Solana (SOL) Gathers Strength: Can the Recent Bullish Spike Propel Prices Higher?

- Solana is hovering around the $127 range.

- SOL’s trading volume has exploded by over 143%.

With the recent spike, the crypto market cap has climbed back above $3 trillion. Major tokens are charted in green, attempting to enter the steady bullish zone, while a few still hover in red. The largest assets, like Bitcoin (BTC) and Ethereum (ETH), are currently trading at $89.5K and $3K, respectively. Among the altcoins, Solana (SOL) has posted a modest gain of 2.95%.

The asset opened the day trading on the downside, at around $123.07, and after the brief bullish wave, the SOL price rose to a high range of $129.30. It has broken multiple key resistance zones between $124.36 and $128.74. If the altcoin continues to build on the recent surge, its price movement could unlock further upside.

Solana traded within the $127.34 level at press time, with the market cap touching $72.05 billion. Moreover, the asset’s daily trading volume has exploded by over 143.93%, reaching the $3.8 billion mark. As per Coinglass data, the market has witnessed $10.92 million worth of SOL liquidations during the last 24 hours.

Is Solana’s Bounce Built to Last?

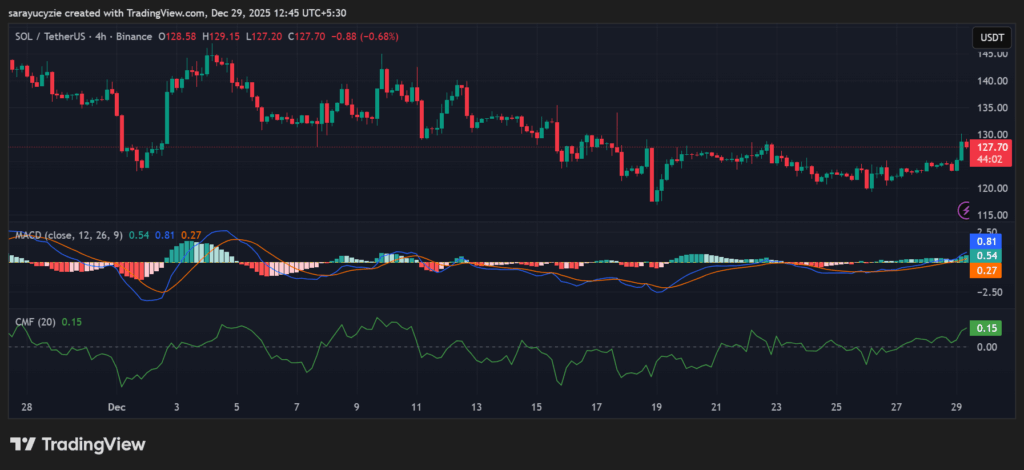

The MACD line of Solana has crossed above the signal line, indicating a bullish outlook. The short-term price momentum is strengthening, and this can be an early sign of a potential upward move. Besides, the CMF value at 0.15 suggests a moderate buying pressure in the SOL market. Notably, the capital is flowing into the asset, not extremely, but it likely supports the bullish bias.

SOL chart (Source: TradingView)

SOL chart (Source: TradingView)

Solan’s 4-hour chart shows a positive trading pattern, with the price seeking to rise to the $129.51 resistance. If the bulls gained more traction, the price could move up to its recent high at around $131, with the golden cross emergence.

Conversely, a bearish turnover invites the Solana bears, and they could send the price toward the $125.34 support. With the formation of the death cross, it might drive the altcoin price to a low below the $123.10 range or even lower.

Furthermore, the daily RSI staying at 62.95 implies a healthy bullish sentiment. Solana is currently leaning toward the overbought zone, leaving enough room for further upward movement. SOL’s BBP reading, resting at 6.29, is pointing out a strong bullish dominance in the market. Significantly, if this momentum holds strong, it reinforces the case for continued upside.

Top Updated Crypto News

Rally Charging Ahead or Hitting a Wall? BNB Bulls Face a Key Test

You May Also Like

Hong Kong Backs Commercial Bank Tokenized Deposits in 2025

TechCabal’s most definitive stories of 2025