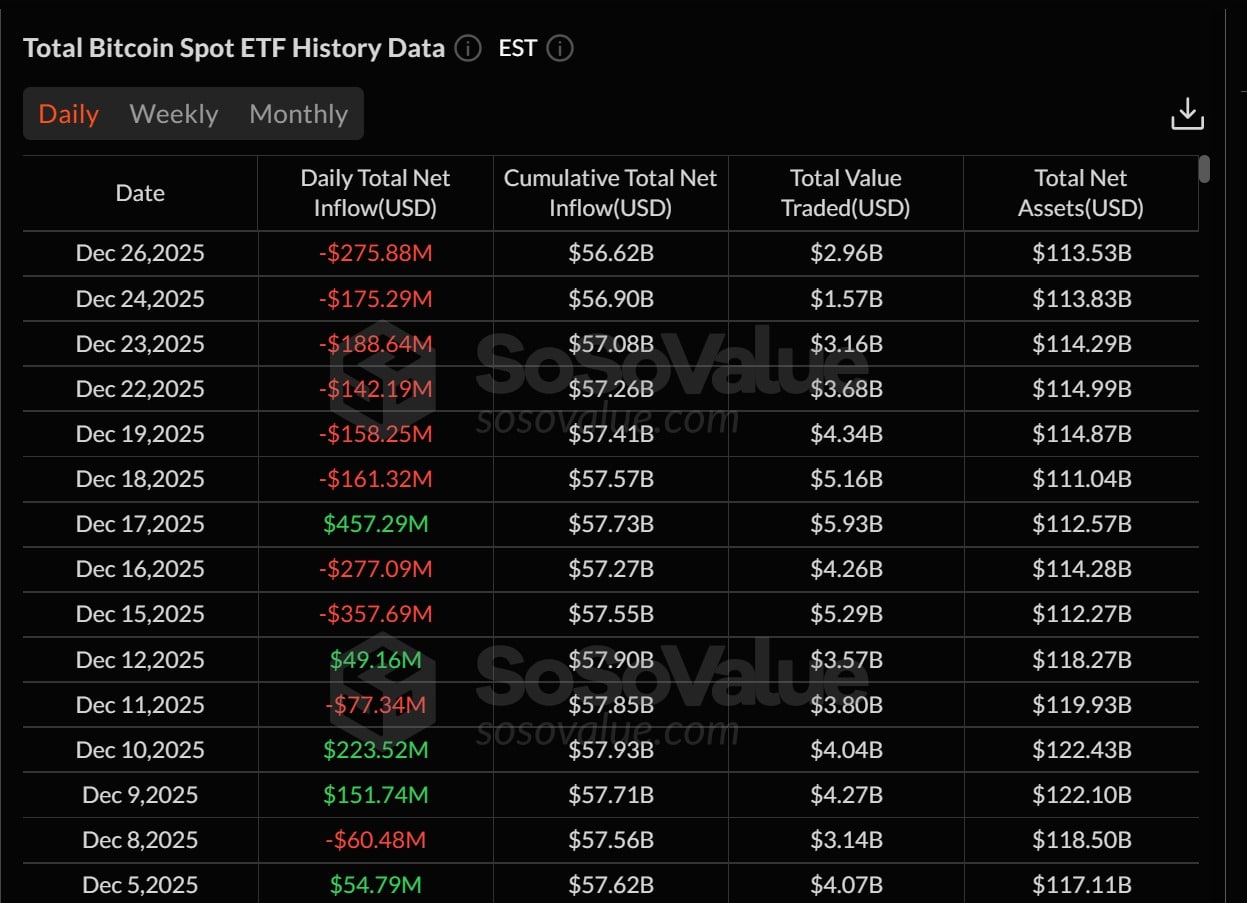

COINOTAG News reports that during the Christmas window, the US spot Bitcoin ETF endured net withdrawals totaling $782 million. On Friday alone, outflows reached $276 million, with BlackRock’s BITO at $193 million, Fidelity’s FBTC $74 million, and Grayscale’s GBTC redemptions continuing. Assets under management fell to $113.5 billion, below the $120 billion level seen earlier in December.

Even as liquidity tightened, BTC traded near $87,000, indicating that the withdrawal flow reflects year-end rebalancing rather than immediate market panic. The discrepancy between fund outflows and price stability underscores how holiday liquidity conditions can drive ETF dynamics without implying systemic risk.

This marks the sixth consecutive day of net outflows for the spot Bitcoin ETF, with aggregate withdrawals exceeding $1.1 billion, the longest stretch since autumn. While holiday exits are described as routine by some institutional professionals, attention will turn to January as potential inflows could alter the ETF flow trajectory.

Source: https://en.coinotag.com/breakingnews/bitcoin-spot-etfs-see-782-million-christmas-outflow-aum-falls-to-113-5b-amid-six-day-net-decline