Bitcoin Falls Below $90,000 As Vanguard Exec Struggles With Bitcoin Value

Bitcoin Magazine

Bitcoin Falls Below $90,000 As Vanguard Exec Struggles With Bitcoin Value

The bitcoin price was trading in the $92,000 range earlier today but has now dropped back toward $90,000, reflecting continued volatility despite the U.S. Federal Reserve’s 25-basis-point rate cut.

After briefly spiking above $93,000 yesterday, the crypto fell below $90,000 and stabilized around $90,600 at the time of writing.

The pullback comes amid mixed signals from the Fed. While the rate cut to 3.50%–3.75% was widely anticipated, Fed Chair Jerome Powell’s cautious remarks and a 9–3 split among FOMC members — one favoring a deeper 50-basis-point cut and two opposing any reduction — tempered enthusiasm for risk assets, including BTC.

Analysts described the decline as a “sell the fact” reaction, since markets had already priced in the move.

On top of this, Vanguard Group has begun allowing clients to trade spot Bitcoin exchange-traded funds (ETFs), marking a notable expansion in access to crypto products for the $12 trillion asset manager’s investors.

Yet, Vanguard’s senior leadership emphasized that its fundamental view of BTC and other cryptocurrencies remains skeptical.

John Ameriks, Vanguard’s global head of quantitative equity, said Thursday at Bloomberg’s ETFs in Depth conference that Bitcoin is better seen as a speculative collectible than a productive asset.

Comparing it to a viral plush toy, Ameriks highlighted that BTC lacks income, compounding potential, and cash-flow generation — the core attributes Vanguard looks for in long-term investments.

“Absent clear evidence that the underlying technology delivers durable economic value, it’s difficult for me to think about Bitcoin as anything more than a digital Labubu,” he said, according to Bloomberg.

Despite this caution, Vanguard’s decision to allow trading of BTC ETFs on its platform was influenced by the growing track record of such products since the first BTC ETF launched in January 2024.

Ameriks said the firm wanted to ensure these ETFs accurately reflect their advertised holdings and perform as expected.

Banks engaging with bitcoin

Earlier this week, PNC Bank became the first major U.S. bank to offer direct spot bitcoin trading to eligible Private Bank clients through its digital platform, using Coinbase’s Crypto-as-a-Service infrastructure.

The launch follows a strategic partnership announced in July and reflects a growing trend among U.S. banks to integrate bitcoin into wealth management services.

Also last week, the Bank of America urged its wealth management clients to allocate 1% to 4% of their portfolios to digital assets, signaling a major shift in its approach to Bitcoin exposure.

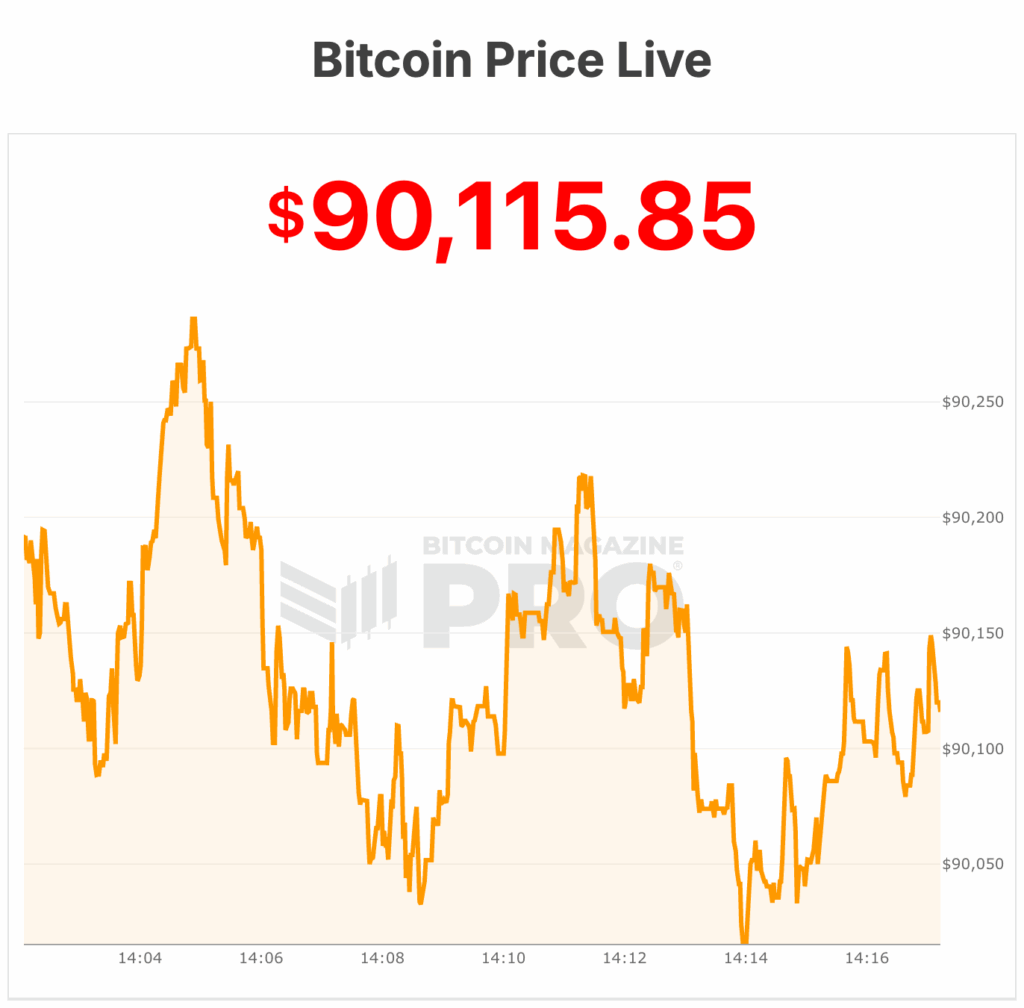

As of today, Bitcoin is trading at approximately $90,115.85, with a circulating supply of nearly 19.96 million BTC and a market cap of $1.81 trillion.

Prices have fluctuated modestly over the past week, reflecting the broader market’s volatility.

This post Bitcoin Falls Below $90,000 As Vanguard Exec Struggles With Bitcoin Value first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

You May Also Like

Pi Network Maps 50M Coins Daily as Mainnet Tops 9B

EUR/CHF slides as Euro struggles post-inflation data