Cardano Price Prediction: ADA Could Reclaim $0.40 Amid Rising Trading Volume

Highlights:

- The Cardano price is soaring towards $0.40, despite the mixed signals in the crypto market.

- The ADA derivatives market shows a rise in bullish bets, as the funding rate flips positive.

- ADA could reclaim $0.40 mark, as the bearish momentum fades.

Cardano (ADA) price is sliding towards the $0.40 mark, as it is exchanging hands at $0.37 level. The daily trading volume has soared 40% indicating a surge in market activity. The derivatives data is also indicating that traders have a risk-on mood, with ADA futures Open Interest and bullish bets surging. The technical forecast is optimistic, and ADA is attempting to break an overhead resistance level as momentum moves to the positive direction.

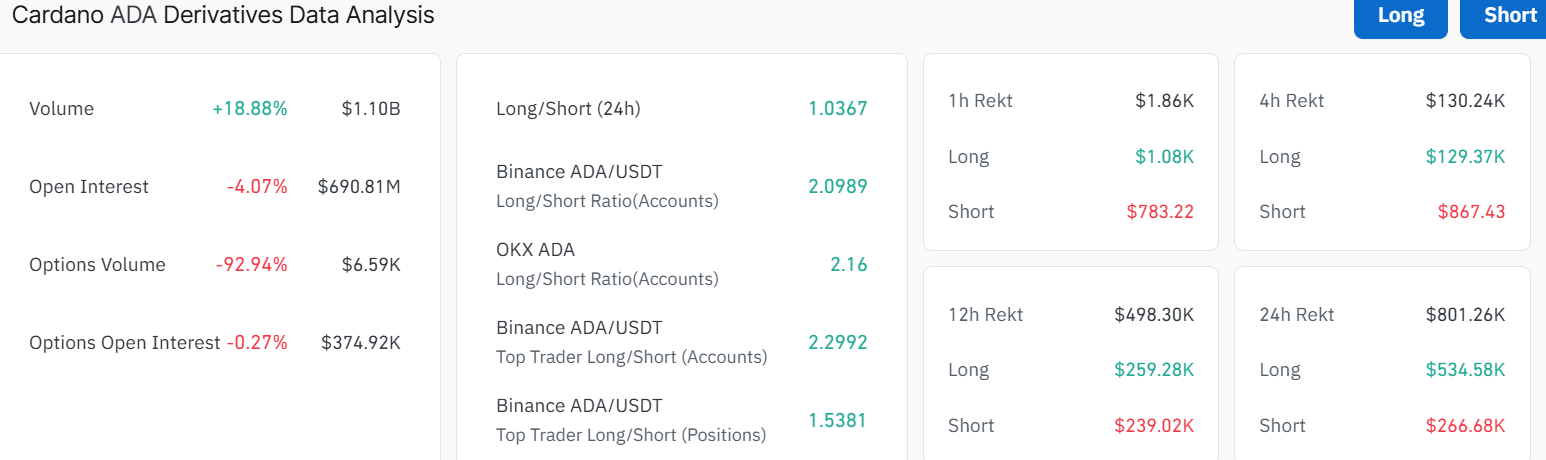

CoinGlass data indicates that the Cardano futures Open Interest (OI) has decreased by 4% in the past 24 hours to hit $690 million on the derivatives side. This is a pointer to a loss of confidence among investors, as traders are exposed to more risk. Meanwhile, the volume has spiked a whopping 18% to $1.10 billion, suggesting heightened trading activity.

