Solana Price Faces Bearish Patterns: Long-Term Bullish Potential?

TLDR

- Long-term cup and handle targets a potential SOL price breakout above $200 with $2,000 projection.

- Weekly charts warn of head and shoulders risk, with downside toward $105–$75.

- A confirmed double top near $200 keeps pressure on SOL around the $120–$130 zone.

- Despite near-term weakness, multi-year higher lows preserve long-term bullish potential.

Solana(SOL) price is navigating a complex technical phase as competing chart signals shape market expectations. While short-term patterns reflect distribution and consolidation, long-term structures continue to point toward significant upside potential. Analysts are weighing near-term downside risks against projections that extend well beyond current levels.

Solana Price Cup and Handle Signals Breakout

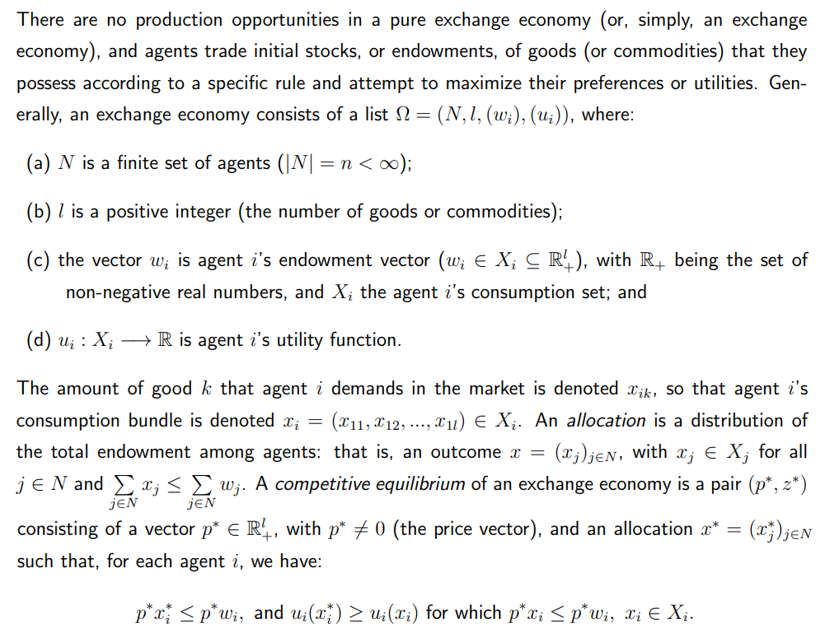

According to analyst curb.sol, the long-term logarithmic SOL price against the USD chart outlines a multi-year Cup and Handle formation. The structure began after the 2022 lows near $10 and developed into a rounded recovery toward $200 during 2024 and 2025. The current pullback between $120 and $150 represents the handle phase.

This pattern is widely viewed as a bullish continuation setup when confirmed by volume. The neckline sits near the $200 region, which previously capped rallies. A decisive breakout above that level would activate a measured move projection toward $2,000.

Moreover, Solana price historical volatility aligns with the magnitude of this structure. Network expansion, DeFi growth, and mobile integrations provide a supportive macro backdrop. However, failure to hold the handle range could expose deeper retracements toward prior consolidation zones.

SOL Price Structure Warns of Prolonged Correction

Meanwhile, analyst Elite Crypto presented a more cautious outlook based on the weekly Solana price tether USD chart. After rising from the 2022 bottom near $10 to a peak around $200, the market has entered a corrective phase. Price recently declined to the $124 area, reflecting weakening momentum.

The chart suggests a developing head and shoulders pattern, which typically signals bearish continuation. Key support rests near $105, with a confirmed breakdown potentially opening a path toward $75 and $51. This corrective phase could persist into mid-2026 if selling pressure continues.

Additionally, despite near-term weakness, the broader trend still shows higher lows over several years. The analyst noted that deeper retracements may offer structured accumulation opportunities. Long-term recovery scenarios remain viable once the corrective cycle matures.

Double Top Pattern Pressures Solana Price Near Key Zones

Furthermore, another market analyst, Henry, highlighted a confirmed Solana price double top pattern on the weekly chart. The formation developed around the $200 level during 2025 and triggered a breakdown below the $150 neckline. Price is now trading near $124, approaching historically active support zones.

Marked CME gap zones between $150 and $170, as well as $120 to $130, frame the current range. Increased volume during the decline suggests active distribution rather than passive consolidation. A failure to defend lower support could extend losses toward the $100 level.

In addition, the analyst noted that these support zones previously attracted strong demand. A successful defense could spark a technical bounce before broader trend resolution. However, rallies remain vulnerable until higher resistance levels are reclaimed.

Across multiple timeframes, Solana price action reflects a market balancing corrective pressure against long-term structural strength. While bearish patterns dominate the near-term outlook, long-horizon formations continue to support the case for renewed upside once consolidation completes.

The post Solana Price Faces Bearish Patterns: Long-Term Bullish Potential? appeared first on CoinCentral.

You May Also Like

Waters’ Scathing Critique Exposes Regulatory Retreat

US Dollar Loses 10% of Its Value in Just One Year As Gold and Silver Send ‘Flash Warning’ To Markets