Circle Partners Intuit to Bring Stablecoin Services to Credit Karma, Turbotax, Quickbooks

Financial services firm Intuit recently announced that it has entered a multi-year, strategic partnership with stablecoin provider Circle.

Under the terms of the agreement, Intuit will leverage Circle’s USDC token and stablecoin infrastructure throughout its platform, which includes products such as Credit Karma, Mailchimp, TurboTax, and QuickBooks.

While details are scarce, according to a Dec. 18 press release, USDC USDC $1.00 24h volatility: 0.0% Market cap: $77.42 B Vol. 24h: $13.44 B integration will be embedded across the Intuit platform to “unlock new experiences in refunds, remittances, savings, and payments that simply weren’t possible on legacy rails.”

Intuit Rises On Stablecoin Bump

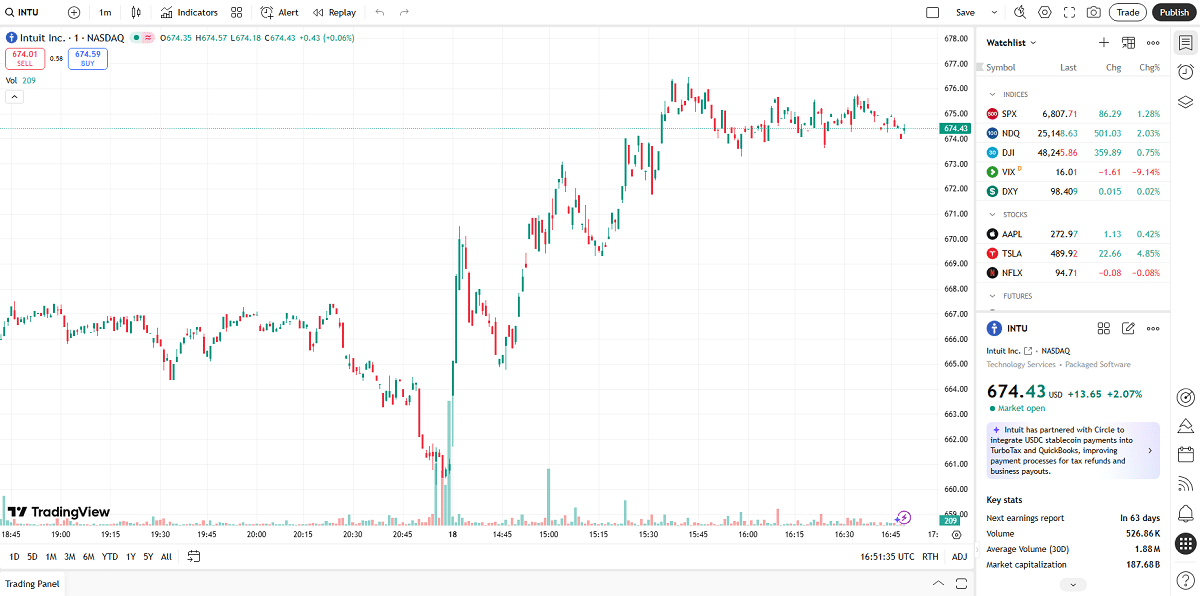

Intuit shares were up more than two percent on the NASDAQ market just hours after the Circle partnership news broke, indicating a strong sentiment toward the integration.

Despite a comparatively rocky 2024, which saw shares reach a multi-year low, Intuit has seen a rising tide of adoption across its product and service suite leading up to its most recent earnings report.

The company’s Q1 2026 earnings, posted on Nov. 20, 2025, indicated consumer revenue of $894 million, up 21 percent for the quarter, with total revenue up 18% at $3.9 billion.

Intuit stocks rose on the news, gaining more than $13 and 2% on the NASDAQ | Source: TradingView

The addition of stablecoin payment rails to Intuit’s suite of products could serve as a boon for millions of consumers, especially in the US where the regulatory winds have shifted to the benefit of the crypto and digital assets communities.

The partnership also further solidifies Circle’s position among the top-tier fintech firms in the global community. Second only to Tether’s USDT USDT $1.00 24h volatility: 0.0% Market cap: $186.23 B Vol. 24h: $86.31 B in the stablecoin market, the firm’s expanding strategic partnerships portfolio has positioned its USDC token as a go-to service token throughout the fintech world.

nextThe post Circle Partners Intuit to Bring Stablecoin Services to Credit Karma, Turbotax, Quickbooks appeared first on Coinspeaker.

You May Also Like

CME Group plans to roll out XRP and Solana futures options in October

DOGE ETF Hype Fades as Whales Sell and Traders Await Decline