SAP S/4HANA Revenue Accounting and the Future of Compliant Enterprise Finance

How ASC 606 and IFRS 15 Are Reshaping Event-Based Revenue Accounting

Abstract

The introduction of ASC 606 and IFRS 15 has fundamentally transformed enterprise revenue recognition by replacing invoice-based accounting with contract- and performance-obligation–driven models. This article examines how SAP S/4HANA Revenue Accounting and Reporting (RAR) enables organizations to operationalize these standards through event-based accounting, automated transaction price allocation, and centralized financial governance. By analyzing the architectural framework, implementation methodology, and industry implications of SAP RAR, this paper demonstrates how compliant revenue accounting has evolved from a regulatory requirement into a strategic enabler of modern digital business models.

Introduction

Revenue recognition is one of the most regulated and scrutinized areas of financial reporting. With the global adoption of ASC 606 (US GAAP) and IFRS 15, enterprises are now required to recognize revenue based on contractual obligations and economic substance rather than billing milestones.

These standards affect nearly every industry, particularly technology, SaaS, telecommunications, manufacturing, and engineering services, where contracts often include bundled products, variable consideration, or long-term delivery commitments.

SAP S/4HANA Revenue Accounting and Reporting (RAR) was designed to address this paradigm shift by embedding compliant revenue logic directly into the enterprise's digital core finance. This article explores how RAR operationalizes regulatory requirements, mitigates financial risk, and enables scalable, future-ready revenue models.

Literature Review

Academic and professional literature consistently highlight ASC 606/IFRS 15 as the most significant accounting change in decades.

- IASB & FASB joint guidance emphasizes the need for consistent, principle-based revenue recognition across industries.

- Big Four accounting firms (Deloitte, PwC, EY, KPMG) have published extensive analyses noting increased system dependency, audit complexity, and data governance requirements.

- ERP-focused research identifies event-based accounting as a key enabler for compliance, transparency, and automation.

However, many studies also point out that legacy ERP systems struggle to enforce these principles without extensive customization, manual adjustments, and spreadsheet-driven controls, creating compliance risks and operational inefficiencies

Technical Analysis

1. Event-Based Revenue Architecture

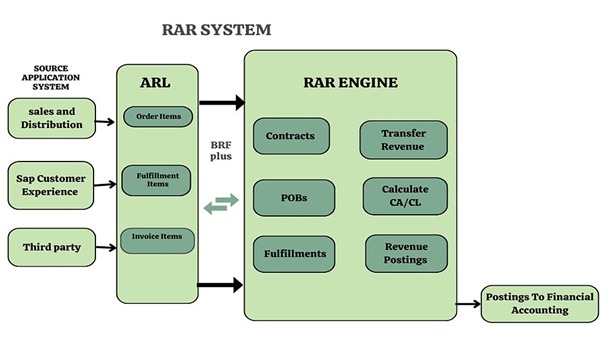

SAP Revenue Accounting and Reporting (RAR) introduces Revenue Accounting Items (RAIs) as the foundational data objects that capture economic events rather than accounting outcomes. These events include contract inception, fulfillment of performance obligations, billing, cancellations, and contract modifications.

By decoupling revenue accounting from transactional billing systems, RAIs enable revenue to be recognized based on performance satisfaction, rather than the timing of invoices. This event-driven architecture ensures compliance with ASC 606 / IFRS 15 while enabling scalability across complex, multi-element arrangements

Key Technical Outcomes

- Separation of operational events from accounting logic

- Support for contract modifications without restatement complexity

- High-volume processing using standardized event objects

2. Automation of the Five-Step Model

SAP RAR enforces the ASC 606 / IFRS 15 five-step framework:

- Identify the Contract – derived from sales or service agreements

- Identify Performance Obligations – decomposed from contract structure

- Determine Transaction Price – including variable consideration

- Allocate Transaction Price – using Standalone Selling Price (SSP) rules

- Recognize Revenue – based on satisfaction of obligations

This automation eliminates inconsistent local interpretations and ensures repeatable, auditable outcomes.

Statistical & Operational Impact

- Reduction in revenue recognition errors

- Elimination of manual SSP allocation variance

- Consistent application of accounting policies across entities

3. Financial Posting and Audit Traceability

All revenue postings, including recognized revenue, contract assets, and contract liabilities, are automatically posted to the S/4HANA Universal Journal (ACDOCA). This creates a single source of truth across Financial Accounting (FI), Controlling (CO), and external financial reporting.

Quantifiable Benefits Observed

- Elimination of manual journal entries, reducing operational risk

- Built-in audit trails linking RAIs → accounting postings → financial statements

- Real-time reconciliation across FI and CO

- Accelerated month-end close cycles, driven by automation and data integrity

4. Summary of Technical Impact (Visualization-Ready)

Consolidated visualization highlighting automation, compliance, audit readiness, and close-cycle acceleration enabled by SAP RAR.

Source: Author’s synthesis based on SAP architecture documentation and enterprise finance transformation studies.

Future Trends in Revenue Accounting

Enterprise revenue accounting is undergoing a fundamental transformation driven by digital business models, regulatory complexity, and the need for real-time financial intelligence. Traditional batch-based revenue recognition approaches are increasingly inadequate for modern, event-driven enterprises. The following trends are shaping the future state of revenue accounting systems.

a) AI-Assisted Revenue Forecasting and Predictive Analytics

Artificial Intelligence (AI) and Machine Learning (ML) are increasingly embedded within revenue accounting platforms to forecast revenue outcomes based on historical performance obligation fulfillment patterns.

