Pepe Coin price eyes rebound as 15 trillion tokens leave exchanges

Pepe Coin price rebounded to its highest point in three weeks as signs of accumulation emerged and as Bitcoin and other altcoins rebounded ahead of the Federal Reserve interest rate decision.

- Pepe Coin price has formed an inverse head-and-shoulders pattern.

- The token has also moved above the Supertrend indicator.

- The coin will likely have a bullish breakout as exchange reserves dip.

Pepe (PEPE) jumped to the psychological point at $0.0000050, up by 28% from its November lows. The rebound brought its market cap to over $2.1 billion.

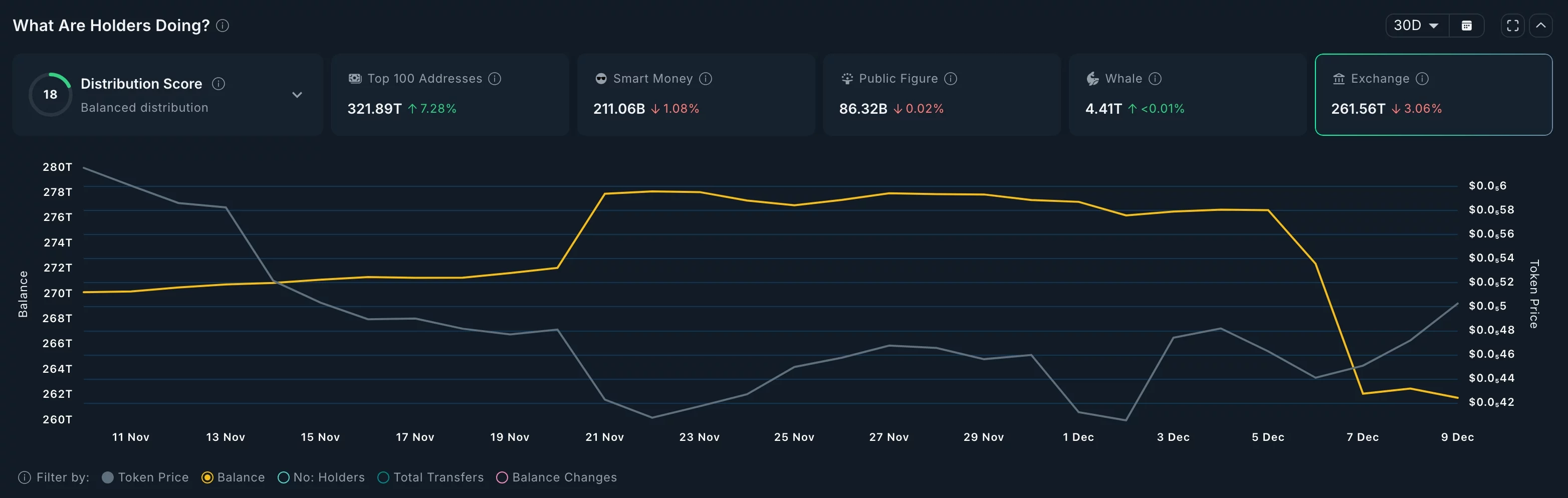

On-chain metrics and technicals suggest that the Pepe Coin price will have a brief rebound in the coming weeks. One of these numbers is that the amount of Pepe tokens in exchanges has nosedived in the past few days.

The supply dropped to 261.6 trillion tokens, down from this month’s high of 276 trillion. This means that over 15 trillion tokens worth over $75 million have been moved to self-custody, which is a bullish sign. This trend coincides with that of other tokens like Chainlink and Shiba Inu.

Pepe’s jump is occurring as market participants await the Federal Reserve’s upcoming interest-rate decisions. Ideally, a Federal Reserve cut accompanied by a dovish statement would favor riskier assets such as Pepe and other meme coins.

Meanwhile, there are signs that the recent decline in Pepe’s futures open interest has bottomed out. CoinGlass data indicate that open interest has been increasing over the past few days. It rose to $255 million today, Dec. 9, from the November low of $174 million. A rebound in open interest would be bullish for Pepe, as it would indicate renewed demand.

Pepe Coin price technical analysis

The four-hour chart shows that the Pepe price has crawled back after bottoming at $0.000003950 earlier this month. The coin has moved slightly above the Supertrend indicator, a move that often leads to a rebound.

Pepe has also rallied above the 50-period Exponential Moving Average. It has also formed an inverse head-and-shoulders pattern, a common bullish reversal sign. The Relative Strength Index has continued rising and is nearing the overbought level.

Therefore, the most likely scenario is that it continues to rise, with the next key target at $0.0000063, ~ 27% above the current level. This target coincides with the highest point on Nov. 11. A drop below the right shoulder at $0.0000043 will invalidate the bullish outlook.

You May Also Like

Pi Network Maps 50M Coins Daily as Mainnet Tops 9B

EUR/CHF slides as Euro struggles post-inflation data