Why 66,000 Starlink users in Nigeria must complete biometric update before 2026

Over 66,000 Starlink subscribers in Nigeria risk having their internet access restricted after December 31, 2025, if they fail to complete a mandatory biometric update.

The requirement, first issued by the Nigerian Communications Commission (NCC) in August 2025, extends the regulator’s subscriber-verification framework beyond mobile networks to satellite internet providers to strengthen identity verification and security across the telecoms ecosystem.

According to an NCC spokesperson, the commission issued the directive via a letter dated August 19, 2025 and set the deadline for “3 months from date of directive (i.e. November 19, 2025).” An extension was granted on November 17, 2025, pushing the final deadline to December 31, 2025.

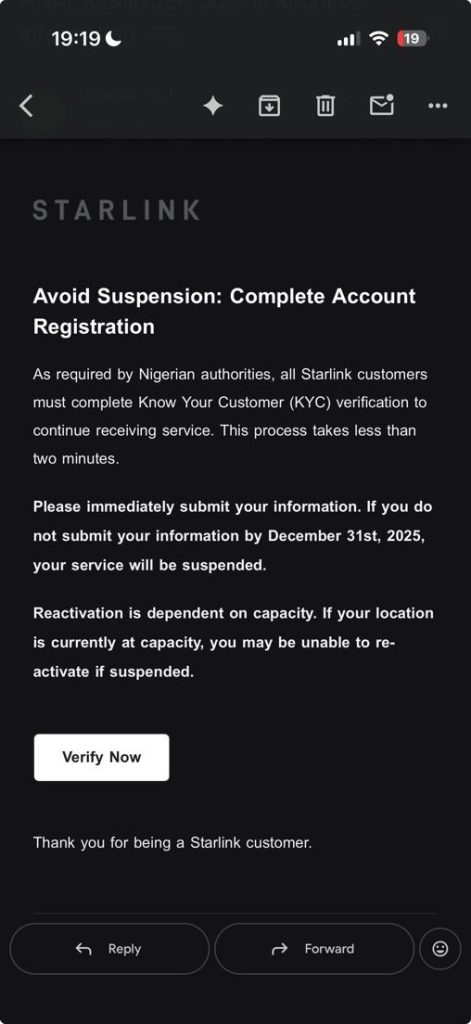

Starlink confirmed the requirement in an email sent to customers on Monday, December 29, 2025, noting that the verification process takes “less than two minutes.” The company warned that subscribers who fail to submit their details by the December 31 deadline will have their service suspended. Reactivation, it added, will depend on network capacity in the subscriber’s location, meaning some users may not be able to restore service if their area is already at capacity.

Starlink’s email to subscribers notifying them to complete their KYC registration by December 31, 2025.

Starlink’s email to subscribers notifying them to complete their KYC registration by December 31, 2025.

A Starlink employee, who spoke on condition of anonymity because they are not authorised to comment publicly, said the process is straightforward. Subscribers are required to upload a headshot photograph, provide their National Identification Number (NIN), and give consent for the information to be linked to their Starlink account.

Capacity constraints could complicate reactivation for affected users. In Lagos, neighbourhoods such as Victoria Island, Ikoyi, Lagos Island, Ikeja, Surulere, Lekki, and surrounding estates frequently appear as “sold out” or “at capacity” on Starlink’s availability checker, prompting prospective users to join a waitlist that requires a deposit. A similar situation exists in Abuja, where several districts have reached capacity and now accept only waitlist deposits rather than new residential activations.

Starlink did not respond to a request for comments.

The policy closely mirrors the NCC’s December 15, 2023, directive to mobile network operators under the NIN–SIM linkage programme, which required subscribers’ NINs to be matched with existing SIM registration records, including facial images and fingerprints, in collaboration with the National Identity Management Commission (NIMC). The move aimed to improve national security, curb identity-related fraud, and create a more reliable national subscriber database.

The mobile sector rollout followed a phased timeline, with September 14, 2024, set as the final compliance deadline. Operators were instructed to fully bar any unverified lines after that date. By the end of the exercise, the NCC reported a 96% compliance rate, with over 153 million SIMs successfully linked to verified NINs. In August 2025, the Commission announced that all improperly registered SIMs had been removed from Nigeria’s networks, setting a regulatory precedent now being applied to satellite internet services like Starlink.

One Starlink subscriber in Lagos, Tochukwu Nwankwu, said he completed the biometric update after receiving an in-app notification from the company in October 2025.

“Just a panel on the app. Just like a poor signal notification, when you’re far from the router, or when there’s a software update,” he said.

You May Also Like

CME Group to Launch Solana and XRP Futures Options

The best IPO stocks to watch in 2026