Bitcoin Price Analysis: Here is the Most Likely Scenario for BTC in the Next Few Days

Bitcoin remains trapped within a corrective structure as sellers continue to defend major resistance zones.

Despite temporary recoveries, the market has not yet shown the strength required for a sustained reversal, and recent order-flow data indicate that downside risk may not be fully exhausted.

Technical Analysis

By Shayan

The Daily Chart

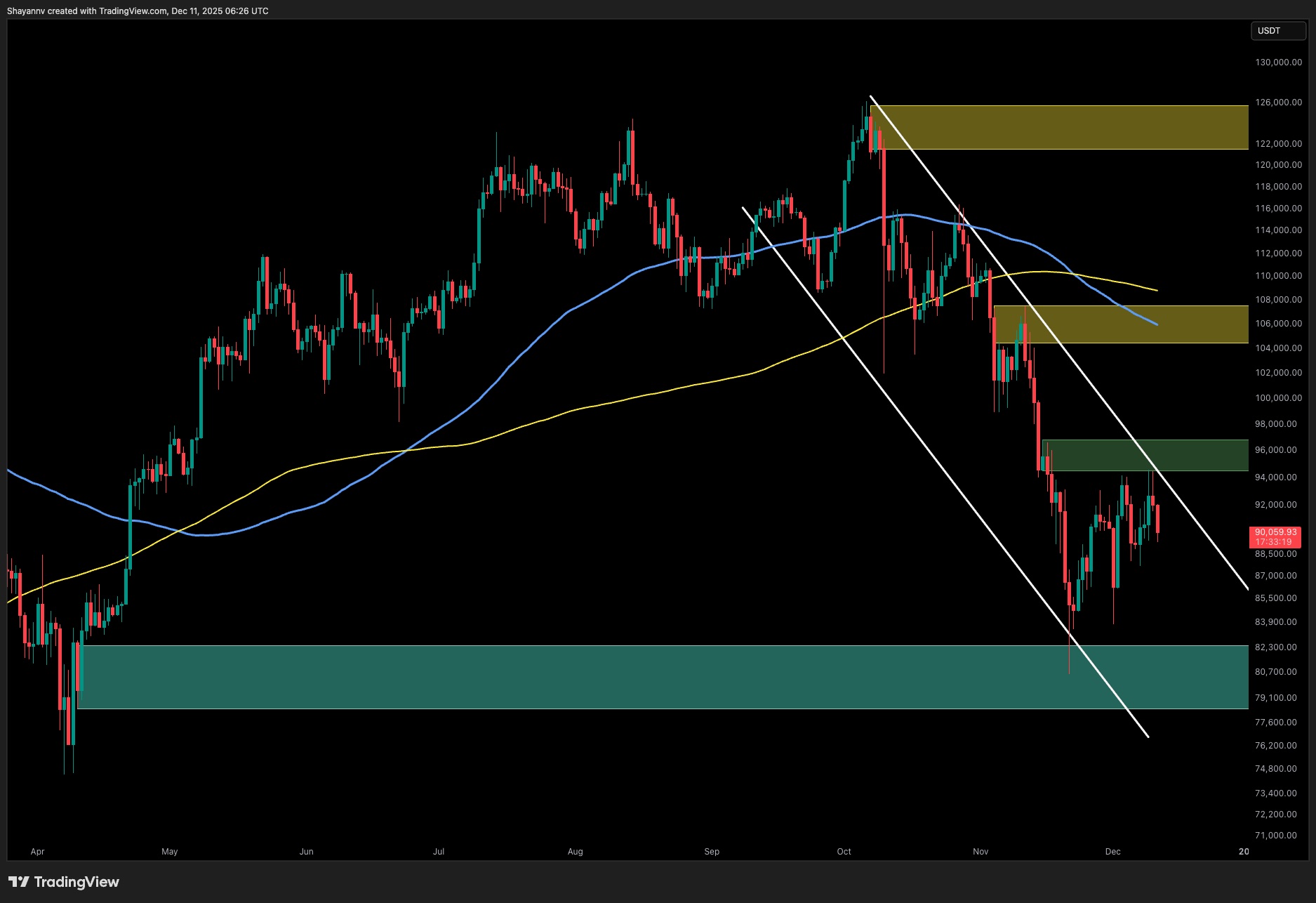

Bitcoin continues to trade within a clearly defined descending channel, with price repeatedly failing to break above the upper boundary. The most recent swing high near the $94K to $95K region aligned with a key daily supply block, which once again rejected upward momentum and preserved the broader bearish structure.

The current pullback from that region has pushed Bitcoin back toward the mid-range of its $82K to $106K macro structure. The market still respects the channel’s slope, and the interaction with the moving averages confirms that the trend has not yet shifted in favor of the bulls.

The $82K to $79K demand zone remains the most significant area of support on the chart. This region represents the origin of the strongest buy-side reaction during the correction and is likely to be tested again if the market continues to lose momentum. Until price closes decisively above the $95K region, the broader structure will remain bearish, and the risk of another visit to the lower demand zone remains elevated.

Source: TradingView

Source: TradingView

The 4-Hour Chart

On the four-hour timeframe, Bitcoin is consolidating within a converging structure defined by ascending support and a horizontal resistance band between $93K and $94K. The repeated failures at this resistance have created a local ceiling that buyers have been unable to break despite multiple attempts.

This pattern reflects compression, where liquidity builds ahead of a significant move. The price is pressing repeatedly into the supply without achieving displacement, which suggests that buying power is currently insufficient. If the ascending trendline breaks, the next sweep of liquidity is expected to target the $83K to $81K region seen on the daily timeframe.

As long as the price remains below both the structure’s upper boundary and the broader descending trendline drawn from the November highs, the short-term outlook remains bearish. Only a clean breakout above $94K would shift momentum back in favor of buyers.

