Crypto Inflows Hit $864M: BTC, XRP Dominate

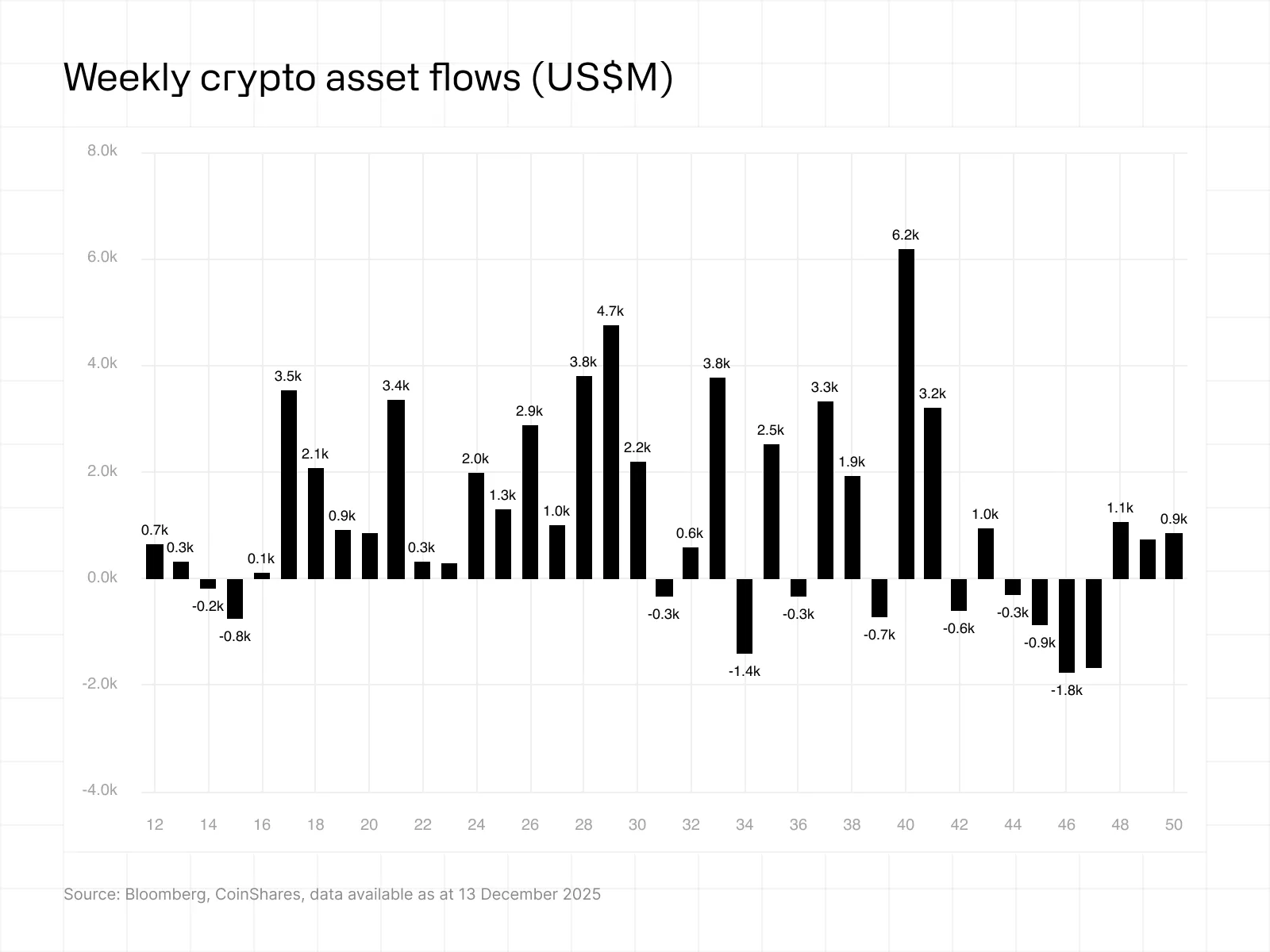

Digital asset investment products recorded another week of net inflows. According to CoinShares data, crypto ETPs attracted a total of $864 million in inflows over the past week, the third consecutive week of positive flows.

Total assets under management rose to around $180 billion, although this figure remains well below the previous all-time high of $264 billion, noted CoinShares in its digital asset fund flows report.

While the US Federal Reserve announced another interest rate cut, price action across major cryptocurrencies remained mixed. CoinShares added:

BTC, XRP Lead Weekly Demand; US Leads Regional Flows

Bitcoin BTC $86 796 24h volatility: 2.4% Market cap: $1.73 T Vol. 24h: $39.82 B once again captured the largest share of inflows. Last week, BTC-linked products attracted between $352 million and $522 million, depending on regional reporting.

At the same time, short-Bitcoin products recorded $1.8 million in outflows, a signal that investors aren’t betting against the asset.

Weekly crypto asset flows in USD. | Source: CoinShares

XRP XRP $1.92 24h volatility: 3.6% Market cap: $116.25 B Vol. 24h: $2.54 B followed BTC with roughly $245 million in weekly inflows. This strong demand placed XRP among the top-performing assets in terms of fund interest. Chainlink LINK $12.84 24h volatility: 4.7% Market cap: $8.97 B Vol. 24h: $546.61 M also stood out, with $52.8 million in inflows.

Ethereum ETH $2 997 24h volatility: 2.7% Market cap: $362.17 B Vol. 24h: $24.99 B saw $338 million in inflows, bringing the year-to-date total to $13.3 billion, up 148% compared to the same period last year.

On the other hand, US-based products recorded between $483 million and $796 million in weekly inflows. Germany followed with inflows ranging from $68 million to nearly $97 million, while Canada added between $26 million and $81 million.

Together, the US, Germany, and Canada now represent nearly 99% of total year-to-date inflows. However, this also indicates how concentrated institutional crypto demand is, limited to a few regions around the globe.

Consistent ETP Demand

CoinShares data shows mixed weekly flows across blockchain ETPs with funds such as VanEck Digital Transformation and VanEck Crypto and Blockchain recording notable inflows of $45.8 million and $20.5 million, respectively.

On the provider side, iShares led weekly inflows with more than $350 million, followed by strong contributions from Fidelity ($84 million), ProShares ($77.36 million), and Volatility Shares ($162 million).

Grayscale, meanwhile, continued to record outflows on both weekly ($12 million) and month-to-date measures ($20 million). However, the firm still holds a large share of total assets.

nextThe post Crypto Inflows Hit $864M: BTC, XRP Dominate appeared first on Coinspeaker.

You May Also Like

Buterin pushes Layer 2 interoperability as cornerstone of Ethereum’s future

BlackRock Increases U.S. Stock Exposure Amid AI Surge