Bitcoin Selling Pressure Eases as Exchange Inflows Drop: CryptoQuant

Bitcoin’s market dynamics have shifted sharply in recent weeks, offering signs of short-term resilience as selling pressure eases and investors reduce deposits to exchanges ahead of a highly anticipated Federal Reserve policy meeting.

According to the latest research report from CryptoQuant, after briefly falling to $80,000 on November 21, Bitcoin has rebounded to a one-month high of $94,000, supported by declining exchange inflows and reduced selling activity from large holders.

Exchange Deposits Fall, Easing Price Pressure

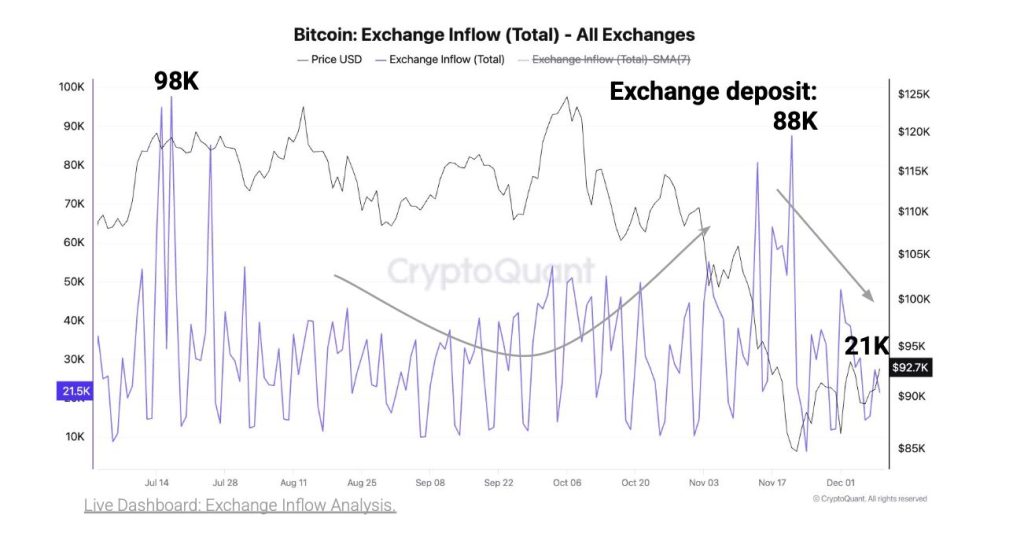

A major driver behind Bitcoin’s recent price stabilization is the sharp decline in BTC transferred to exchanges. Deposits have fallen to 21,000 BTC today, compared with 88,000 BTC on November 21, marking a 76% decrease in sell-side supply over the past three weeks, according to CryptoQuant.

This decrease indicates that holders, especially short-term traders, are less inclined to sell immediately into the market. Lower exchange inflows traditionally reduce downward pressure, creating more opportunity for price recovery in the near term.

Large Holders Pull Back: Lower Deposits, Smaller Transfers

Institutional-scale investors and whales have played a major role in the shifting environment. The share of exchange deposits linked to large holders dropped from 47% in mid-November to 21% today, while the average transfer size fell 36%, from 1.1 BTC to 0.7 BTC.

These patterns suggest that major players are stepping back rather than accelerating sell-offs. Large holders tend to dictate market direction during periods of volatility, and their reduced activity typically supports more orderly price behavior.

Loss Realization Peaks, Reducing Future Sell-Side Pressure

Bitcoin’s recent rebound also comes after a wave of realized losses, often a turning point in market psychology. On November 13, as Bitcoin broke below $100,000, whales and short-term holders realized $646 million in losses, the highest since July.

Across the last several weeks, that figure has climbed to $3.2 billion in net losses, likely flushing out weaker hands and reducing forced selling. Loss realization can fuel capitulation in bear phases, but once completed, it can set a foundation for more stable price action.

Key Levels to Watch: $99K, $102K, and $112K

If selling remains muted, analysts say Bitcoin could advance toward $99,000, marking the lower band of the Trader On-chain Realized Price indicator, typically a major resistance during market drawdowns. Beyond that, major resistance levels stand near $102,000 (one-year moving average) and $112,000 (Trader On-chain Realized Price) reports CryptoQuant.

Market uncertainty remains, particularly ahead of the Federal Reserve’s decision, but Bitcoin’s latest trend suggests a market catching its breath—the calm before the next wave of volatility.

You May Also Like

Pi Network Maps 50M Coins Daily as Mainnet Tops 9B

EUR/CHF slides as Euro struggles post-inflation data