Solana Inflation Revolution: SIMD-0228 Proposal Sparks Community Controversy, 80% Reduction in Issuance Hides Risk of "Death Spiral"

Author: Frank, PANews

Recently, the Solana Governance Forum launched a proposal called SIMD-0228, which aims to reduce the annual issuance of SOL by 80% by dynamically adjusting the inflation rate and guide funds from staking to DeFi. However, this seemingly "smart issuance" blueprint has aroused fierce controversy in the community about the "inflation spiral" and interest game - when the staking rate falls below the critical point, higher inflation may backfire on market confidence. The income structure of validators and the distribution of benefits among ecosystem participants have become the invisible explosives of this token economy experiment.

The new proposal may reduce inflation by 80%, reducing the issuance of 22 million SOLs that year

Solana's token SOL issuance mechanism has always adopted a fixed schedule mechanism, that is, the inflation rate decreases from 8% to 15% per year over time until it reaches the target of 1.5%. The current inflation rate is 4.694%. Under this inflation rate mechanism, the number of additional tokens issued this year is about 27.93 million tokens, and the pledge rate is about 64%.

In comparison, Ethereum’s inflation rate is currently about 0% and its staking rate is about 30%. The inflation model of SOL tokens is obviously more detrimental to the value preservation of tokens, and the excessively high inflation rate also causes a large number of tokens to choose to be staked in order to obtain higher returns. Therefore, it is not conducive to the development of the DeFi ecosystem.

The proposal believes that currently in the Solana network, MEV income has become the main source of income for validators, and reducing the staking yield will not have much impact on income. "Simply put, it is a 'stupid issuance'. Given Solana's booming economic activity, it makes sense to develop the network's monetary policy to achieve 'smart issuance'."

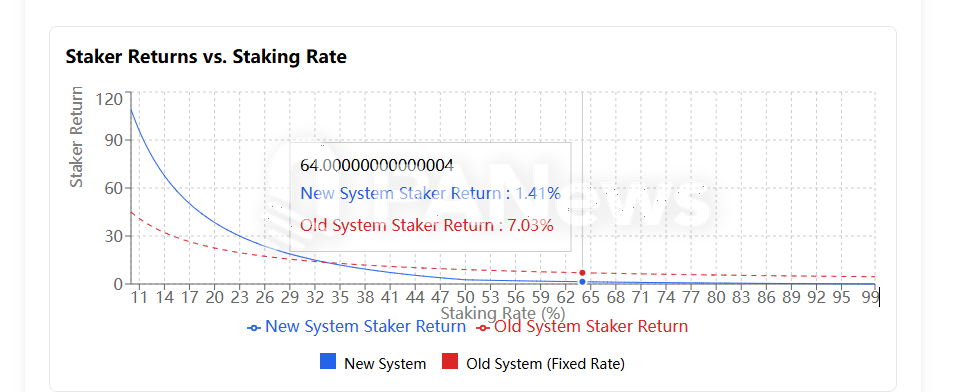

In the proposal, a dividing line is proposed, which is initially assumed to be 50%. That is, when the pledge rate exceeds 50%, the inflation rate decreases, reducing the network's pledge income. When the pledge rate is lower than 50%, the inflation rate is increased and the rewards are expanded to encourage more funds to pledge.

Later, forum users questioned the lack of rigorous calculation basis for the 50% threshold, believing that it was set too hastily. Subsequently, the proposer provided a new algorithm curve, setting the pledge rate at 33% as a dividing line. When the pledge rate is higher than 33%, the annual inflation rate will be lower than the current inflation rate.

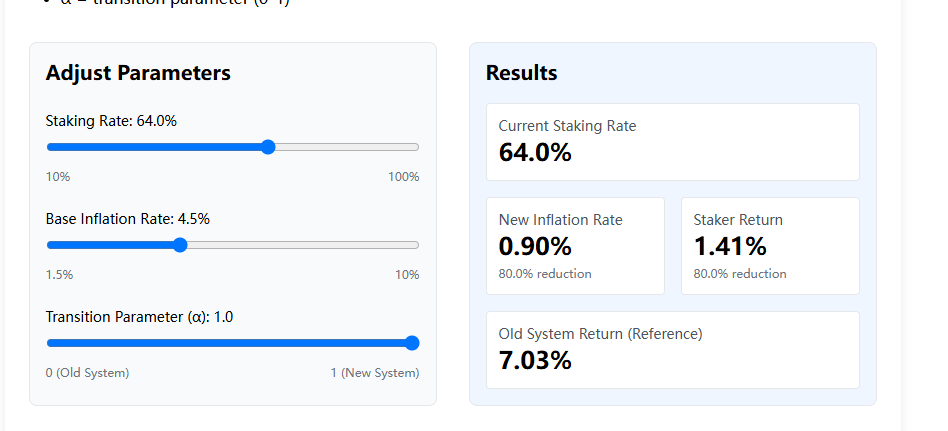

According to PANews calculations, taking the current 64% staking rate as an example, according to the new token issuance curve, the annualized inflation rate will drop from 4.694% to 0.939%, a decrease of about 80%.

