45% of Young Investors Own Crypto as Housing Dreams Fade: Survey

Nearly half of younger US investors now hold crypto as traditional wealth-building paths grow increasingly out of reach, according to new data from Coinbase.

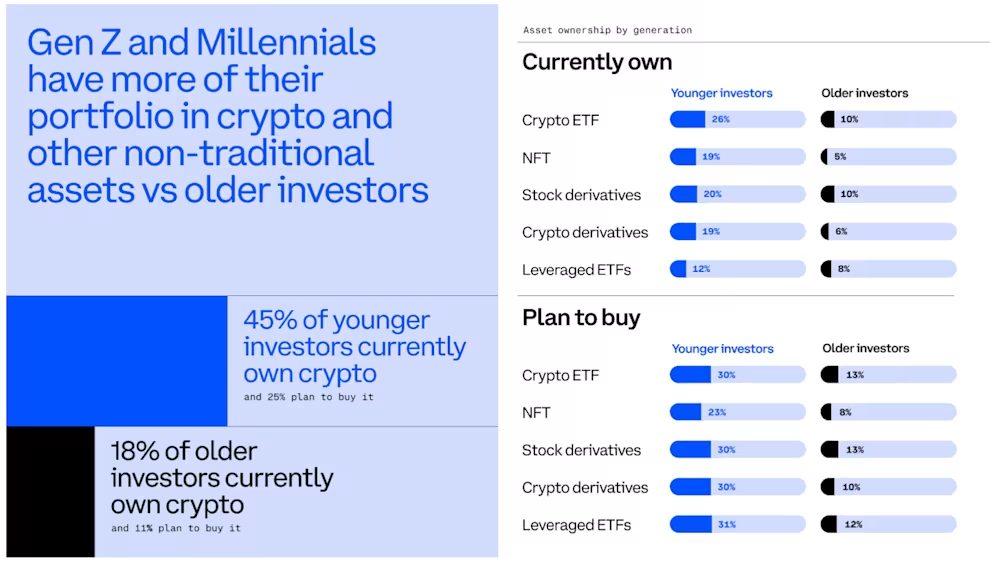

The findings show that 45% of younger investors already own crypto, compared to just 18% of older generations, and that three-quarters believe their generation faces harder odds of building wealth through conventional means than previous cohorts did.

The State of Crypto Q4 2025 report, compiled from a survey of 4,350 US adults, including 2,005 active investors, found younger generations allocating 25% of their portfolios to non-traditional assets, triple the 8% allocation among older investors.

Beyond the allocation gap, younger investors demonstrate markedly different attitudes toward digital assets, with four in five viewing crypto as creating financial opportunities that wouldn’t otherwise exist for their generation.

Source: Coinbase

Source: Coinbase

A Generation Betting Against the Old Playbook

Despite reporting greater optimism about broader economic conditions, younger investors don’t believe traditional wealth-building mechanisms work in their favor.

The cohort has watched housing affordability deteriorate while student debt mounted and wage growth lagged, driving 73% to conclude that their generation faces steeper wealth-building challenges than 57% of older adults.

This perception translates directly into portfolio decisions. While stock ownership rates remain similar across age groups, younger investors add substantially more alternative exposure, actively seeking reward mechanisms beyond conventional stock dividends.

The strategy reflects deliberate pursuit of tools and markets that might help close generational wealth gaps rather than passive investment approaches.

The crypto allocation isn’t treated as speculative positioning but as a central strategy. Nearly half of younger investors (47%) want access to new crypto assets before general market availability, compared with just 16% of older investors.

Four in five younger adults believe cryptocurrency will play a significantly larger role in future financial systems, dropping to three in five among older investors.

Risk Appetite Extends Beyond Bitcoin and Ethereum

The willingness to embrace emerging opportunities doesn’t stop at spot crypto holdings.

Four in five younger investors say they’re willing to try new investment opportunities before others, compared with under half of older adults.

Interest spans crypto derivatives, prediction markets, round-the-clock stock trading, early-stage token sales, altcoins, and decentralized finance lending products.

This pattern marks a clear departure from recent data showing cooling crypto enthusiasm across broader investor populations.

A December FINRA Foundation study found crypto consideration among US investors dropped from 33% to 26% between 2021 and 2024, while those viewing digital assets as extremely or very risky rose from 58% to 66%.

Yet that pullback appears concentrated among older demographics rather than the younger cohort driving current adoption.

The generational divide extends to trading behavior and information sourcing.

Younger investors trade more frequently, take more calculated risks to chase higher returns, and push platforms toward always-on operations that support a wider asset range.

Notably, social media “finfluencers” now guide investment decisions for 61% of investors under 35, with YouTube serving as the dominant platform, and word-of-mouth from friends and family surpassing financial professional recommendations.

The Infrastructure for a New Investment Generation

The shift toward non-traditional assets among younger investors aligns with separate findings showing institutional adoption bolstering confidence.

A November Zerohash survey found that 35% of wealthy young Americans had already moved money away from advisers who did not offer crypto exposure, with more than four-fifths reporting increased confidence as major institutions like BlackRock, Fidelity, and Morgan Stanley embraced digital assets.

Portfolio concentration in volatile assets raises legitimate concerns about long-term financial stability.

However, the trend appears durable rather than speculative, with median allocations to non-traditional assets reaching meaningful levels, and younger investors consistently describing crypto as essential to wealth-building strategy rather than an opportunistic position.

Coinbase is responding by building what it calls the Everything Exchange, designed to support trading across asset types at any time while maintaining security, compliance, and responsible innovation standards.

The approach recognizes that younger investors expect platforms native to an internet-first generation rather than traditional market structures built around limited trading hours and narrow asset selection.

You May Also Like

CME Group to Launch Solana and XRP Futures Options

Metaplanet CEO Denies Hiding Details