Ethereum Price Prediction: ETH at a Decision Zone as Bulls Target $3,000

Highlights:

- The Ethereum price is currently up 1% to $2,964 as bulls eye higher levels.

- ETH derivatives data show mixed signals as the funding rate flips positive.

- The technical outlook shows ETH at a decision zone, with the bulls eyeing $3,000 zone.

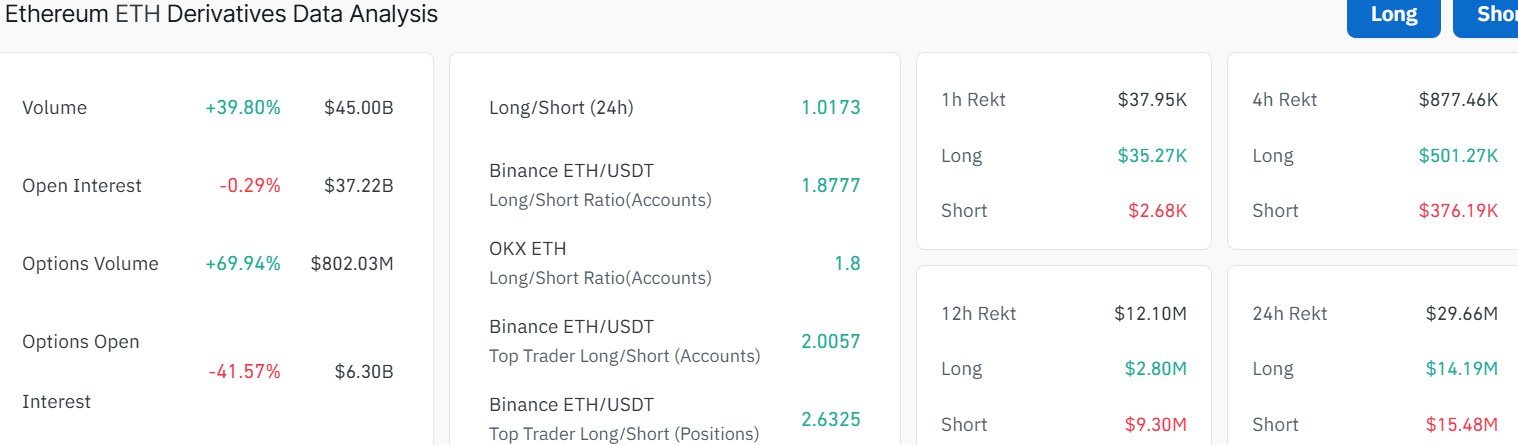

Ethereum price(ETH) is trading near $3,000 level, currently at $2,964, making a 1% surge in the past 24 hours. The derivatives data on Ethereum have a mixed signal. The Open Interest (OI) in the futures contracts of ETH decreased to $37.22 billion, marking a slight 0.27% plunge in the past 24 hours. This decline in OI indicates a lack of confidence in investors. However, the volume has soared to $45 billion, marking a whopping 39% rise. This signals that the trading activity in the ETH market is intense, with ETH at a decision zone.

ETH Derivatives Data: CoinGlass

ETH Derivatives Data: CoinGlass

On the other hand, the ETH OI-Weighted Funding Rate has flipped positive, at 0.0026%. This suggests that the longs are paying the shorts, and it could lead to the Ethereum price surging above $3000 level soon.

Ethereum OI-Weighted Funding Rate: CoinGlass

Ethereum OI-Weighted Funding Rate: CoinGlass

ETH At a Decision Zone

The Ethereum price daily chart action has shifted into a corrective phase after staging a strong rally from the mid-2024 support region near $2,100. That push skyrocketed the Ethereum price toward a cycle peak around $4,900, where buying momentum began to fade, and profit-taking emerged.

Following the rejection at the highs, Ethereum entered a prolonged pullback, forcing the altcoin into a rounding top pattern. This retracement has dragged the price below both the 50-day($3,072) and 200-day($3,583) Simple Moving Averages (SMAs), which now act as the immediate resistance levels.

ETH/USD 1-day chart: TradingView

ETH/USD 1-day chart: TradingView

Meanwhile, the Relative Strength Index (RSI) is hovering around 46.13, suggesting subdued momentum without reaching oversold conditions. This level reflects a tug-of-war among the bulls and bears, reinforcing the idea that Ethereum is consolidating and could move in either direction.

Meanwhile, the MACD indicator is still below the neutral line(0.0000). However, downside momentum is weakening. The histogram bars are contracting, signalling that bearish pressure is losing strength, as the blue MACD line flips above the signal line.

Although no decisive bullish crossover has yet formed, the Ethereum network activity has nearly doubled in a week. According to popular crypto analyst Ali Martinez, active ETH addresses have risen from 496,000 to 800,000.

Looking at the bigger picture, the ETH price is at a make-or-break level. The confluence of the 50-day MA and horizontal support between $2,913–$3,072 forms a critical demand zone that bulls must defend.

A breakdown below this support region could expose ETH to a deeper move toward the major demand zone near $2,700. A break below this level will see further downside, revisiting the broader base around $2,500-$2,100. Meanwhile, Ali has noted that the 3-day chart shows $1700 as a great spot to buy ETH.

On the other hand, if buyers successfully defend the 50-day SMA and momentum stabilizes, the price of ETH could attempt a recovery toward $3,172-$3,200 zone. A sustained push above this region would place the 200-day SMA at $3,583 back into focus as the next resistance hurdle.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

Hoskinson Says XRP and Cardano Projects Lead Tokenization Race

Fed forecasts only one rate cut in 2026, a more conservative outlook than expected