Bitcoin Flashes Technical Sell Signals as Bulls, Bears Clash

TradingViews' overall technical analysis gauge based on key data from moving averages, oscillators, and pivots gave a sell signal for the week ahead.

Source: TradingView

Source: TradingView

The short term indicators point to a neutral signal, while the long-term gauges show a strong sell signal.

Source: TradingView

Source: TradingView

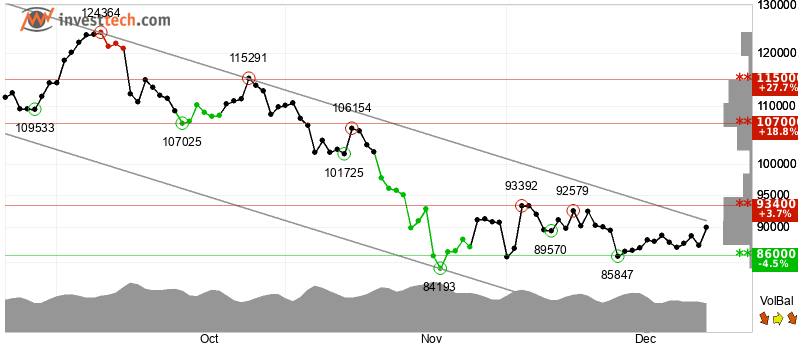

Separately, InvestTech's Algorithmic Overall Analysis for Bitcoin and the recommendation for one to six weeks pointing to negative.

Source: InvestTech

Source: InvestTech

InvestTech said, "Investors have accepted lower prices over time to get out of Bitcoin and the token is in a falling trend channel in the short term. This signals increasing pessimism among investors and indicates further decline for Bitcoin.

"The token has support at points $86,000 and resistance at $93,400. The token is assessed as technically negative for the short term.," added the firm.

2026: Bets in Favour vs. Against

A compelling case for an optimistic outlook on Bitcoin in 2026 can be found in the consistent increase in involvement from institutions and government entities.

Certain experts are optimistic about the potential for a significant upswing in the top token over the coming year, despite recent market fluctuations.

It is highly probable that Bitcoin will achieve a new peak next year, according to Swan Bitcoin CEO Cory Klippsten, who is also bullish on the cryptocurrency's adoption trajectory, institutional support, and historical cycle characteristics.

Klippsten highlighted that the current trend in BTC adoption is predominantly unidirectional. He mentioned that individuals usually don't enter the Bitcoin market only to exit later. They typically remain consistent.

The persistence of this trend, along with the significant investment from major entities, establishes a robust basis for value growth.

In contrast to previous cycles characterized by speculative retail interest, the current market is underpinned by institutional players such as pension funds, asset managers, and sovereign entities.

The broader base of purchasers diminishes the chances of a sudden downturn and enhances the likelihood of ongoing positive growth.

The majority of Bitcoin's price movement has been influenced by periodic halving events that occur every four years.

Experts noted that 2025 departed from this pattern. After hitting all-time highs in 2013, 2017, and 2021, prices haven't been able to go much higher since. Due to the lack of a notable upsurge.

They argue it is hard to imagine a sharp fall from here.

As the asset finds support between $85,000 and $90,000, market analysts are bullish on the prospects for a substantial increase.

El Salvador's president's advisor and well-known Bitcoin supporter Max Keiser has reiterated his bullish prediction for Bitcoin in 2025.

The potential of the cryptocurrency to protect investors from inflation and other economic concerns is something he stresses.

Keiser claims that Bitcoin is poised for massive growth in the next year because of its limited supply and emerging market infrastructure, especially with established banking institutions facing increasing strain.

On the other hand, the naysayers bet that the token's price is likely to fall through the floor.

Among the most shocking predictions for 2026 is Bloomberg's Mike McGlone, who is forecasting a significant decline.

Bitcoin, in his opinion, will not find a stable foundation or support at $50,000 but will instead crash well below that mark. He considers the price target that was mentioned earlier as only a landmark along the way.

According to McGlone, the cycle's last peak was likely in 2025. The expert has assigned $10,000 as the current goal for mean reversion.

How did the $10,000 amount come to be? This is about the price at which Bitcoin was trading just before the 2020 speculative bubble burst.

The Bloomberg analyst likely thinks that a surplus of liquidity is the main factor driving the price increase since then. At $10,000, we would have reached "reversion to the mean."

But despite the mixed reactions, the one thing most analysts agree on is that Bitcoin appears to be entering a more mature stage, likely to get more consistent thanks to increasing liquidity and wider acceptance, rather than going through its typical cycles of fast rise and decline.

You May Also Like

ADA Price Prediction: Here’s The Best Place To Make 50x Gains

US SEC approves options tied to Grayscale Digital Large Cap Fund and Cboe Bitcoin US ETF Index