Ethereum’s First ZK-Rollup ZKsync Lite to Shut Down in 2026

ZKsync has announced plans to deprecate ZKsync Lite, Ethereum’s first zero-knowledge rollup, in 2026 as the protocol shifts its focus entirely toward the ZKsync network and ZK Stack-powered chains.

The original Layer 2 solution, which launched in December 2020 as a groundbreaking proof-of-concept, will undergo an orderly sunset after serving its purpose of validating critical ideas for production ZK systems.

No immediate action is required from users, as ZKsync Lite continues to operate normally, with funds remaining secure and withdrawals to Ethereum’s Layer 1 functioning throughout the deprecation process.

The ZKsync Association will share detailed migration guidance, specific dates, and a comprehensive deprecation plan in the coming year.

From Pioneer to Legacy System

ZKsync Lite emerged as the first zero-knowledge rollup on Ethereum, pioneering technology that would later evolve into ZKsync Era and the Elastic Network.

The protocol addressed Ethereum’s fundamental challenges of high transaction fees and slow transaction processing by executing transactions off-chain and submitting cryptographic proofs of validity back to Layer 1.

The project gained significant momentum in November 2025 when Ethereum co-founder Vitalik Buterin publicly endorsed ZKsync following its Atlas upgrade, describing the work as “underrated and valuable.“

His backing catalyzed institutional adoption, triggering a 50% surge in ZK token prices while positioning ZKsync as central to Ethereum’s “Lean Ethereum” scaling strategy.

ZKsync evolved from its initial Lite version to ZKsync Era in March 2023, becoming the first publicly available zkEVM.

The June 2024 ZKsync 3.0 upgrade transformed the ecosystem from a single Layer 2 into the Elastic Network, an interconnected system of autonomous ZK chains sharing liquidity and security through cryptographic proofs rather than traditional bridges.

Institutional Traction Validates ZK Technology

While ZKsync Lite phases out, the broader ZKsync ecosystem has attracted major institutional interest.

Deutsche Bank is developing an Ethereum Layer 2 blockchain using ZKsync technology as part of Project Dama 2, which involves 24 financial institutions testing the blockchain for asset tokenization under Singapore’s regulatory sandbox.

UBS also conducted a proof-of-concept for its Key4 Gold product using ZKsync Validium, testing the platform’s ability to support tokenized gold investments with privacy and scalability.

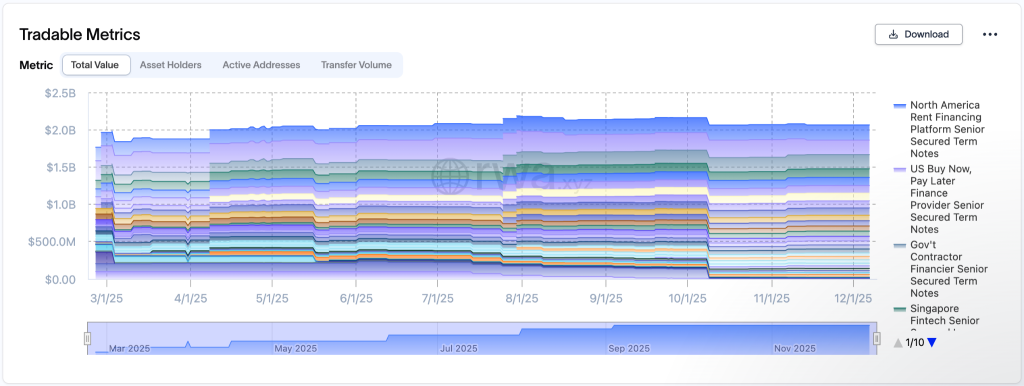

Tradable has also tokenized $2.1 billion in institutional-grade private credit on ZKsync, accounting for nearly 90% of the network’s market share for real-world asset protocols.

Source: RWA[dot]xyz

Source: RWA[dot]xyz

The Ethereum Foundation launched “Ethereum for Institutions” in October 2024, providing enterprises with structured pathways to blockchain adoption using zero-knowledge proofs, fully homomorphic encryption, and trusted execution environments.

Projects like Chainlink, RAILGUN, and Aztec Network pioneer privacy-preserving smart contracts that secure counterparty information while maintaining transparency.

Security Incidents Test Platform Resilience

The deprecation announcement follows two significant security breaches in 2025 involving ZKsync’s protocols.

In April, an attacker exploited admin access to the airdrop distribution contract, minting 111 million unclaimed ZK tokens worth approximately $5 million during the protocol’s token distribution to ecosystem participants.

The hacker agreed to return 90% of the stolen assets in exchange for a 10% bounty, transferring nearly $5.7 million back to the ZKsync Security Council within the designated 72-hour safe harbor window.

The recovered amount exceeded the original stolen value due to token price increases, with ZK gaining 16.6% and ETH rising 8.8% following the incident.

Just one month later, hackers compromised the official X accounts of ZKsync and Matter Labs, spreading false regulatory warnings claiming SEC investigations and Treasury Department sanctions.

The attackers also published phishing links promoting a fake ZK token airdrop designed to drain users’ wallets, causing the token price to drop approximately 5% despite a prior 38.5% weekly rally.

The breach occurred through compromised delegated accounts with limited posting privileges, which have since been disconnected.

These back-to-back incidents contributed to broader industry concerns, as crypto hacks resulted in $1.6 billion in losses during the first quarter of 2025 alone. The quarter was among the worst for crypto security breaches in history.

You May Also Like

Wintermute CEO Reveals Crucial Structural Shifts

XRP Native Lending Becomes Core Strategy as Evernorth Anchors Protocol Adoption