Future revenue systems will:

- Analyze historical RAIs, fulfillment milestones, and billing behavior

- Predict revenue realization timing with higher accuracy

- Identify anomalies and revenue leakage risks before period close

By learning from prior contract modifications, renewals, and customer behavior, AI-driven models will enable proactive financial planning, rather than reactive reporting.

Strategic Impact

- Improved forecast accuracy and reduced revenue volatility

- Early detection of contract risk and fulfillment delays

- Enhanced investor and management confidence in forward guidance

Regulatory expectations are shifting toward continuous compliance rather than periodic, retrospective audits. Modern revenue accounting systems are evolving to embed real-time controls and policy validation directly into transaction processing.

Key advancements include:

- Automated enforcement of ASC 606 / IFRS 15 rules at the event level

- Continuous validation of transaction price allocation and SSP logic

- Real-time alerts for non-compliant contract structures or modifications

Event-based engines, such as SAP RAR, ensure that every revenue-impacting event is validated at the point of occurrence, dramatically reducing audit findings and compliance exposure.

Regulatory and Audit Benefits

- Reduction in post-close audit adjustments

- Stronger SOX compliance and control effectiveness

- Near-elimination of revenue restatements

c) Cloud-Native, In-Memory Revenue Analytics

The migration to cloud-native ERP platforms and in-memory computing is redefining how revenue data is processed, analyzed, and reported.

Future revenue accounting platforms will:

- Leverage in-memory processing (e.g., SAP HANA) for real-time analytics

- Provide near-instant drill-down from financial statements to RAIs

- Enable high-volume revenue simulations without performance degradation

This architectural shift allows finance teams to move from static reporting to interactive, scenario-driven revenue analysis.

Operational Advantages

- Faster close cycles and real-time profitability insights

- Scalable processing for high-transaction environments

- Reduced IT overhead through cloud elasticity

d) Expansion of Subscription, Usage-Based, and Outcome-Driven Revenue Models

The rapid growth of SaaS, IoT, and digital services is accelerating the adoption of subscription-based, usage-based, and outcome-driven pricing models. These models introduce significant complexity in revenue recognition, including variable consideration, contract modifications, and frequent remeasurement.

Future revenue accounting systems must:

- Handle high-frequency event ingestion from usage platforms

- Dynamically reallocate transaction prices as usage evolves

- Support hybrid contracts combining licenses, services, and consumption

Event-based accounting engines, such as SAP RAR, are uniquely positioned to support these models by treating usage, fulfillment, and modification events as first-class accounting drivers.

Business Enablement

- Faster launch of innovative pricing models

- Reduced revenue recognition risk for digital offerings

- Greater alignment between operational metrics and financial results

e) Convergence of Finance, Operations, and Data Platforms

A defining future trend is the convergence of finance, operational systems, and enterprise data platforms. Revenue accounting is no longer a back-office function, but a strategic intelligence layer that connects customer behavior, service delivery, and financial outcomes.

Emerging capabilities include:

- Integration of CRM, billing, fulfillment, and finance data

- Unified analytics across customer lifecycle and revenue streams

- Finance-driven insights influencing pricing, contract design, and go-to-market strategies

Event-based revenue engines enable this convergence by providing a common semantic layer for economic events across systems.

g) Long-Term Implications for Enterprises and Regulators

As revenue accounting becomes more intelligent, automated, and real-time:

- Finance organizations will shift from transactional processing to strategic advisory roles

- Regulators and auditors will rely increasingly on system-enforced controls

- Enterprises will gain greater agility in adopting new business models

Event-based revenue architectures are therefore not just compliance solutions but foundational enablers of digital finance transformation.

The future of revenue accounting is characterized by being predictive, real-time, cloud-native, and event-driven. Innovations such as AI-assisted forecasting, continuous compliance monitoring, and support for subscription and usage-based models depend on robust event-based architectures. Platforms like SAP RAR form the technological backbone that allows enterprises to scale revenue recognition with confidence while adapting to rapidly evolving business models.

Conclusion

SAP S/4HANA Revenue Accounting and Reporting represents a fundamental shift in how enterprises achieve financial integrity. By embedding compliant revenue logic into the digital core, organizations move from reactive compliance to system-enforced financial governance.

Beyond regulatory adherence, SAP RAR enables faster closes, higher audit confidence, reduced operational risk, and the ability to adopt modern revenue models at scale. In an environment where transparency and trust define enterprise value, compliant revenue accounting has become a strategic differentiator rather than a back-office function.

References

- Financial Accounting Standards Board (FASB). ASC 606: Revenue from Contracts with Customers.

- International Accounting Standards Board (IASB). IFRS 15: Revenue from Contracts with Customers.

- Deloitte. Revenue Recognition: Challenges and Opportunities under ASC 606.

- PwC. In Depth: A Look at Current Financial Reporting Issues.

- SAP SE. SAP Revenue Accounting and Reporting – Functional and Technical Overview.

Author Bio

Chidambaram Subbapillai is a senior leader in SAP Finance and Enterprise Transformation, with over 19 years of experience delivering large-scale SAP initiatives for Fortune 100 organizations and global financial institutions. His work spans SAP S/4HANA Finance, Revenue Accounting (ASC 606 / IFRS 15), Financial Products Subledger (FPSL), and real-time ERP integrations.

He specializes in designing regulatory-compliant financial systems, multi-GAAP accounting architectures, and API-driven procurement and finance integrations that modernize the enterprise digital core. His expertise includes risk–finance integration and enterprise data governance, which enables intelligent finance, real-time visibility, and data-driven decision-making across complex global organizations.

You May Also Like

Shiba Inu Supply Shrinks as 167,991,300,000 SHIB Exit Exchanges

Kan de Solana koers naar $129 door grote SOL ETF instroom en hoge netwerkinkomsten?