Polygon Improves Stability with New Hardfork Rollout

Polygon launches the Madhugiri Hardfork, boosting throughput, enhancing stability, and enabling seamless future upgrades across its PoS network.

Polygon has initiated a major network upgrade designed to strengthen stability and improve performance. The Madhugiri Hardfork increases the throughput by 33%, while making it possible to increase speed further in future without disruptive procedures.

Polygon’s Madhugiri Upgrade Marks Critical Technical Shift

Background work on this upgrade began with previous forks pointing out some structural limitations. Polygon set out to make adjustments to performance easier and make the lives of validators easier. Several previous improvements led to solid foundations and this latest fork improves on those lessons, according to developer statements and technical reports.

Related Reading: BDACS Expands KRW1 Stablecoin to Polygon Network | Live Bitcoin News

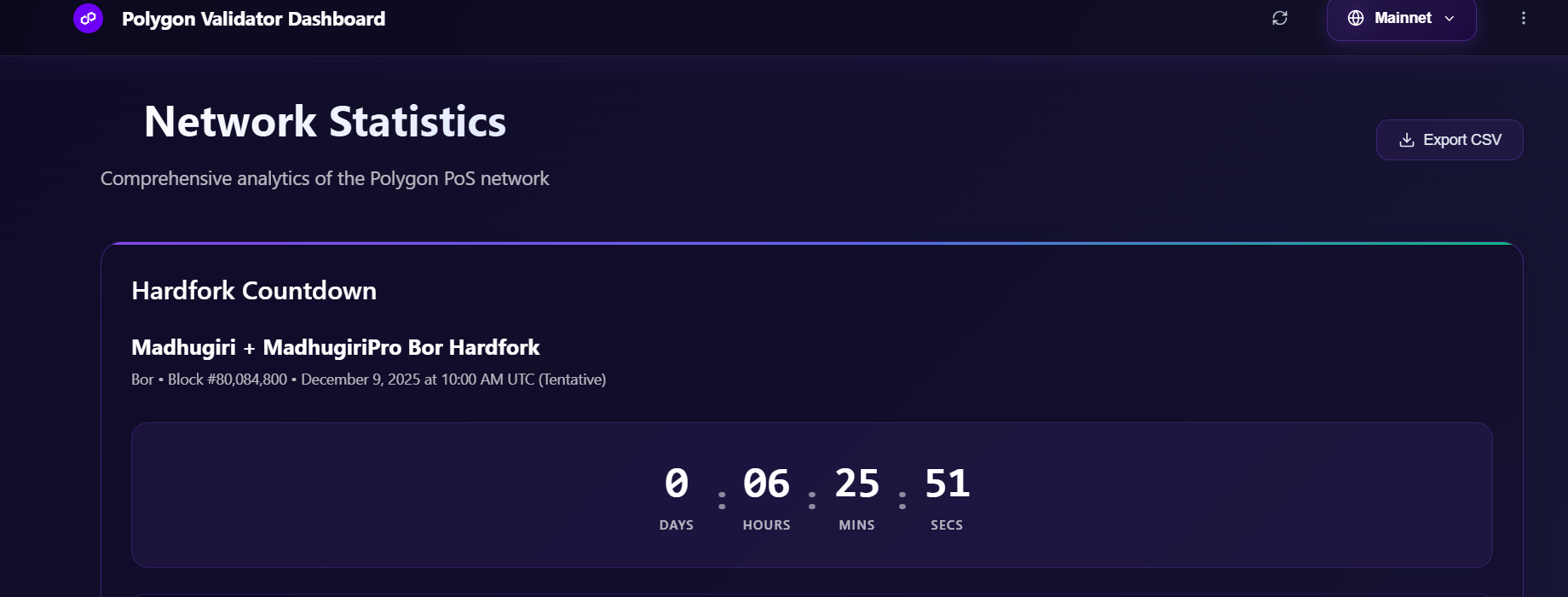

The planned deployment time the around 10 a.m. UTC on December 9. The update brings with it faster synchronization of nodes, improved reliability of block production, and stronger characteristics of protecting the execution layer. It also brings support for Fusaka EIPs of Ethereum that reinforce cross-chain security practices.

In addition, some important proposals are present in the hardfork. These include PIP-75 for the one-second time for consensus and PIP-74 for regulated StateSync inclusion. It also includes the cost increases for ModExp (EIP-7883), gas limit caps (EIP-7825), and upper bounds on MODEXP (EIP-7823). These include components that are designed to increase resiliency and protect operations during heavy cycles of use.

Broader Network Enhancements Reshape Polygon PoS Direction

Earlier upgrades paved the way for this development. Heimdall v2, released in early 2025, tried to lower the finality to five seconds and rectify technical limitations that had existed for some time now. Despite one disruption, it progressed the chain faster toward coordination. The Bhilai Hardfork in July increased throughput past one thousand transactions per second and adopted the Pectra EIPs of Ethereum.

Polygon went on to release the Rio upgrade in October. That update introduced the Validator-Elected Block Producer model, which simplified the block-formation process and increased expectations overall. Rio also started to implement stateless validation and modification of incentives to validators. These redesigns help Polygon now with its ambition to be the leader of the global payments infrastructure.

The combination of these upgrades increases the platform reliability. Rio’s design reduces the amount of reorganization that would have to happen and Madhugiri creates better finality and accommodates later throughput extensions. Stateless validation also lowers hardware requirements, which opens up participation and lowers operation barriers.

Source: X

Source: X

Therefore, Polygon puts itself in the position of high-volume payment traffic. Developers emphasize possible speeds in the five thousand transactions/supported by architecture suited to stablecoin transfers and real-world asset systems.

Polygon Hardfork Paves Way for Faster, Scalable Transactions

The current upgrade is also related to the ongoing GigaGas road map. Engineers are shooting for long-term capacity of up to one hundred thousand transactions per second. To achieve that goal, further protocol segmentation and redesigned bridge components are required. Future iterations might separate the consensus from the cross-chain operation to mitigate the risk and increase modularity.

Polygon’s continued evolution shows its attempt at developing a sustainable layer for the world’s settlements. Faster confirmation, steady throughput, as well as decreased validator power, help with business adoption as well as with payment integration. These improvements also come with the ability to carry out orderly liquidation processes when markets are in some measure of stress due to the uniformity of execution and predictable settlement conditions.

With the upgrades, Polygon enhances its capacity to support enterprises with stable performance requirements. This hardfork is continuing that path forward with the ability to increase speed in the future through simple configuration changes, another step on the roadmap for the development of the technical aspects of the platform.

The post Polygon Improves Stability with New Hardfork Rollout appeared first on Live Bitcoin News.

You May Also Like

Worldcoin Price Prediction 2025-2030: Will WLD Skyrocket to $10?

Top Altcoins To Hold Before 2026 For Maximum ROI – One Is Under $1!