XRP Price Today: Sitting on a Dangerous Line

$XRP is currently trading in what can only be described as a high-risk technical zone. After a strong rally earlier in 2025, the XRP chart now shows a prolonged downtrend, with price compressing just above the $1.6–$1.8 support area.

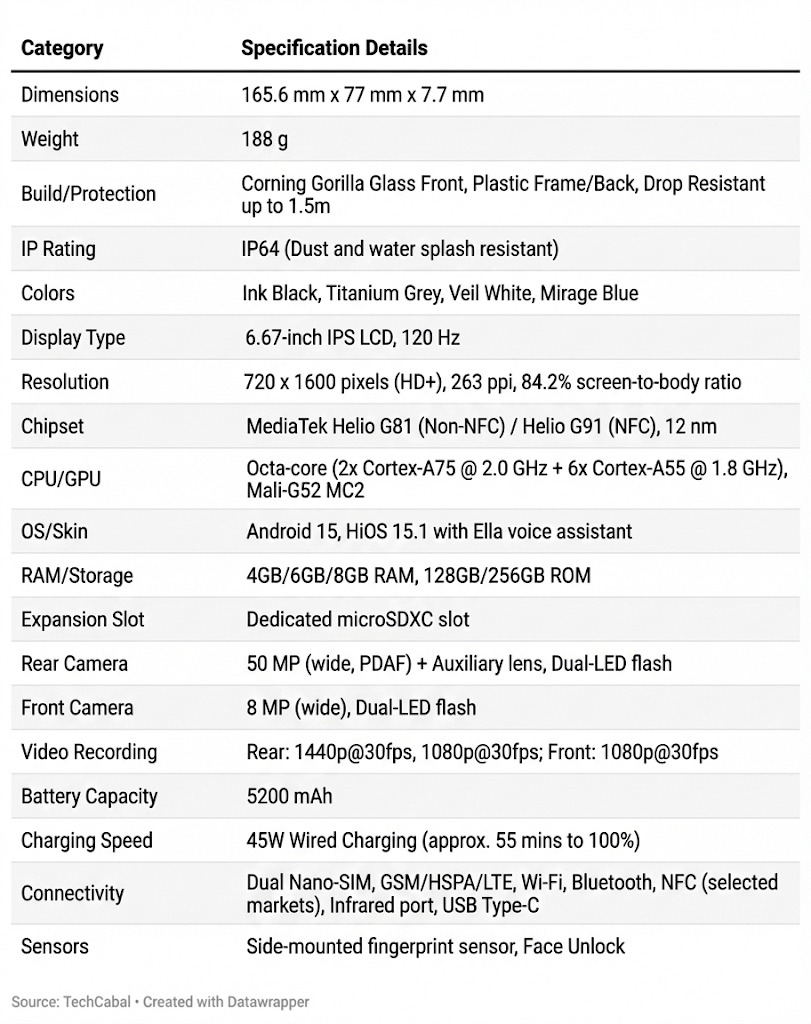

XRP/USDT 1D – TradingView

This zone has acted as a temporary floor multiple times over recent weeks. However, repeated tests of the same support usually weaken it — and that’s exactly what the current structure suggests.

The market is no longer trending strongly; instead, XRP is drifting lower while volatility compresses, a classic setup for a decisive move.

The $1.8 Level: Broken, Reclaimed, But Losing Strength

The attached charts clearly show that $1.8 has already been broken several times recently. Each time, those moves turned into fakeouts, with price quickly reclaiming the level and pushing back above it.

XRP/USDT 2H – TradingView

While that may look bullish at first glance, technically it tells a different story:

- Buyers are still defending the zone

- But each bounce is weaker than the last

- Lower highs continue to form under descending resistance

This is not accumulation — it’s distribution under pressure.

As long as XRP holds above $1.8 on daily closes, downside remains limited. But the margin for error is shrinking fast.

Why the $1.6 Zone Is the Real Line in the Sand

The $1.6 area is far more critical than $1.8.

If XRP loses $1.6 with a confirmed daily close, the chart opens up aggressively to the downside. There is very little structural support below, which is why the risk accelerates quickly.

Based on historical price action and visible liquidity zones on the chart, the next downside targets would be:

- $1.20 – prior consolidation and demand zone

- $1.00 – major psychological level

- $0.80 – last major structural support before the 2024 base

Once below $1.6, XRP would likely enter a fast-moving bearish leg, not a slow grind.

Descending Trendline Pressure Is Still in Control

Another key element visible on the chart is the descending trendline that has capped XRP’s price since its local top near $3.5.

Every meaningful bounce has been rejected at that trendline, reinforcing the bearish structure. Until XRP reclaims that diagonal resistance — ideally above $2.5–$2.7 — the broader trend remains downward biased.

Momentum indicators also reflect this uncertainty, with oscillators bouncing but failing to produce sustained trend reversals.

XRP/USD 1D – TradingView

Everything Now Depends on Crypto Market Sentiment

XRP is no longer trading in isolation. The broader crypto market’s behavior will likely decide whether this support holds or breaks.

Key sentiment drivers include:

- Bitcoin holding or losing its major support zones

- Overall market liquidity and risk appetite

- Absence of strong bullish catalysts for altcoins

If the broader market stabilizes or turns higher, XRP could once again defend $1.8 and attempt a relief rally.

If sentiment deteriorates, $1.6 will not hold.

In weak markets, altcoins like XRP tend to break support faster and harder than Bitcoin.

Source: https://cryptoticker.io/en/xrp-price-warning-bearish-structure-still-intact/