A new paradigm for Bitcoin perpetual hedging: How does Aegis use short contracts to create a decentralized stablecoin YUSD?

By Stacy Muur

Compiled by: Tim, PANews

We’ve seen fiat-backed stablecoins, and we’ve seen crypto-collateralized stablecoins, but Aegis is thinking differently: a Bitcoin-backed stablecoin.

Here’s why its design is bold and why it’s likely to succeed.

Most stablecoins today rely on a centralized system that Bitcoin was designed to avoid:

- Fiat Currency Custody

- Bank Liquidation

- Regulatory constraints

Aegis took a different tack, choosing to build its system around Bitcoin rather than a bank.

Aegis named its stablecoin YUSD:

- Anchored to $1

- Backed by Bitcoin Collateral

- Maintain stability by shorting perpetual contracts

No oracle required, no currency reserve, no third-party intermediary

YUSD is only minted when stablecoins such as USDT, USDC or DAI are deposited into the Aegis Mint smart contract.

Once verified, YUSD will be generated and the corresponding collateral will be transferred to a secure custodial vault.

There is no off-chain casting switch, no human intervention, everything is controlled only by smart contract logic.

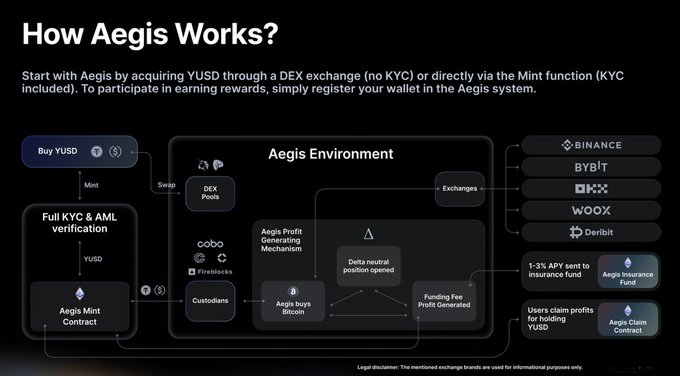

So, how does Aegis work end-to-end?

- You can use funds to mint or redeem (on-chain or decentralized exchanges) to obtain YUSD

- Aegis uses these funds to buy BTC

- Hedge against price volatility risk by opening a short perpetual contract

- Short positions earn funding rate income

- Profit distribution: part of it will be injected into the insurance pool, and part of it will be distributed to YUSD holders

This is the circulation mechanism of YUSD.

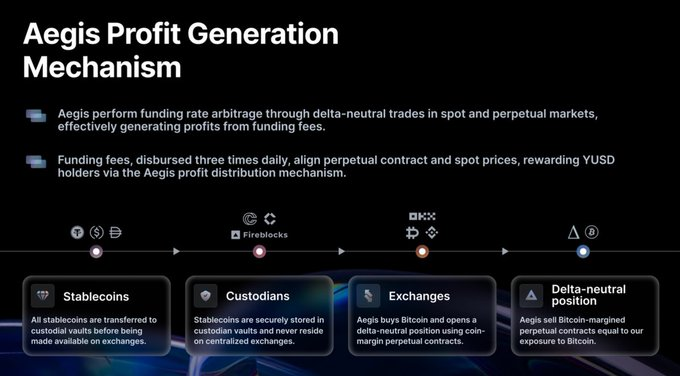

But where do these profits come from?

When Aegis shorts a Bitcoin perpetual contract, it profits from the funding rate paid by traders making bullish bets.

These fees will be charged three times per day as long as long demand exists.

This is not staking, and this is not inflation.

This is how opponent pressure is converted into profit.

Aegis doesn't ask you to do anything extra.

Hold YUSD → Earn fees from Aegis → Snapshot record share → Generate rewards → Receive via APP

See, the profits come from the wind.

Aegis is built to be secure, reliable, independent and free from centralization risks and common single points of failure:

- No legal currency backing

- No USDC reserves

- No oracle dependency

Bitcoin only, collateral hedging processing, over-the-counter holding, real-time monitoring.

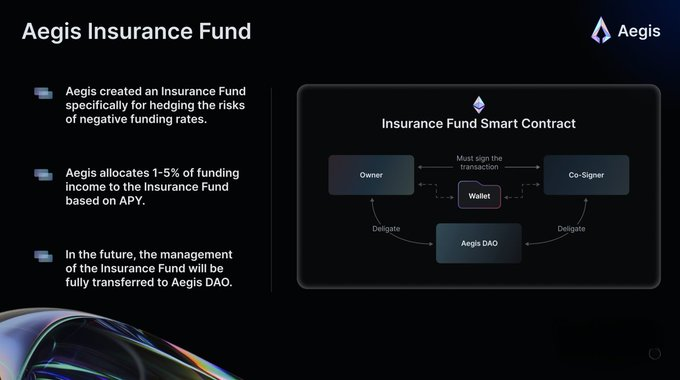

No yield model is perfect, especially one tied to the funding rate. So what happens if the funding rate turns negative?

