Is the $124 Support Critical as Solana (SOL) Bulls Fight to Maintain Control?

- Solana (SOL) is hovering around the $138 level.

- Its daily trading volume has exploded by over 141%.

With the recent 2.98% spike, the overall crypto market sentiment is wavering between the red and green zones. The major assets are seeking to get charted in a bullish phase. The largest asset, Bitcoin (BTC), hovers at $92.1K while the largest altcoin, Ethereum (ETH), trades near $3.1K. Following suit, Solana (SOL) has posted a gain of over 4.82%.

SOL opened the day trading at a low of $128.29, and with the brief bullish encounter, it has tested a series of resistance levels between $130 and $137. Gradually, the asset has climbed to a high of $139.21. As per the CoinMarketCap data, at the time of writing, Solana traded within the $138.73 mark.

The market cap of the altcoin stays at $77.85 billion, with the daily trading volume of SOL having skyrocketed by over 141.77%, to the $4.86 billion zone. According to the report of Coinglass data, the market has witnessed a liquidation of $31.17 million of Solana in the last 24 hours.

An analyst chart explains that Solana is currently moving sideways, showing a critical support at $124. Losing this level would likely trigger a deeper correction toward these lower zones, with the next strong supports appearing near the $115 and $106 zones.

Can Solana Avoid a Steeper Slide Ahead?

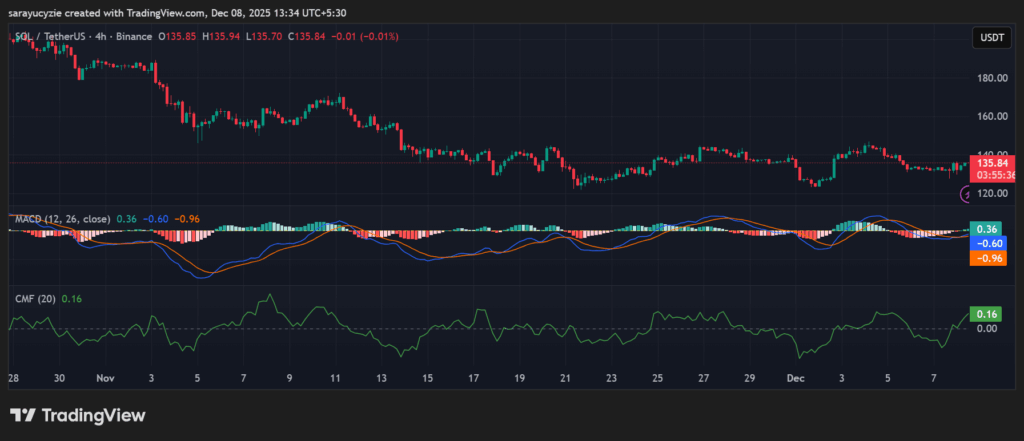

The technical analysis of Solana reports that the Moving Average Convergence Divergence (MACD) and the signal lines are below the zero line. The overall sentiment is bearish, and any crossover below zero is a weaker bullish signal compared to one that occurs above zero.

SOL chart (Source: TradingView)

SOL chart (Source: TradingView)

The Chaikin Money Flow (CMF) indicator, which is positioned at 0.16, implies that the SOL market has moderate buying pressure. Notably, with this value, the capital is flowing into the asset, but the strength is not extreme — more like steady accumulation rather than aggressive buying.

SOL’s daily Relative Strength Index (RSI), found at 52.46, shows that the market is in a neutral zone, slightly leaning bullish. Also, it gives no overbought or oversold signals, with the price action balanced. Moreover, the Bull Bear Power (BBP) value of 3.30 infers that bullish strength is slightly higher than bearish pressure. It is a mild positive signal, not extremely strong, but supporting the upward price movement.

With the bearish correction in the SOL market, the price might slip sharply to test the key support at $134.58. Assuming the bears gain more strength, the death cross could unfold, and the bears may drive the asset’s price below the $130 range.

Conversely, if the Solana bulls regain the lost momentum, the price could move up toward the nearby $142.37 resistance. Further correction on the upside might initiate the golden cross to take place, and trigger the bulls to send the price above $146.85.

Top Updated Crypto News

Bulls in Action: Can Ethereum (ETH) Break the $3.5K Resistance?

You May Also Like

CME Group to Launch Solana and XRP Futures Options

Asia Morning Briefing: BTC Steadies Around 90k With Liquidity Drained and a Fed Cut Fully Priced In

Copy linkX (Twitter)LinkedInFacebookEmail