Solana price prediction: Will SOL hold $125 in late 2025?

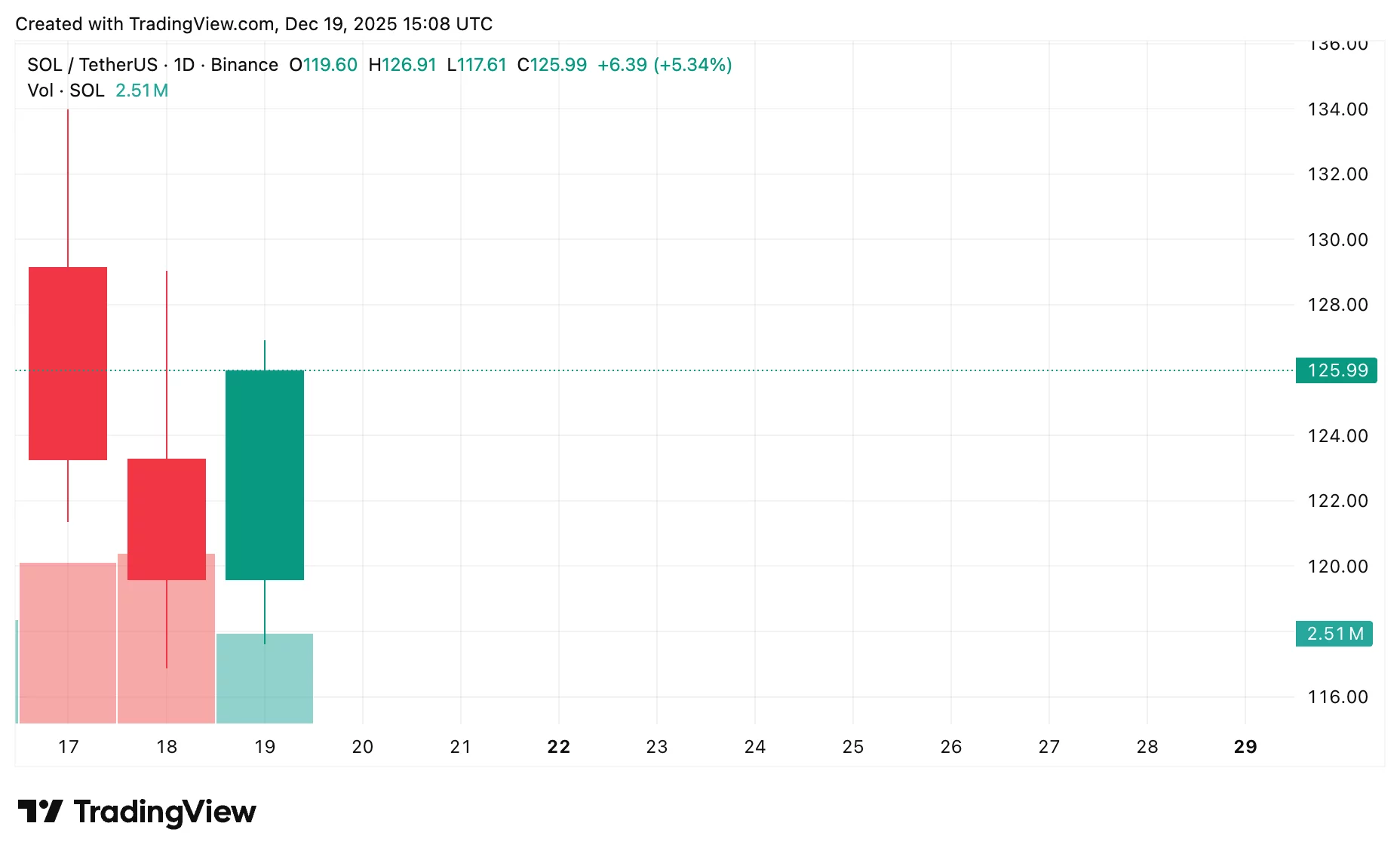

Solana trades in a tight $117.3–$128.8 band on December 19, hinting that traders are treading carefully. After a roller-coaster few months, the question on everyone’s mind: has SOL finally found solid ground?

Table of Contents

- Current market scenario

- Upside outlook

- Downside risks

- Solana price prediction based on current levels

With the final weeks of 2025 ahead, technical levels are coming into focus and could heavily influence the short-term Solana price prediction.

- As of December 19, Solana trades between $117.3 and $128.8, reflecting cautious market sentiment after recent volatility.

- SOL is hovering near $125.9, recovering slightly from a steep weekly drop of almost 10%, following U.S. CPI data showing slower inflation.

- Upside potential targets $160 if support holds, while a break below $125 could trigger a deeper decline toward $120-$110 or even below $100, increasing volatility.

Current market scenario

Currently, Solana (SOL) is hovering near $125.9 as it recovers from a steep decline. The SOL price has declined by almost 10% over the past week, indicating heavy selling. Still, a small daily gain of 0.1% suggests some buyers are starting to test the market again.

This slight rebound comes after a steep sell-off that pushed SOL down to $117. The move followed U.S. CPI data indicating slower inflation. The crypto market responded cautiously, with traders booking profits and reducing exposure.

Over the past year

Over the past year, SOL has traded between $125 and $250, occasionally breaching the upper bound but always reverting to this range. This price action has confirmed $125 as a significant support level.

Now, with the Solana price hovering right above it, the battle between buyers and sellers is intensifying. Despite solid on-chain activity, momentum indicators are turning weaker, leaving the current SOL outlook dependent on whether this support can hold.

Upside outlook

A solid defense of $125 could give Solana a shot at reaching the $150-$160 area in the near term. That zone has seen extensive trading in the past and could attract sellers taking profits. Any lasting rally would require more substantial volume and greater confidence among buyers.

For now, volume suggests hesitation, so moves higher may stay limited. Even so, staying above $125 keeps the short-term SOL forecast on a more optimistic track.

Downside risks

If Solana can’t hold $125, it could slide even further. Most SOL price outlooks indicate $110- $120 as the next support zone. Break that, and we could see prices drop below $100.

This type of move would likely trigger cascading stop-losses and forced liquidations, thereby increasing market volatility.

Solana price prediction based on current levels

The SOL price prediction currently revolves around whether $125 can hold as support. Strong fundamentals remain the backbone of Solana, but technical stress and market uncertainty are constraining gains. As 2025 comes to a close, watching volume and momentum could provide clues about SOL’s next move.

You May Also Like

Unlocking Opportunities: Coinbase Derivative Blends Crypto ETFs and Tech Giants

Crossmint Partners with MoneyGram for USDC Remittances in Colombia