Solana’s Trajectory Looks Strong; Ozak AI Prediction Shows a More Parabolic Curve

Solana is coming into an effective new segment of market momentum as rising liquidity, increasing developer activity, and renewed investor self-assurance position the community for another strong upward move. Its environment maintains attracting developers across DeFi, trading, and AI-integrated tools, giving Solana a stable basis because the broader crypto marketplace prepares for its next predominant cycle.

Yet even with Solana’s impressive momentum and clear bullish structure, analysts increasingly point toward Ozak AI as the project with a far more explosive and parabolic long-term growth curve, driven by early-stage pricing, advanced AI-native technology, and rapidly accelerating global interest.

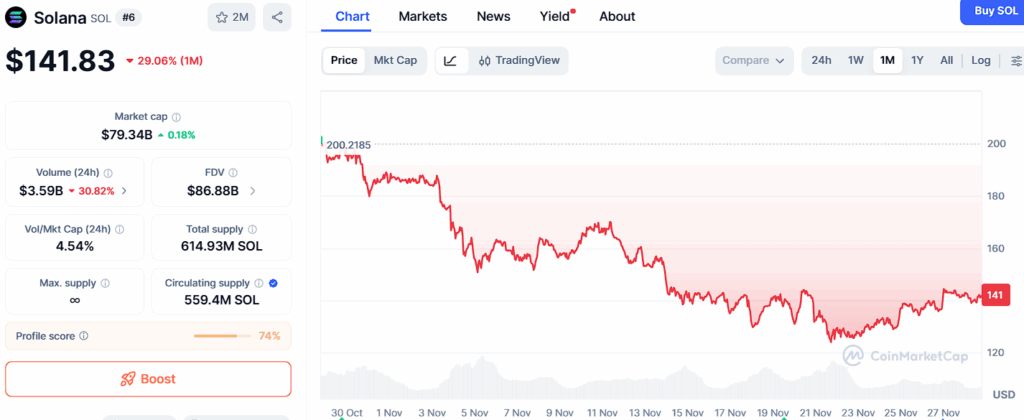

Solana (SOL)

Solana is once again emerging as one of the most resilient performers in the crypto market as liquidity increases and traders return to high-performance networks. With developers expanding usage across DeFi, AI-integrated tools, and high-throughput applications, Solana’s trajectory remains firmly upward.

The asset, trading near $141, holds a solid structure supported at $137, $129, and $120, zones where long-term buyers consistently step in. These levels reinforce Solana’s stability and highlight the confidence that both investors and builders continue placing in the network. For Solana to extend its rally further, it must break resistance at $152, $165, and $178, thresholds that have historically triggered multi-week expansions as network activity surges.

Even though Solana is positioned to climb higher, its growth naturally tapers due to its large market capitalization. SOL may still push toward the $500 range, supported by increasing adoption and expanding ecosystem strength, but analysts agree that its multipliers are capped compared to emerging projects. Solana offers reliability and sustained growth, yet its size prevents it from delivering the kind of exponential returns that smaller, early-stage tokens can achieve in a booming market cycle.

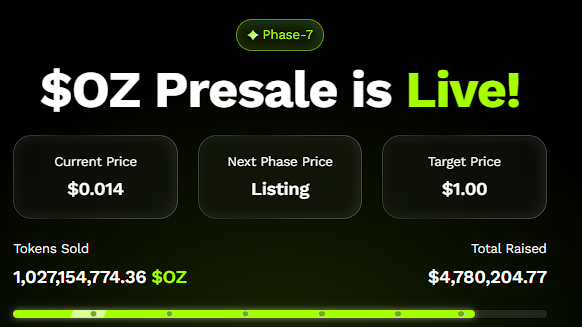

Ozak AI Displays a Far Steeper and More Parabolic Growth Curve

This is where Ozak AI stands out in an extraordinary way. Operating from a much earlier phase, Ozak AI carries the advantage of small market cap entry while offering genuine, high-value AI-native utility. Its ecosystem includes millisecond-speed AI prediction agents, cross-chain intelligence engines, ultra-fast 30 ms trading signals via its HIVE integration, and SINT-powered autonomous AI agents designed for voice-driven execution and automated workflows.

These fused capabilities position Ozak AI not as a speculative AI token but as a foundational intelligence layer for trading systems, Web3 applications, analytics tools, and decentralized automation.

Ozak AI’s presale results provide one of the strongest confirmations of its parabolic trajectory. With over $4.8 million raised and more than 1 million tokens sold, the demand surrounding Ozak AI is accelerating rapidly. This level of early momentum mirrors the early stages of past breakout projects that later achieved 50x–100x returns. Because Ozak AI sits at the intersection of AI hype, real technological use cases, and early-stage tokenomics, analysts increasingly view it as one of the most explosive opportunities of the next major cycle.

Solana’s trajectory looks undeniably strong, supported by powerful fundamentals, rising adoption, and robust technical momentum. It remains one of the most reliable large-cap assets heading into the next expansion phase.

However, Ozak AI’s prediction shows a significantly more parabolic curve, fueled by early positioning, real AI-native functionality, and exceptional presale traction. While Solana may deliver impressive gains, Ozak AI is emerging as the project with the steepest long-term growth potential—standing out as one of the most compelling high-ROI opportunities in the entire market.

About Ozak AI

Ozak AI is a blockchain-based, totally crypto task that offers a generation platform that specializes in predictive AI and superior fact analytics for economic markets. Through the system gaining knowledge of algorithms and decentralized community technologies, Ozak AI permits real-time, accurate, and actionable insights to assist crypto fans and corporations in making the perfect decisions.

For more, visit:

- Website: https://ozak.ai/

- Telegram: https://t.me/OzakAGI

- Twitter: https://x.com/ozakagi

Disclaimer: TheNewsCrypto does not endorse any content on this page. The content depicted in this Press Release does not represent any investment advice. TheNewsCrypto recommends our readers to make decisions based on their own research. TheNewsCrypto is not accountable for any damage or loss related to content, products, or services stated in this Press Release.

You May Also Like

Binance Founder Predicts Bitcoin “Super Cycle” in 2026