Cardano Derivatives Data Analysis: CoinGlass

Cardano Derivatives Data Analysis: CoinGlass

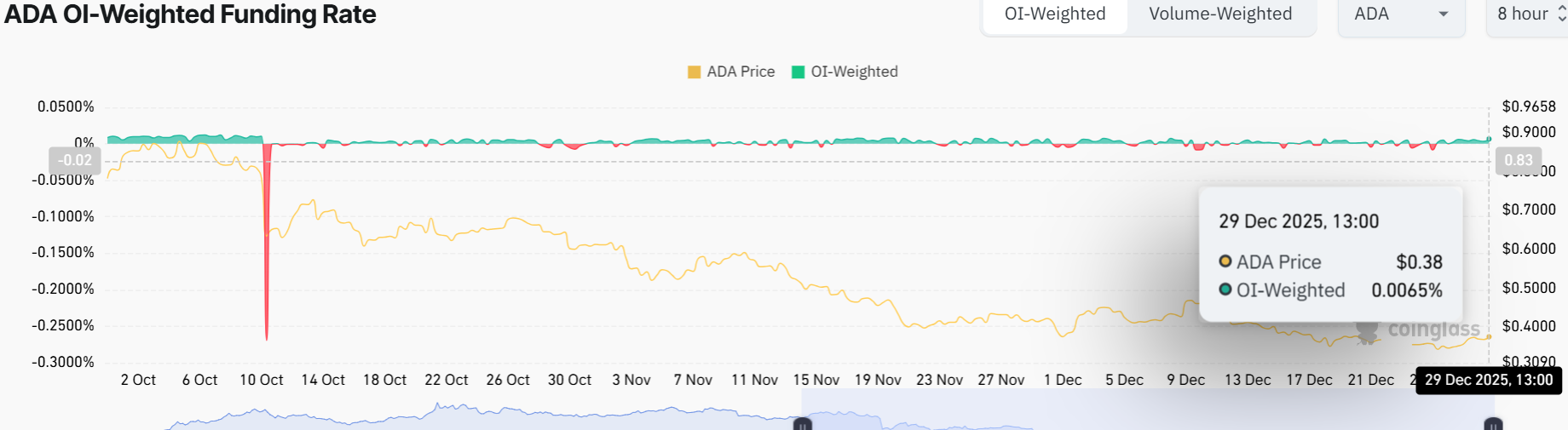

On the other hand, its OI-weighted derivatives rate of 0.0065% indicates a bullish shift in the derivatives market where traders are willing to pay a premium to have long positions. Moreover, the long-to-short ratio shows that the long positions are covered to 54.73%. Another possible surge in leverage in Cardano may be viewed as the long positional accumulation becomes more solid. Currently, the long-to-short ratio sits at 1.0367, indicating that the bulls are having the upper hand in the market.

ADA OI-Weighted Funding Rate: CoinGlass

ADA OI-Weighted Funding Rate: CoinGlass

ADA Price Could Reclaim $0.40 Level Soon

The chart shows ADA/USD on a 1-day timeframe, and momentum is battling to break out above the consolidation channel. The Cardano price is currently consolidating, with the bulls building a structure for a potential breakout towards $0.40 immediate resistance.

Still, the bulls have a big fight to win as the death cross is evident in the market. This is manifested as the 50-day SMA($0.42) has crossed below the 200-day SMA ($0.66). However, if the bulls reclaim the $0.42mark, a quick rebound towards the long-term resistance could be plausible.

However, the Relative Strength Index (RSI) at the bottom is climbing, sitting at 43.01 near the neutral-to-bullish territory. This shows that the bulls are building momentum, but only a close above the 50-mean level will flip the market mood to bullish. The MACD indicator is also positive, tilting the odds towards the bulls. This is manifested as the blue MACD has crossed above the orange line, calling for traders to rally behind ADA.

ADA/USD 1-day chart: TradingView

ADA/USD 1-day chart: TradingView

Looking ahead, ADA’s daily trading volume has risen 40% in a day, a sign the community is jumping in. In the meantime, if ADA could reclaim $0.40 resistance, there could be a test of the next resistance near $0.42, aligning with the 50-day SMA in the coming weeks. However, if the resistance zones prove too strong, ADA could continue consolidating within the channel.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

Tether CEO Delivers Rare Bitcoin Price Comment

TechCabal’s most definitive stories of 2025