Analysts Say Bitcoin Price is Poised for $92K Rally If $85K Support Holds

TLDR

- Bitcoin price defends critical $85K–$88K support amid consolidation

- Declining volume suggests accumulation rather than distribution

- Reclaiming $88K–$90K is needed to confirm bullish continuation

- Holding support could open upside targets toward $92K–$94K

Bitcoin is consolidating after a sharp correction from its 2025 highs, with analysts closely watching critical support and resistance levels. Market structure suggests accumulation is underway, keeping upside targets in focus if key zones remain intact.

Recent price action highlights indecision near major supports, while declining volume and stabilizing momentum point to a potential directional move. Analysts suggest that confirmation above resistance is required to unlock higher price targets.

Bitcoin Price Holds Key Support, Accumulation Signals Emerge

According to Ted Pillows, Bitcoin price is trading within a defined consolidation range. Strong support between $85,000 and $88,000 has held through repeated tests, aligning with previous breakout levels and high-volume zones.

Price action near $87,000 reflects short-term uncertainty, but the formation of higher lows suggests accumulation rather than distribution. Volume has declined during this phase, a common feature of re-accumulation structures within broader bullish trends.

Ted noted that as long as Bitcoin price remains above the $85,000 support zone, the higher-timeframe uptrend stays intact. A sustained move above $88,000 could shift momentum positively and open a path toward the $90,000–$92,000 area.

However, a breakdown below $84,000–$85,000 would increase the risk of a deeper retracement toward November lows. Rising volatility also raises the probability of stop-driven moves on either side of the range.

Resistance Limits Bitcoin Price Recovery

Meanwhile, analyst Franklin’s four-hour chart highlights ongoing resistance near the $93,000 level. This zone has capped multiple rebound attempts since the recent peak, with repeated rejections leading to renewed pullbacks. Bitcoin price is near $86,500 after another rejection, with early recovery candles showing buyer interest from lower supports. Despite this reaction, the lack of a confirmed higher high keeps short-term bias cautious.

SOURCE: X

Further, the analyst emphasized that no daily timeframe close has occurred above the key resistance, limiting bullish confirmation. Volume spikes on recent sell-offs have faded, hinting at potential selling exhaustion. Traders are watching closely for a four-hour close above the reclaimed level to validate upside continuation. Failure to hold current support could expose lower range levels between $82,000 and $84,000.

Momentum Indicators Suggest Downside Pressure Is Fading

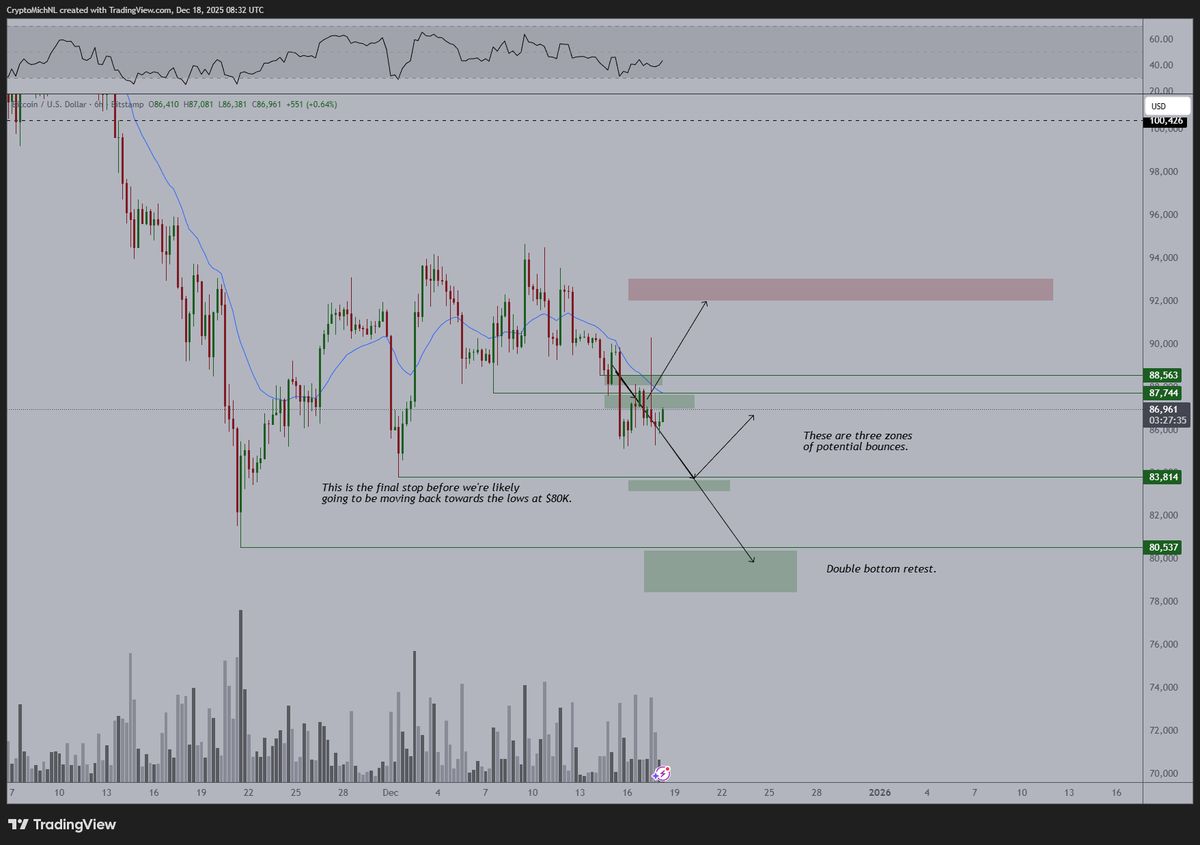

Additionally, analyst Michaël van de Poppe pointed to weakening bearish momentum on the daily chart as Bitcoin stabilizes near $86,000–$88,000. An accompanying indicator, likely tied to sentiment or funding, continues to trend lower, signaling a reset in market conditions. The structure suggests a possible double-bottom retest, with layered support levels around $88,500, $86,900, and $83,800. These zones may act as buffers before a deeper move toward the $80,000–$82,000 region.

SOURCE: X

The analyst highlighted $80,000 as a critical make-or-break area, often associated with cycle-defining reactions. Resilience above this zone would likely reinforce a broader bullish framework. He also noted that market participants remain cautious ahead of macro events, including the Bank of Japan decision. A break above $88,000 could quickly shift sentiment and target the $92,000–$94,000 range.

Overall, analysts agree that Bitcoin remains at a pivotal technical juncture, with support holding the key to renewed upside momentum.

The post Analysts Say Bitcoin Price is Poised for $92K Rally If $85K Support Holds appeared first on CoinCentral.

You May Also Like

CME Group plans to roll out XRP and Solana futures options in October

DOGE ETF Hype Fades as Whales Sell and Traders Await Decline