Uniswap Approves 100M UNI Burn, Activates Fee Switch

Uniswap governance approved the UNIfication overhaul on December 25, locking in a 100-million-UNI treasury burn. The vote also activated protocol fees that will fund ongoing UNI $5.95 24h volatility: 2.8% Market cap: $3.75 B Vol. 24h: $369.66 M destruction, according to the finalized proposal on the Uniswap forum and Labs blog.

Uniswap Vote Details

The on‑chain vote closed with 125,342,017 UNI in favor, and 742 against. Uniswap founder Hayden Adams posted on X, clearing the 40 million UNI quorum by more than 3x.

After the mandatory ~2‑day timelock, the contracts execute, and the burn transactions and fee parameters go live. Governance records on the Uniswap portal show turnout of more than 20% of outstanding UNI, one of the highest participation rates in the protocol’s history, with more than 99.9% of cast votes backing the change.

UNI traded around $6.05, +2.3% in 24h at 17:00 UTC on December 26, holding gains from a run that started when the vote opened.

Uniswap price on Dec. 26 | Source: CoinMarketCap

What Changes After the Uniswap Vote

The primary spec, published as the UNIfication proposal on the Uniswap governance forum and mirrored in the Uniswap Labs blog, lays out eight concrete actions.

The protocol will transfer 100 million UNI from the treasury to a burn address. It will remove roughly 16% of total supply from circulation, and flip the long‑dormant fee switch on Uniswap v2 and a curated set of high‑volume v3 pools on Ethereum mainnet. For v2, LP fees move from 0.30% to 0.25%, with 0.05% of volume now accruing to the protocol. For v3, the proposal sets protocol fees at 25% of LP fees on the 0.01% and 0.05% tiers and at 16.7% of LP fees on the 0.30% and 1% tiers, with governance able to adjust pool-by-pool in follow‑up votes.

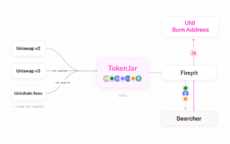

All protocol fees, plus net sequencer revenue from Unichain after L1 data costs and the 15% Optimism share, now route into a programmatic burn mechanism described in the proposal and supporting documentation. The design uses two contracts, commonly referred to in community analysis as TokenJar and Firepit.

Uniswap burn mechanism | Source: gov.uniswap.org

Fees will accumulate there until UNI is destroyed. At that point, the contract will release claims, turning protocol usage directly into supply reduction.

In addition, Labs committed in the proposal to turn off all frontend, wallet, and API fees, removing application‑layer monetization from its products. In exchange, governance approved a 40-million-UNI treasury allocation on a two‑year vesting schedule as a recurring growth and development budget. That allocation is separate from the 100 million UNI burn and will fund Labs’ protocol‑focused roadmap, including Uniswap v4 “hooks,” Protocol Fee Discount Auctions, and aggregator functionality.

Uniswap to Burn Up to $700M of UNI Annually

Uniswap Labs’ blog notes that Unichain currently runs at roughly $100 billion in annualized DEX volume and around $7.5 million in annualized sequencer fees. It will now join swap fees as inputs to the burn engine.

Third‑party modeling from research pieces by Tekedia and OKX estimates that the combined system can erase $280 million to $700 million worth of UNI annually if 2025 fee levels persist.

nextThe post Uniswap Approves 100M UNI Burn, Activates Fee Switch appeared first on Coinspeaker.

You May Also Like

XAG/USD Soars Past $84.00 As Safe-Haven Frenzy Meets Crucial NFP Test

Trading Moment: With the non-farm payrolls report imminent, crude oil prices surge, while gold, silver, and Bitcoin face pressure; 80% of analysts are bullish on BTC.