Meet ScyllaDB: HackerNoon Company of the Week

Welcome one, welcome all to another HackerNoon Company of the Week feature. Every week, we highlight a standout company from our Tech Company Database that’s making waves in the global tech ecosystem and positively impacting the lives of its users. Our database features everything from S&P giants to rising stars in the Startup scene.

\ Ever used Discord, ordered Starbucks through your phone, or browsed Zillow for your dream home? There's a good chance ScyllaDB was working behind the scenes. This week's pick is a monstrously fast and scalable NoSQL database that's built differently, literally. With a shard-per-core architecture that delivers predictable single-digit millisecond latencies at millions of operations per second, ScyllaDB helps companies power data-intensive applications at massive scale with lower costs and better performance. You can grab it as open source, enterprise software, or a fully-managed cloud service.

\

:::tip Want to be featured on HackerNoon’s Company of the Week?

Request Your Tech Company Page on HackerNoon Today!

:::

\

Fun Facts About ScyllaDB

From Hypervisor Hackers to Database Disruptors

ScyllaDB's origin story is rooted in deep systems expertise. The company was founded in 2012 by Avi Kivity and Dor Laor, the brilliant minds behind the KVM hypervisor - you know, that technology that basically powers most of today's cloud infrastructure. They initially set out to build OSv, a revolutionary cloud-based operating system, and were having great success improving database performance along the way. But then they hit a wall with Apache Cassandra. No matter what they tried, they couldn't push it past a certain performance ceiling due to fundamental architectural limitations.

\ So what did they do? They made the bold (some might say crazy) decision to rebuild the entire thing from scratch in C++. The result? A database that can handle 1 million transactions per second on a single server. Not too shabby for a "let's start over" moment.

\

\

:::tip Curious about the vision behind ScyllaDB? HackerNoon interviewed founder and CEO Dor Laor last year—it's worth a read.

:::

\

The Discord Migration That Made Headlines

One of ScyllaDB's most famous success stories is Discord's migration of trillions of messages from Cassandra to ScyllaDB. And we're not talking about a small app here - Discord has over 350 million users who collectively send an astronomical number of messages every day, and ScyllaDB handles all of it.

\ Here's the heartwarming part: CEO Dor Laor mentioned in a recent interview that he has a special soft spot for the Discord deployment because "my son was very excited and proud about this." Even database CEOs get proud parent moments when their tech powers their kids' favorite apps.

\

\

Monster Scale in Real Numbers

When ScyllaDB says they handle "monster scale," they're not exaggerating. Check out these real-world deployments:

- Palo Alto Networks runs over 10,000 clusters on ScyllaDB (yes, you read that right, ten thousand)

- China Mobile operates a mind-boggling 4 petabyte, 180-server workload

- Disney+ Hotstar uses ScyllaDB to deliver instant recommendations to hundreds of millions of viewers

\ These aren't just impressive numbers on a spec sheet, they represent the real-time experiences millions of people have every day. Whether it's your morning Starbucks mobile order, your evening Discord gaming session, or binge-watching your favorite show, there's a good chance ScyllaDB is working behind the scenes to make it all feel instant and seamless.

\

:::tip Share Your Company's Story Via HackerNoon!

:::

