21Shares’ XRP ETF Receives Listing Approval from Cboe BZX

Highlights:

- 21Shares’ XRP ETF has officially received approval to list and trade on the Cboe BZX Exchange.

- The ETF will trade on the exchange under the market ticker symbol TOXR.

- It will track the CME CF XRP-Dollar Reference Rate and carries a 0.3% yearly sponsor fee.

21Shares’ XRP exchange-traded fund (ETF) has finally secured trading approval on the Cboe BZX Exchange. This approval is one of the final steps needed before trading can officially begin. Upon listing, the fund will join other XRP ETFs that have already started trading with impressive market activity.

Cboe confirmed the approval in a filing submitted to the US Securities and Exchange Commission (SEC) on December 10. The filing shows that the exchange is ready to list the fund upon completion of the final paperwork and issuance notices. The ETF will track the New York Variant of CME CF XRP-Dollar Reference Rate.

The ETF approval comes about three weeks after the SEC had automatically approved 21Shares’ 8-A registration that followed the company’s updated S-1 filing. Although 21Shares’ most recent S-1/A from December 8 was marked “Subject to Completion,” regulators say this label is routine and does not affect the listing process. If all remaining steps move quickly, trading could begin as early as next week. However, XRP experts on X are predicting that the ETF sales could start earlier.

Details About 21Shares’ XRP ETF

The 21Shares XRP ETF charges a 0.3% yearly sponsor fee. The fee is calculated daily and paid each week in XRP. The fund uses a multi-custodian structure, with Coinbase Custody, Anchorage Digital Bank, and BitGo Trust Company responsible for holding the actual XRP. Notably, Ripple Markets has seeded the ETF with 100 million XRP, valued at over $200 million based on the asset’s current prices.

Meanwhile, Shares of the ETF can be created or redeemed either through XRP transfers or with cash, depending authorized participants’ choices. When trading begins, the ETF will appear on the Cboe BZX Exchange under the ticker symbol TOXR, joining other crypto funds recently launched on the exchange.

XRP ETF Market Continues to Expand

The 21Shares XRP ETF will add to the growing number of SEC-approved XRP funds, which have increased rapidly since the SEC settled its lawsuit with Ripple earlier this year. The settlement confirmed that XRP is not a security when traded on the secondary market. Moreover, since late November, several spot XRP ETFs have launched and expanded at a pace similar to that of Bitcoin (BTC) and Ethereum (ETH) ETFs in their early days.

SosoValue’s data shows that four XRP ETFs are currently active. They include Canary Capital’s XRPC, Grayscale’s GXRP, Bitwise’s XRP, and Franklin’s XRPZ. All funds trade on the New York Stock Exchange (NYSE) except XRPC, which trades on the Nasdaq platform. XRPC remains the most valuable fund with $371.27 million in cumulative net inflows.

GXRP follows closely with $217.10 million. XRP and XRPZ have amassed $199.76 million and $166.20 million, respectively. Overall, the four XRP funds have accumulated $954.33 million in net inflows, $24.53 million in value traded, and $939.46 million in net assets.

Source: SosoValue

Source: SosoValue

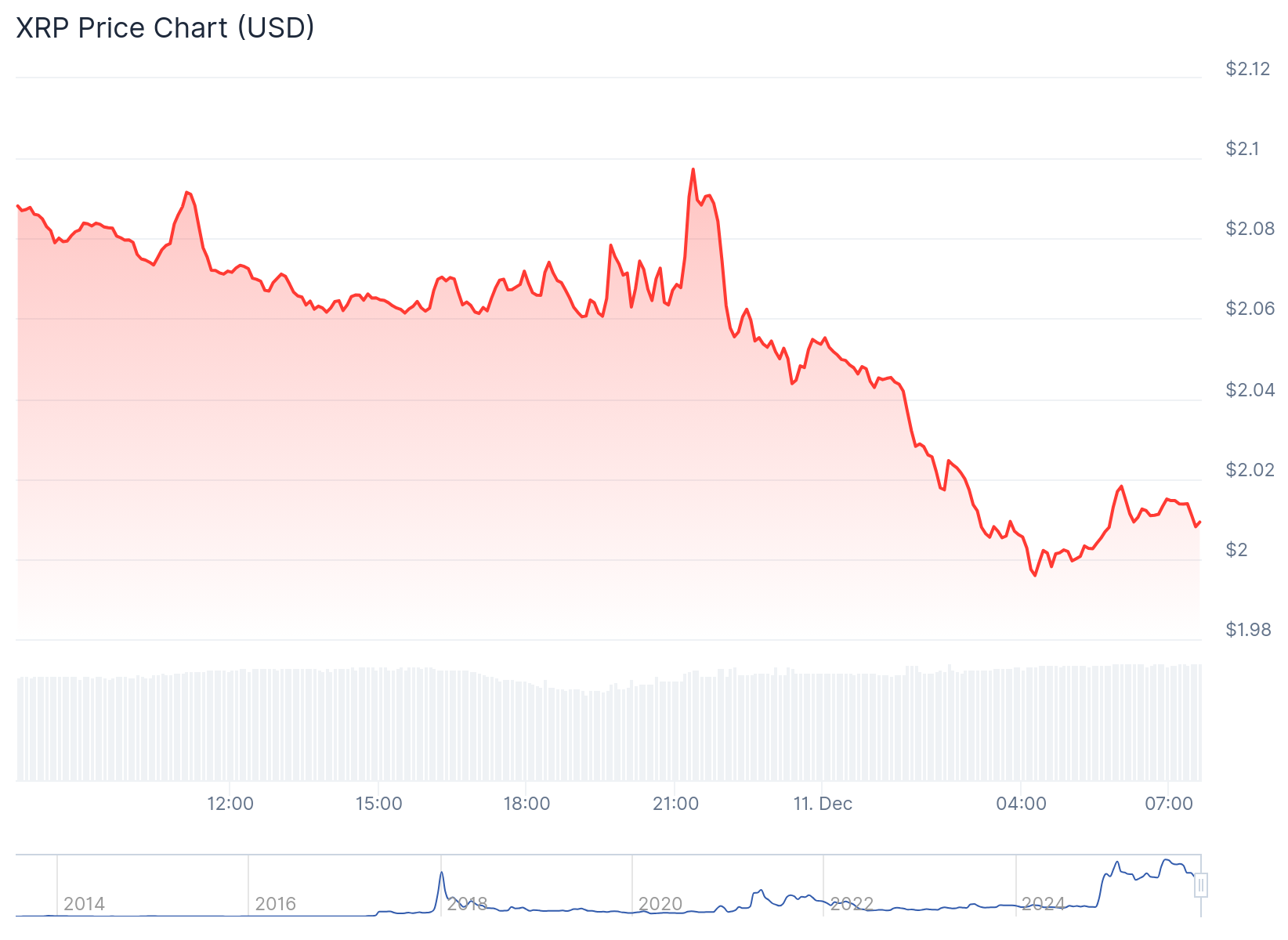

Meanwhile, XRP is trading at $2.02, following a 3.5% decline in the past 24 hours. CoinGecko ranks the asset as the fourth most valuable cryptocurrency with a market cap of $121.55 billion, a fully diluted valuation of $201.44 billion, and a 24-hour trading volume of $4.12 billion.

Source: CoinGecko

Source: CoinGecko

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

Analyst Ignores Bitcoin (BTC) Price Crash Narratives, Points to Hidden Bull Signals That May Matter More

Pundit Describes How $10,000 In XRP Could Become $1,000,000