If the proposal is finally passed, maintaining the current pledge rate, the number of SOL issued that year will drop from 27.93 million to 5.59 million.

Proposed changes to the staking rate and inflation rate

However, this statement in the proposal does not seem to have reached a consensus in the forum, and many comments believe that if the plan is passed, reality may not happen as expected. For example, when the pledge rate decreases, the increase in inflation rate will further reduce the market's expectations for tokens, which may lead to further selling of unstaked tokens, causing greater uncertainty.

PANews calculated that when the pledge rate is only 25%, inflation of 44.13 million tokens will be generated, which is much higher than the current inflation rate.

If we really fall into this inflationary vortex, the result may be counterproductive. As the proposal says, the current source of income for validators is MEV income. This phenomenon is mainly due to the current active transactions on the Solana network, and the demand of many MEME players for transaction speed and anti-sandwich attack makes MEV income account for a high proportion. If the overall transaction volume of the network decreases in the future, the proportion of MEV income may be difficult to maintain as the main source of income for validators. If the double blow of inflation and price drop is added at that time, it may further dampen the enthusiasm for staking, and instead lead to a reverse spiral of rising inflation and falling staking.

The collective silence of the validators may be due to the interests of the big coin holders.

The proposal was initiated by Vishal Kankani, an investor at Multicoin Capital. Multicoin Capital is an early investor in Solana and led a $20 million Series A round in 2019. It also holds a large number of SOL tokens, and early investments choose to receive SOL tokens rather than equity. From this background, Vishal Kankani represents a large Solana coin holder who is more sensitive to the impact of inflation on the token market price.

Interestingly, as of February 26, Helius, binance staking, Galaxy and other large validators in the Solana network have not made any statement on this proposal. The founder of Helius usually speaks frequently about the development of the Solana ecosystem, but for this proposal that has a huge impact on the ecosystem, he just forwarded a related content and commented that it is stupid to sell SOL tokens now.

In fact, once this proposal is passed, it may not be good news for validators like Helius, which returns 100% of MEV income to stakers. Because at present, since Helius does not obtain income through MEV, it may rely more on the income from staking itself.

In general, this proposal represents the interests of large SOL holders, who prefer to reduce inflation to achieve value stability. In addition, from an ecological perspective, the current staking yield of the Solana network is about 7.03%. Under the new plan, the same staking rate will be reduced to 1.41%, a drop of nearly 80%. This is not a good thing for large validator nodes that hope to obtain risk-free returns through staking.

Of course, the proposal believes that it is the decline in staking yields that will stimulate these validators to invest their tokens in more DeFi ecosystems, which can further enhance the ecological prosperity of Solana DeFi.

Solana's token economic reform is essentially a rebalancing of power between large coin holders, validators, and ecosystem builders. After the proposal is passed, the 7.03% staking yield may drop sharply to 1.41%, forcing validators to shift from relying on inflation rewards to focusing on MEV and transaction fees - this is both an opportunity and a gamble.

If DeFi can absorb billions of dollars of idle liquidity, Solana may usher in explosive innovation like Uniswap and Aave; but if the market sells off due to declining yields, the huge increase of 44.13 million coins at a staking rate of 25% may drag the network into a death spiral of "inflation-selling pressure-more inflation".

At present, the silence of Helius and other head validators implies the subtle tension of the interest chain - when the business model of 100% return of MEV encounters a halving of basic income, the "decentralized" narrative of the ecosystem may face realistic torture. The position of Multicoin Capital, as an early whale, reveals the deep logic of this game: in the eyes of institutional investors, SOL's value storage attribute has taken precedence over network security needs. In the coming months, as the March 7 vote approaches, Solana's fate will no longer be determined by code dictatorship, but by whether the community can find that dangerous balance between idealism and capital rationality.

You May Also Like

Horror Thriller ‘Bring Her Back’ Gets HBO Max Premiere Date

TRM Labs Becomes Unicorn with 70M$: BTC Fraud Risk