\ \

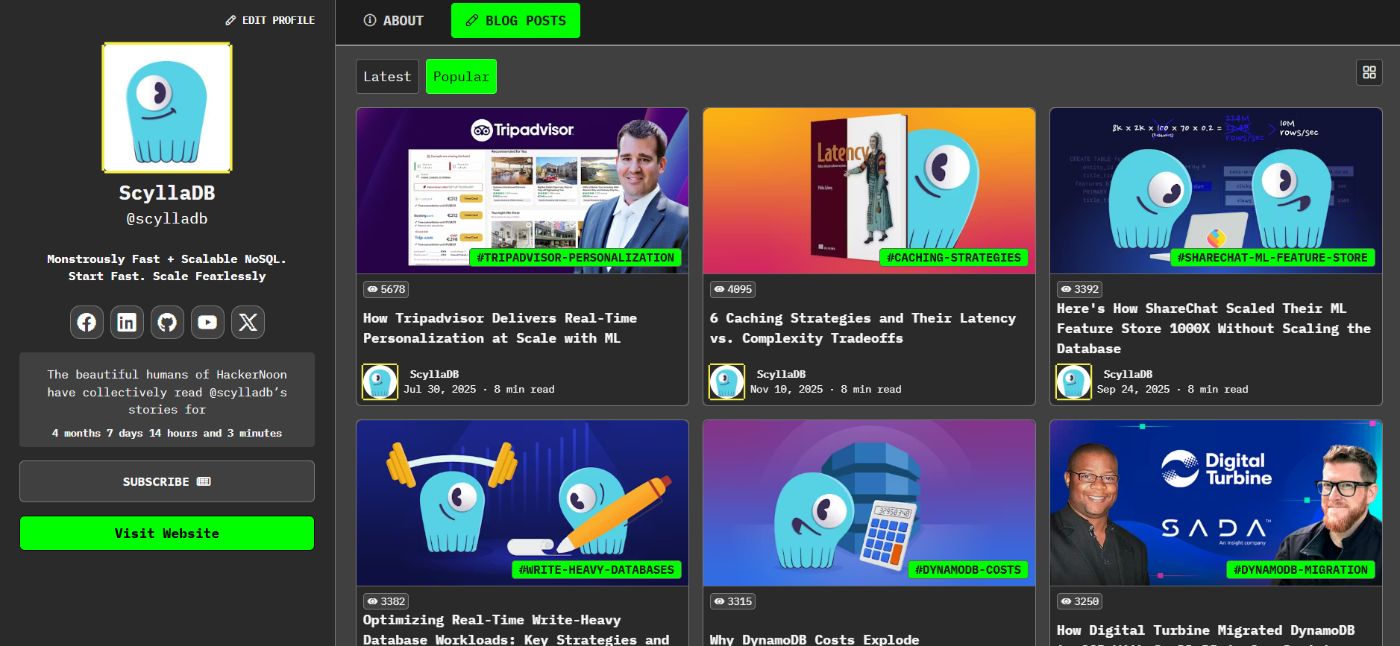

HackerNoon 🤝 ScyllaDB

ScyllaDB has published a series of insightful articles on HackerNoon that showcase their technical expertise in high-performance database architecture. Their pieces include deep-dives into NoSQL data modeling, performance debugging with Rust drivers, database migrations, and detailed case studies of how companies like Tripadvisor and Yieldmo leverage ScyllaDB for machine learning feature stores and real-time personalization at massive scale. As of today, ScyllaDB has amounted an impressive 4 months 7 days 14 hours and 3 minutes of reading time on their stories.

\ Check out the ScyllaDB profile here.

\

\ Here are their top 3 best performing articles on HackerNoon:

- How Tripadvisor Delivers Real-Time Personalization at Scale with ML

- 6 Caching Strategies and Their Latency vs. Complexity Tradeoffs

- Here's How ShareChat Scaled Their ML Feature Store 1000X Without Scaling the Database

\ \

Join HackerNoon Business Blogging

HackerNoon’s Business Blogging Program is one of the many ways we help brands grow their reach and connect with the right audience. This program lets businesses publish content directly on HackerNoon to boost brand awareness and build SEO authority by tapping into ours.

Here’s what’s in it for you:

- Full editorial support – we’ll help refine your story so it truly shines.

- Multiple permanent placements – across HackerNoon, plus social media amplification.

- Audio storytelling – your articles converted into audio format and distributed via RSS feeds.

- Global reach – automatic translation into 12–76 languages.

- SEO & domain authority boost – piggyback on HackerNoon’s trusted brand to strengthen your search rankings.

\

:::tip Publish Your First Story with HackerNoon Today

:::

\ And that’s all for this week, hackers.

Stay creative, Stay iconic.

HackerNoon Team

You May Also Like

Visa Expands USDC Stablecoin Settlement For US Banks

Nasdaq Company Adds 7,500 BTC in Bold Treasury Move