Aegis has established an insurance fund for this purpose.

- 1-5% of the proceeds will be transferred to the insurance fund

- This fund is enabled when the funding rate turns negative and the cost of short selling increases.

- Managed by multi-signature smart contracts

- Subsequent control will be transferred to Aegis DAO

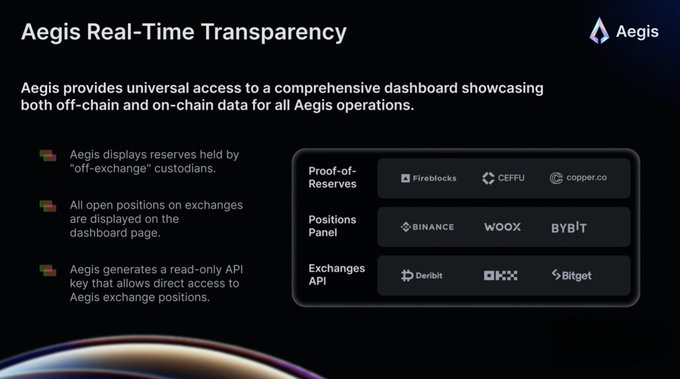

Aegis seems to be very focused on transparency:

- Escrow reserves are verifiable

- Exchange Position Disclosure

- Read-only API exposes system status

You don't have to guess at its inner workings, but you can watch the results in real time.

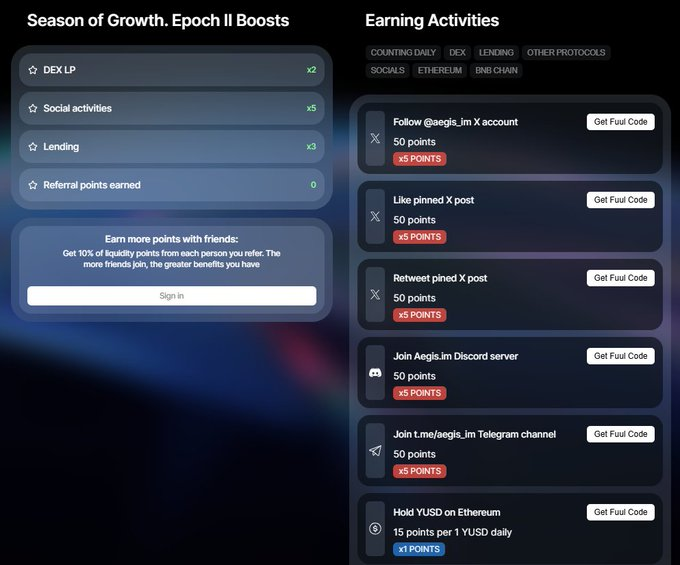

The insurance fund is responsible for managing risks, while the Aaegis points system is responsible for driving growth. Users can earn points daily in the following ways:

- Hold YUSD (earn 15 points per $1 per day)

- Provide liquidity (30 points per $1 per day, 2x bonus)

- Borrowing through Euler (45 points per day, 3x bonus)

- Complete social tasks (50 points per task, 5 times bonus)

The product and service are now fully available on Ethereum and BNB chains.

In Season 1, all points earnings will receive a 50% bonus, allowing early users to receive a higher proportion of AEG token rewards.

Excess Rewards: Euler integration unlocks a circular strategy - deposit YUSD → earn points → borrow stablecoins → repeat this process.

This maximizes your profits and multiplies your points.

Points are more than just numbers. Every week, 0.2% of the total AEG supply will be distributed based on your share of points.

No need to worry about airdrop delays or guess at distribution rules.

Transparent and open, everything goes according to plan and is directly linked to the use of the protocol.

Aegis is an early-stage project aiming to build a stablecoin that does not rely on fiat currencies, oracles, or permissioned collateral.

It remains uncertain whether the model will remain valid in volatile markets or be scalable in real-world use cases.

But it is one of the clearest experiments yet in the design of a currency based on Bitcoin.

You May Also Like

Top 5 News This Week: Senators vs. Chinese embassy; Rodrigo Duterte and ICC

Cardano Latest News, Pi Network Price Prediction and The Best Meme Coin To Buy In 2025