL was approximately US$2.9 billion. From the overall data comparison, Berachain's TVL currently ranks sixth among all networks, with only Bitcoin, Ethereum, Solana, BSC and Tron having higher TVL than Berachain. From this perspective, Berachain's PoL (liquidity proof mechanism) consensus mechanism still has certain natural advantages in attracting pledge funds.

Among them, the largest amount of funds is pledged in Infrared Finance, which is the main application of the Berachain network liquidity consensus mechanism.

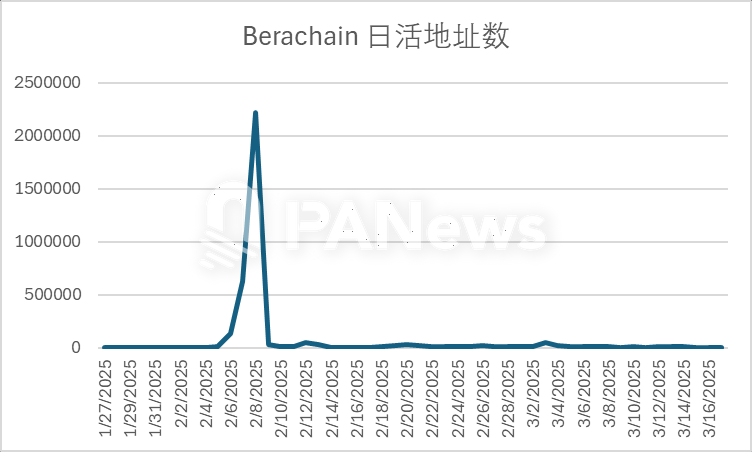

In addition to the good effect of the introduction of funds, network activity is also a test of the actual health index of a new public chain. According to Berachain's official data, the number of daily active users has experienced a great ups and downs. The number of daily active addresses soared to more than 2 million between February 4 and February 10, and then returned to normal and stabilized at around 10,000 addresses. In the past month, the average number of daily active addresses of Berachain was about 13,400. Compared with several other mainstream public chains, this data still has a large gap, but it is relatively stable at present. The subsequent activity still needs a larger time sample to explain the problem.

At the data level, the most noteworthy thing is the performance of the token. BERA token is also the source of the most controversy for Berachain recently.

From the chart, BERA tokens once surged to $15.5 after going online, and then began to fall. This performance is roughly similar to the trend of most large airdrop projects. However, in the subsequent market, BERA showed great volatility. It fluctuated repeatedly in the range of $5 to $9. It often rose by nearly 90% in a few days, and then fell 40% back to the original point. However, since there were fewer chips in the market in the early stage of the project, it was relatively easy to have violent fluctuations.

From airdrop carnival to crisis of trust

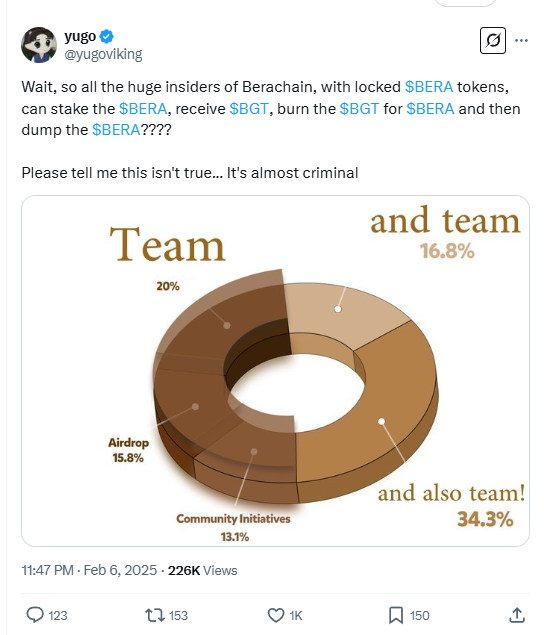

The doubts about BERA mainly focus on the airdrop and token economic model. Previously, PANews has reviewed Berachain’s airdrop (Related reading: Berachain airdrop “rich-poor disparity”: NFT holders received up to 55.77 million US dollars, while testnet users only received 60 US dollars ). In the airdrop distribution, the benefits of NFT holders and ordinary test users were very different, resulting in a huge gap between the rich and the poor.

In addition, many users feel that it is unfair that early VCs can earn returns by staking locked tokens even though they have not unlocked their tokens. More than 35% of BeraChain’s BERA tokens are allocated to private investors, raising concerns about centralization and fairness.

Afterwards, Smokey the Bera, the anonymous co-founder of Berachain, said in an interview with Un Chained: “I don’t think the criticism is entirely wrong. If we could do it again and the team could start from scratch, we might not sell so much supply to VCs.”

In addition, a blogger named Ericonomic discovered that one of Berachain’s co-founders sold 200,000 tokens he received from the airdrop. The Berachain team did not respond to this.

With the fading of the airdrop enthusiasm and the sharp fluctuations in token prices, Berachain’s popularity on social media has also gradually disappeared recently. The news of a safety accident in an ecological project has attracted much attention again.

On March 15, Berally, a platform that uses AI agents for social trading in the Berachain ecosystem, announced a security issue. "Part of the deployer key information was leaked, causing all vesting tokens to be sold off and withdrawn from the liquidity pool." Fortunately, Berally officials acted quickly and announced a token compensation plan of up to 120% a day later, claiming that the hacker had been locked up through a centralized exchange.

Airdrops are about to end and liquidity experiments are about to begin

Berachain’s airdrop collection period will end on March 20. When the airdrop activity is completely over, whether to rely on Berachain’s PoL to continue to attract users or to create a new growth curve through the rise of other projects in the ecosystem may be the key issue that Berachain will face.

In the ecosystem, several key partners of Berachain have also made progress recently. Infrared, as the application with the most deposited funds on Berachain, received another $14 million Series A financing on March 4, bringing the total financing amount to $18.75 million. From a product perspective, the highest APR of the pledge products provided by Infrared reached 95.45%, which is relatively attractive.

However, given that this high-yield trading pair is WBERA-HONEY, referring to the sharp rise and fall of BERA, this yield is more important to resist the ups and downs of BERA tokens to be of practical significance.

In addition, there have been some new developments in several ecosystem partners such as Orderly, XrossRoad, and Moby. However, in terms of importance, these new developments are not really major progress. Berachain officials seem to be focusing on governance and establishing the PoL mechanism. As of March 18, the number of Berachain validators was 60, and the PoL mechanism has not yet been officially launched.

Judging from the official statements, they seem to be confident about the performance of PoL after its launch. However, former NFT holders received massive airdrops, and later VCs have not unlocked them for staking. The trust that the community has left for Berachain may be insufficient, and the only thing Berachain can do is to prove itself through PoL.

In the future, whether the PoL mechanism can be transformed into a real ecological moat and a balance can be found between decentralized governance and user value distribution, will determine whether it can evolve from a "dark horse" to an "evergreen tree". After the airdrop ends on March 20, this experiment around liquidity may really begin.

You May Also Like

Tokyo’s Metaplanet Launches Miami Subsidiary to Amplify Bitcoin Income

US Senate Democrats plan to restart discussions on a cryptocurrency market structure bill later today.