Source: TradingView

Source: TradingView

Sentiment Analysis

By Shayan

The Spot Average Order Size chart offers deeper insight into market psychology during the current downtrend. The two highlighted zones in yellow represent critical periods where behavior among whales, smaller investors, and retail traders shifts dramatically.

In the first yellow box, which captures activity during the March to May distribution phase, the chart shows a dense concentration of smaller order sizes mixed with sporadic larger orders. This pattern marked a period of heavy distribution where large players reduced exposure gradually while retail buyers absorbed supply.

Shortly after this distribution cluster completed, Bitcoin entered a deeper correction.

The second yellow box, which illustrates order flow during the recent decline from $110K dollars to the current range, reveals a similar yet more concerning pattern. Order sizes have contracted sharply, and the chart is dominated by smaller red and green clusters, suggesting predominance of retail involvement while whale activity remains limited. Historically, strong bullish reversals are preceded by aggressive whale accumulation, which is not yet visible in this formation.

The downward arrow inside the second yellow box underscores the structural difference between this phase and previous bullish recoveries. Instead of increasing order size during the decline, large players appear to be stepping back, allowing the market to move lower with minimal resistance.

When this pattern occurred previously, Bitcoin eventually capitulated into a deeper liquidity pocket before strong accumulation began. The comparison between the two highlighted zones suggests that Bitcoin may not have found its final low. If whale participation does not return and order sizes continue to shrink, the market still has the potential to sweep lower levels and enter a capitulation phase before any sustainable bullish move emerges. The $82K to $79K dollar zone remains the prime candidate for such a liquidity event, aligning both technically and behaviorally with historical accumulation dynamics.

The post Bitcoin Price Analysis: Here is the Most Likely Scenario for BTC in the Next Few Days appeared first on CryptoPotato.

You May Also Like

Best Sit and Go Poker Sites – Where to Play SNG Poker Tournaments in 2025

XAG/USD Plunges To Near $89.00 As Resilient US Dollar Exerts Pressure