XRP and SOL ETF Inflows Rise as BTC and ETH See Year-End Outflows

This article was first published on The Bit Journal.

XRP and SOL ETF inflows sent a clear signal through crypto markets, at a time when confidence in dominant assets showed visible restraint. As the year approaches its close, institutional capital appears less focused on size and more interested in selective positioning tied to narrative-driven growth.

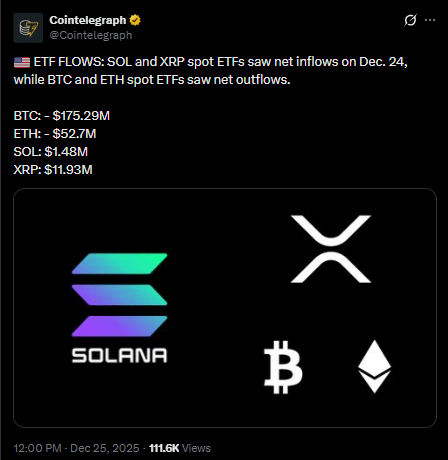

The shift surfaced in daily ETF data. According to the source, spot exchange-traded funds linked to XRP and Solana attracted fresh inflows, while products tied to Bitcoin and Ethereum recorded notable withdrawals. This contrast points to a market shaped by strategy and timing rather than fear.

Bitcoin and Ethereum Step Back as Rebalancing Sets In

Spot ETFs tracking Bitcoin recorded sharp withdrawals, with Bitcoin ETF outflows nearing $175 million in a single trading session. Ethereum-based ETFs followed the same trend, posting net redemptions of more than $50 million. These Bitcoin ETF outflows do not suggest panic selling. Instead, they reflect typical year-end portfolio rebalancing after extended gains.

Historical ETF flow patterns show that institutions often trim large-cap exposure late in the year to lock in performance and reset risk. Research on fund flows has repeatedly shown that ETF movements tend to appear before broader market shifts.

In this case, the scale of Bitcoin ETF outflows signals caution and profit-taking rather than declining confidence. Aggregated fund flow disclosures reinforce this view and highlight how regulated products act as early indicators of capital rotation.

Source: X (Formerly Twitter)

Source: X (Formerly Twitter)

Why XRP and SOL Attracted Fresh Capital

Against this cautious backdrop, XRP and SOL ETF inflows stood out. XRP-focused spot ETFs recorded net inflows of nearly $12 million, the strongest among altcoin-linked products that day. Solana ETFs added roughly $1.5 million. While smaller than Bitcoin volumes, these inflows arrived during a session dominated by Bitcoin ETF outflows, increasing their significance.

XRP’s inflow is closely tied to expectations of regulatory clarity. Recent legal developments have reduced uncertainty around the asset’s standing, and studies on regulation and market participation show that institutions prefer assets with clearer compliance paths. This shift in perception helped support XRP and SOL ETF inflows even as capital exited Bitcoin and Ethereum funds.

Solana’s Case Rests on Technology and Usage

Solana’s appeal lies in execution rather than headlines. The network continues to attract developers building payment tools and decentralized applications. On-chain metrics and ecosystem reports point to steady growth in activity, supporting the case for sustained institutional interest.

For institutions, ETFs provide regulated exposure without custody or infrastructure risk. This structure makes ETF allocations a reliable signal of conviction. In contrast, Bitcoin ETF outflows and parallel Ethereum withdrawals suggest a pause rather than a move away from crypto as an asset class.

XRP and SOL ETF Inflows Signal a Strategic Shift as BTC and ETH Cool

XRP and SOL ETF Inflows Signal a Strategic Shift as BTC and ETH Cool

What ETF Flows Reveal About Market Direction

The contrast between Bitcoin ETF outflows and selective altcoin inflows highlights capital rotation rather than retreat. Academic research on portfolio allocation shows that professional investors often shift funds toward assets with asymmetric upside once core positions mature. ETF flow data makes this behavior visible in real time.

For financial students and analysts, XRP and SOL ETF inflows offer insight into evolving institutional sentiment. For blockchain developers, the trend highlights which ecosystems are gaining long-term trust. For traders, it reinforces why ETF flows deserve attention alongside price charts. Broader coverage continues to track these movements across major crypto market platforms.

Conclusion

As 2025 draws to a close, XRP and SOL ETF inflows stand out because they emerged during a session dominated by Bitcoin ETF outflows and mirrored by Ethereum redemptions. This timing suggests preparation rather than fear. Capital is not leaving crypto markets. It is becoming more selective.

The divergence points to a maturing market where regulation, technology, and future growth narratives shape investment decisions. For those tracking institutional behavior, ETF signals may offer an early view into where confidence is quietly building for the next cycle.

Glossary of Key Terms

Spot ETF: An exchange-traded fund that tracks the current market price of an asset.

ETF Inflows: Net capital entering an ETF over a defined period.

ETF Outflows: Net capital withdrawn from an ETF during trading.

Capital Rotation: Movement of investment funds between assets based on risk and opportunity.

FAQs About XRP and SOL ETF Inflows

Why do ETF flows matter more than daily prices?

ETF flows reflect institutional intent before price trends emerge.

Are Bitcoin ETF outflows bearish overall?

No. They often reflect rebalancing and profit-taking.

Why is XRP seeing ETF inflows now?

Improving regulatory clarity has reduced perceived risk.

What does Solana’s inflow suggest?

Growing confidence in its technology and usage.

References

CoinoMedia

Coindesk

Bitget

X (formerly Twitter)

Read More: XRP and SOL ETF Inflows Rise as BTC and ETH See Year-End Outflows">XRP and SOL ETF Inflows Rise as BTC and ETH See Year-End Outflows

You May Also Like

Ethereum Millionaires’ Focus Turns Towards Ozak AI Presale

XRP Sees Panic Selling as Glassnode Data Shows Significant Holder Losses