Best Memecoins to Invest in Today, December 17 – DOGE, PENGU, PEPE

Highlights:

- Dogecoin, Pudgy Penguins, and PEPE are the top memecoins to invest in today, showing potential for gains.

- Dogecoin’s oversold conditions indicate an upcoming rise in price, thus offering a good investment opportunity.

- PEPE is currently bouncing off support at $0.0040 and could rise to $0.0050 in case buying activity increases.

Crypto prices are trading in green today as the broad market recovers from the ongoing slump. The overall market cap has surged by 1.34% to $2.96 trillion, while the 24-hour trading volume stands around $100 billion. Meanwhile, the memecoin sector has failed to gain traction, with its market cap and trading volume declining to $38 billion and $3.42 billion, respectively. With several tokens showing positive price movements, let’s take a look at the top memecoins to invest in today, such as Dogecoin, Pudgy Penguins, and PEPE.

Best Memecoins to Buy Today

1. Dogecoin (DOGE)

Dogecoin is trading around $0.1310, showing minimal significant upward movement. The price of DOGE is currently up around 1.90% over the last 24 hours, but remains down by 10% and 18% on the weekly and monthly charts. Its market cap and trading volume are sitting at around $20 billion and $965 million, respectively.

Source: CoinMarketCap

Source: CoinMarketCap

Recently, Trader Tardigrade shared an insight regarding the movement of Dogecoin in the market, focusing on its stochastic chart. The weekly chart displays several oversold conditions, where the stochastic indicator falls below a critical value. The signals have historically led to rallies, which may indicate a potential upward momentum.

The current oversold signal indicates an imminent trend reversal. Dogecoin is holding in the oversold phase, and one should expect a similar rise in price. For investors seeking the best memecoins to invest in today, Dogecoin would offer a valuable opportunity for a potential price surge.

2. Pudgy Penguins (PENGU)

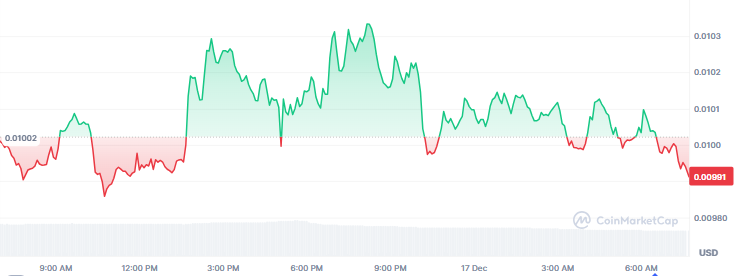

PENGU has undergone fluctuations over the last 24 hours, with the price retracing above the $0.0100 mark and falling below it again. As of this writing, the memecoin is hovering around $0.009986, with a modest loss of 0.25%. Additionally, its market cap and trading volume have declined to $620 million and $127 million, respectively.

Source: CoinMarketCap

Source: CoinMarketCap

Looking at the 4-hour chart, PENGU is poised for a new rally as the price bounces off the key support level around $0.009783. The next significant mark for the memecoin lies around $0.010835, while the key resistance awaits at $0.011887.

Source: TradingView

Source: TradingView

Several indicators are supporting this imminent upward rally. The MACD line is on the verge of crossing above the signal line, which usually indicates a shift from the current trend. Moreover, the 14-day RSI is lying slightly above the oversold region, whereby, should the buying pressure increase, PENGU could witness a robust price upwards.

3. PEPE

The frog-themed memecoin, PEPE, is up by 1.40% to trade at $0.000004066 on the daily chart. Despite this brief bullish momentum, the memecoin is down by over 15% over the last 7 days. Moreover, its trading volume has declined to $310 million.

Source: CoinMarketCap

Source: CoinMarketCap

The PEPE price has established an accumulation zone, according to a recent market insight by crypto analyst Hailey LUNC. The lower boundary is set at $0.0040, which is also a critical support. Should the price reach this level and respond positively, it may be followed by a robust surge.

This potential rally would target the EQH liquidity at $0.0050. This analysis offers a significant investment opportunity to those looking for the leading memecoins to invest in today. However, it is important to closely monitor the price at the $0.0040 level, as a break below it would invalidate this rally.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

Santander UK Announces Intention to Appoint Nicola Bannister as New TSB CEO

XRP Community Reacts as Ripple Prime Joins NSCC Directory