Opinion: Although gold and silver prices may face profit-taking pressure in the short term, long-term macroeconomic factors will continue to support the rise in precious metal prices.

PANews reported on December 29th that The Kobeissi Letter, a capital markets commentary journal, points out that gold and silver prices will surge in 2025, becoming a "new stimulus check." Gold prices are projected to rise from $2,400/ounce in 2024 to the current $4,500/ounce, an increase of 88%; silver prices are expected to rise from $29/ounce to $79/ounce, an increase of over 170%.

It is estimated that about 11% of Americans hold gold and about 12% hold silver. American households saw their net worth increase by approximately $244.5 billion this year due to rising gold and silver prices. Globally, China and India are expected to purchase 700-900 tons of gold annually between 2022 and 2024, driving gold prices to double.

Furthermore, China plans to implement silver export restrictions starting January 1, 2026, further exacerbating market supply shortages. Analysts believe that while short-term profit-taking may occur, potentially leading to a shift of funds to other assets such as stocks and cryptocurrencies, in the long run, factors such as inflation expectations, central bank interest rate cuts, and global central banks increasing their gold holdings will continue to support rising precious metal prices.

You May Also Like

The Critical Analysis Behind ADA’s Potential $2 Surge

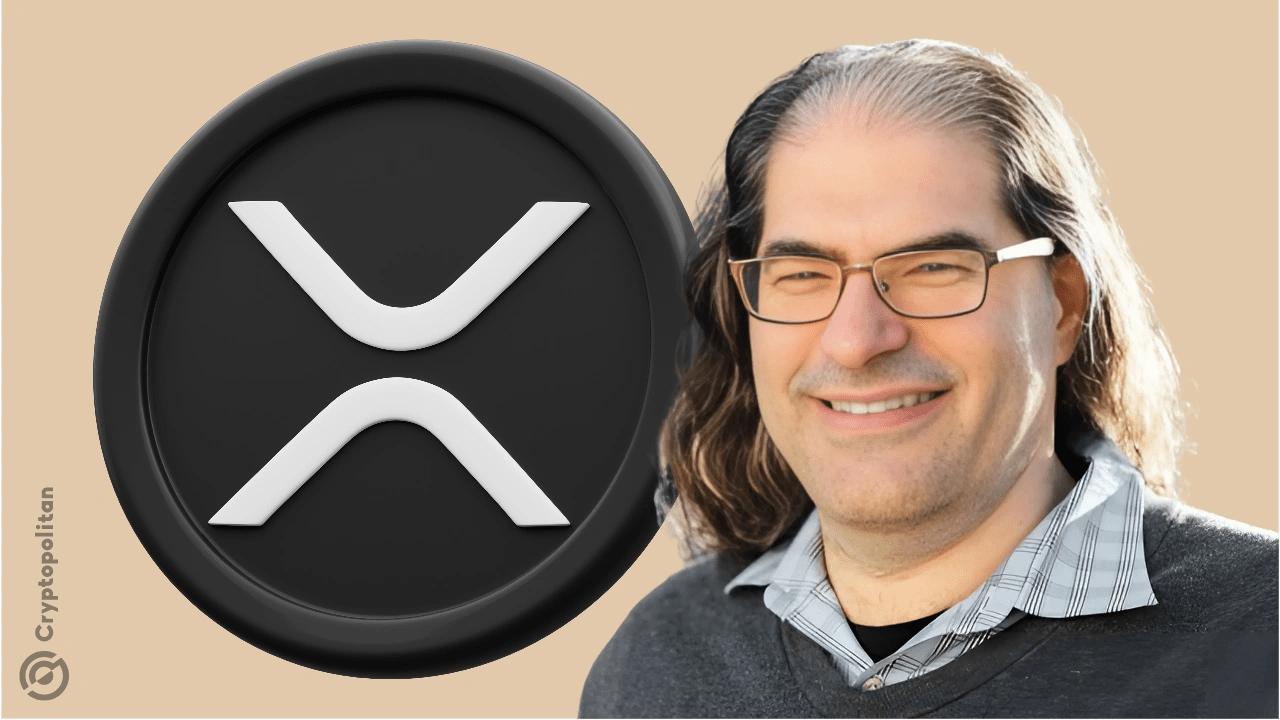

Novogratz doubts XRP and Cardano can maintain relevance as crypto market matures