Stealth Money launches Bitcoin self-custody service in Nigeria

Stealth Money, a bitcoin platform, has officially launched its self-custody service in Nigeria, introducing a first-of-its-kind offering on the African continent. Designed for users who want complete control of their Bitcoin without relying on or trusting third parties, the platform simplifies secure Bitcoin ownership through a smooth, end-to-end personalized experience.

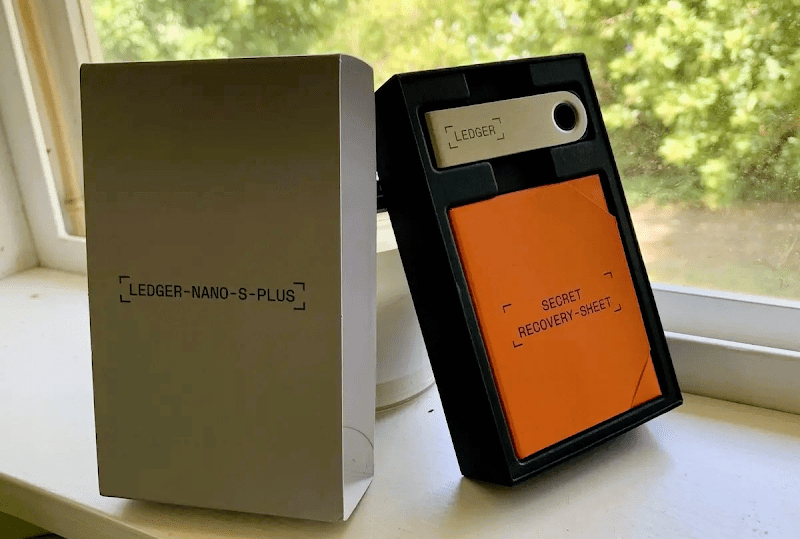

The safest and most secure way to hold digital assets like Bitcoin is through self-custody with a hardware wallet. Thanks to Stealth Money’s partnership with leading global hardware wallet providers and its fast, nationwide delivery, users can more securely hold their Bitcoin than ever.

Simplifying the self-custody onboarding experience

As noted by Davidson Atere-Roberts, COO of Stealth Money, “Bitcoin is money and savings tech in this digital era.” Therefore, Stealth Money is streamlining access to Bitcoin self-custody in Nigeria, enabling anyone to pay for a hardware wallet in Naira and have it delivered within a couple of days. We add a personal touch to self-custody onboarding, eliminating the need to trust and hope your bitcoin is safe.

With exchanges often at risk of constant hacks, theft, or poor management, people really need simple ways to keep their own digital assets safe. Stealth Money helps with this by making it easy and safe for people to start using self-custody.

Prioritizing user sovereignty

Leaving your digital assets on exchanges or apps means you are choosing the easy option and hoping for the best, rather than choosing the highest level of safety. You are trusting that the exchange’s security and rules are good enough, even though you cannot see what happens with your digital assets. You are also hoping that the people who run these companies do not make mistakes or steal customers’ money, as we saw with the collapse of FTX and similar exchanges.

However, self-custody eliminates this trust assumption and returns user sovereignty. With Stealth Money, clients on the platform can schedule a free self-custody onboarding session after ordering the wallets, and then proceed to buy and store bitcoin in their self-custody after verifying their identity.

With Christmas and new year around the corner, Stealth Money is offering free nationwide delivery keeping with the spirit of the season. Even from across the globe anywhere in the diaspora, you can now deliver the gift of financial sovereignty to your loved ones back home with a hardware wallet sent to any local pickup point or their doorstep.

With Stealth Money, self-custody becomes a simple, streamlined experience, empowering users to hold their bitcoin safely and securely.

For more updates you can follow us across our socials:

X: https://x.com/stealthmoney_

LinkedIn: https://www.linkedin.com/company/stealthmoney/

Facebook: https://facebook.com/stealthmoney

You May Also Like

Woodway Assurance receives $1 million in funding for data privacy assurance solution EviData

OpenVPP accused of falsely advertising cooperation with the US government; SEC commissioner clarifies no involvement