Bitcoin ETFs Attract $287M as Ethereum, XRP and Solana ETFs Follow Suit

- Bitcoin spot ETFs logged $287M weekly inflows as Ethereum and Solana funds stayed positive.

- U.S. spot XRP ETFs extended its inflow streak to 18 straight days, entering week five.

Bitcoin spot exchange traded funds recorded $287 million in net inflows for the week ended Dec. 12, according to data shared by Wu Blockchain. The figures cover Dec. 8 to Dec. 12 and came as Bitcoin traded around $90,000 during the period.

The inflow added to the asset base held by U.S. listed Bitcoin ETFs, which stayed net positive through recent price consolidation. Flow activity continued even as Bitcoin’s pace of additions cooled from earlier highs, as we discussed earlier.

Ethereum spot ETFs also reported net inflows for the same week. The group posted $209 million, based on the same dataset, while Ethereum traded in a tighter range compared with earlier swings.

Solana spot ETFs saw net inflows as well. The funds added $33.6 million over the week, and Wu Blockchain said none of the seven listed products recorded net outflows in that window.

Bitcoin, Ethereum and Solana ETF Weekly Net Inflows. Source: SoSoValue

Bitcoin, Ethereum and Solana ETF Weekly Net Inflows. Source: SoSoValue

The combined data showed positive weekly flows across multiple crypto ETF categories, not only Bitcoin, as investors continued to use regulated products for market exposure.

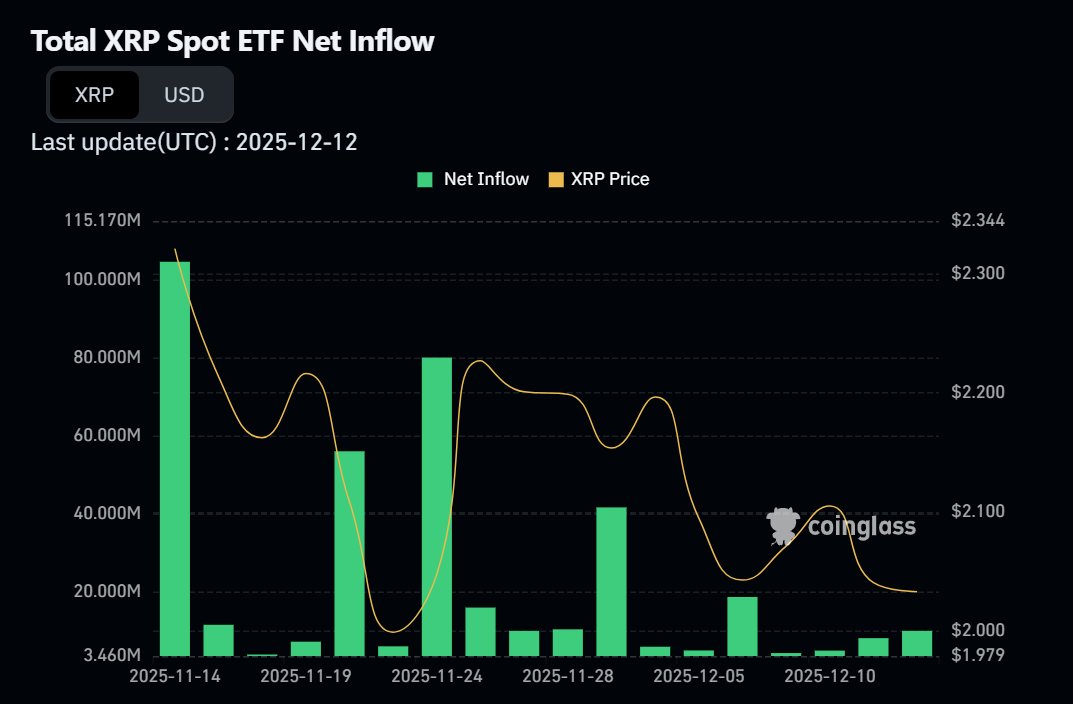

XRP Spot ETFs Extend Inflow Streak Into Week Five

Meanwhile, U.S. spot XRP ETFs have recorded 18 straight days of net inflows since launch, according to analyst Rand, citing flow tracking data and as previously explored. The streak pushed the product into its fifth week of trading. CoinGlass data showed several larger inflow days in late November, followed by smaller daily additions in early December. The pattern held even as XRP price movement turned softer at times.

XRP Spot ETF Net Inflow. Source: CoinGlass / X

XRP Spot ETF Net Inflow. Source: CoinGlass / X

Daily net inflows continued while XRP traded closer to the lower end of its recent range, indicating that ETF subscriptions did not move in lockstep with short term price changes.

The XRP product has also avoided sharp outflow days that often appear soon after new fund launches. The inflow run has remained intact as broader crypto markets stayed mixed.

Bitcoin, Ethereum, Solana, and XRP ETFs all posted positive inflow readings in the latest data, extending the trend of steady demand across multiple digital asset funds into mid December.

]]>You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC